- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 Recession-Resistant Tech Stocks To Buy Amid Coronavirus Scare

The looming threat of recession is on the rise due to COVID-19 outbreak induced weakening in macroeconomic environment. The coronavirus crisis has sent ripples across the U.S. stock market, with the S&P 500, Nasdaq and the Dow Jones declining 21.4%, 19.3% and 26.4%, respectively, year to date.

The coronavirus pandemic continues to spread, with death toll in the United States alone hitting 75, as of Mar 17, 2020, according to a Statista report. Globally, the virus is estimated to have caused over 7,900 deaths.

Precautionary measures are being undertaken worldwide to deal with the pandemic. Companies are urging employees to work from home. Schools, colleges, other education institutions, have been shut down. Theaters, malls and public recreation places have been closed to minimize the risk of spread. Although the panoptic impact of the crisis has only aggravated apprehensions regarding an imminent recession, the U.S. tech sector has been more resilient compared with the others.

The Technology Select Sector SPDR Fund (XLK) is down 15.4% YTD, while Energy Select Sector SPDR Fund, Financial Select Sector SPDR Fund, and Industrial Select Sector SPDR Fund have lost 53.4%, 31.9%, and 28.3%, respectively.

Tech Stocks Worth Taking a Look

The tech sector’s resiliency can be attributed to the massive long-term growth prospects of tech stocks. The sector remains attractive owing to continuous digital transformations. Rapid adoption of cloud computing, and ongoing integration of AI and machine learning (ML), has been acting as a major catalyst.

The accelerated deployment of 5G technology is likely to be a tailwind. Moreover, blockchain, IoT, autonomous vehicles, AR/VR, and wearables are other positives. In fact, COVID-19 induced Work-from-home wave favors the prospects of technology companies providing the required hardware including office equipment, software, networking infrastructure and network security.

Additionally, the tech companies are cash rich, which provides them buoyancy amid adverse business environment. Per their latest quarterly results, the FAAMG stocks (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple, Microsoft, and Alphabet’s Google (NASDAQ:GOOGL)) have a cumulative cash and short-term investments of more than $460 billion.

With fears of an imminent recession, investors can take refuge in recession-resistant tech stocks that have robust fundamentals despite anticipated decline in IT spending. These stocks have better prospects once the impact of coronavirus cools down given the accelerated measures to contain the virus.

Buy These 5 Recession-Proof Tech Stocks Now

We have selected five tech stocks that carry a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The five picks also have good dividend pay outs and market cap greater than $5 billion. Both these factors provide resilience to a company’s financial position amid a crisis and imply that the companies are more mature, with established customer base and relatively stable revenues, earnings, and cash flow.

Microsoft (NASDAQ:MSFT) is well poised to beat the coronavirus-induced recession fears, on the back of robust adoption of Azure cloud platform. Moreover, work from home surge is expected to bolster adoption of its enterprise communication offerings including Teams. This, in turn, will provide it competitive edge in the enterprise communication market against Slack and Zoom.

This Zacks Rank #1 stock is also well-poised to gain from a growing user base of different applications like Office 365 commercial, Dynamics and Outlook mobile.

The company has a market cap of $1.115 trillion and dividend yield of 1.39%.

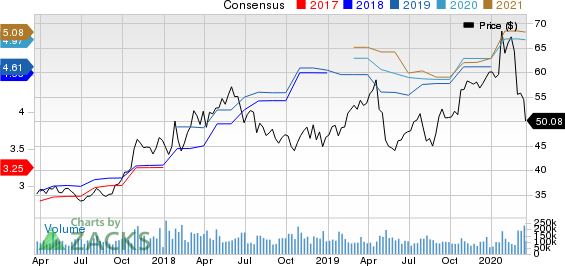

The Zacks Consensus Estimate for Microsoft’s fiscal 2020 earnings is pegged at $5.62 per share, indicating 18.3% growth from the year-ago reported figure.

Intel (NASDAQ:INTC) is benefiting from its data-centric focus. Strong adoption of its second-gen Xeon scalable processors and solid demand from cloud service providers is expected to drive data centric business revenues.

This Zacks #1 Ranked company is planning nine product releases on 10 nm this year. Moreover, it is adding 25% wafer capacity across its 14 nm and 10 nm nodes in 2020.

The company has a market cap of $214.19 billion and dividend yield of 2.64%.

The Zacks Consensus Estimate for Intel’s 2020 earnings is pegged at $4.97 per share, suggesting growth of 2.1% from the year-earlier reported figure.

SAP SE (DE:SAPG) (NYSE:SAP) gains traction from robust adoption of S/4HANA, C/4HANA, Fieldglass, Concur and SuccessFactors Employee Central solutions. The company's alliances with Microsoft, Accenture (NYSE:ACN) and Verizon (NYSE:VZ) favour business prospects. It is harnessing the power of ML to enhance enterprise applications. This, in turn, is enabling the company to bolster adoption of its solutions and provide clientele with data-driven business insights.

Moreover, with SAP Machine Learning and SAP Leonardo Machine Learning to its credit, this company currently flaunting a Zacks Rank of 1, offers platforms that aid enterprises and users develop robust ML tools in the cloud.

The company has a market cap of $122.89 billion and dividend yield of 1.17%.

The consensus mark for SAP’s 2020 earnings stands at $6.17 per share, indicating an improvement of 7.9% from the prior-year quarter.

Applied Materials (NASDAQ:AMAT) is well poised to gain from integration of advanced ML capabilities across its semiconductor fabs to enhance automated defect analysis.

The company, currently sporting a Zacks Rank #1, has developed an automated defect classification technology that utilizes different imaging techniques to identify and eliminate defects in chip manufacturing.

Moreover, the company's commitment toward development of new AI and ML powered computing materials and designs, hold promise.

The company has a market cap of $41.2 billion and dividend yield of 1.87%.

The consensus mark for its earnings for fiscal 2020 is pegged at $4.14 per share, suggesting growth of 36.2% from the year-ago reported number.

Apple (NASDAQ:AAPL) is expected to benefit from the upcoming 5G upgrade cycle. The iPhone-maker, carrying a Zacks Rank #2, is expected to launch its first 5G-supported device later this year. Additionally, continued momentum in the Services segment, backed by strong App Store sales and the robust acceptance of Apple Music and Apple Pay, are expected to drive growth this year.

Moreover, the company’s wearables market domination is expected to continue in 2020 owing to strong adoption of AirPods and Apple Watch. The solid uptake of Apple Watch Series 5 is helping the iPhone maker strengthen presence in the personal health monitor space.

The company has a market cap of $1.106 trillion and dividend yield of 1.22%.

The Zacks Consensus Estimate for Apple’s fiscal 2020 earnings stands at $13.50 per share, indicating growth of 13.5% from the year-ago reported number.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

SAP SE (SAP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.