- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

4 Chip Stocks Positioned for Explosive Growth Amid Surging AI Demand

- AI-driven growth has propelled the semiconductor industry.

- U.S. policies aim to strengthen domestic chip production.

- The stocks featured in this article are set to benefit in a rapidly growing sector.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The emergence of artificial intelligence has significantly boosted semiconductors this year.

Among the key beneficiaries are semiconductor manufacturers. This is evident in the remarkable rally of the Philadelphia Semiconductor Index, which has maintained its upward trajectory, hitting all-time highs this year.

Semiconductor chips are crucial for developing generative AI platforms, as they provide the necessary processing power.

This is a sector poised for growth in the coming years. The semiconductor market is expected to grow at a compound annual growth rate (CAGR) of 14.9% from 2024 to 2032.

The United States is aiming to reclaim its leadership in the semiconductor industry and reduce its reliance on Asia. This year, the U.S. introduced several measures, including extending the 25% tax credit to include chip wafers.

By doing so, the U.S. hopes to meet domestic demand and reduce its dependence on markets like Taiwan and South Korea. Ongoing technological disputes with China also motivate these efforts to bolster local chip manufacturing.

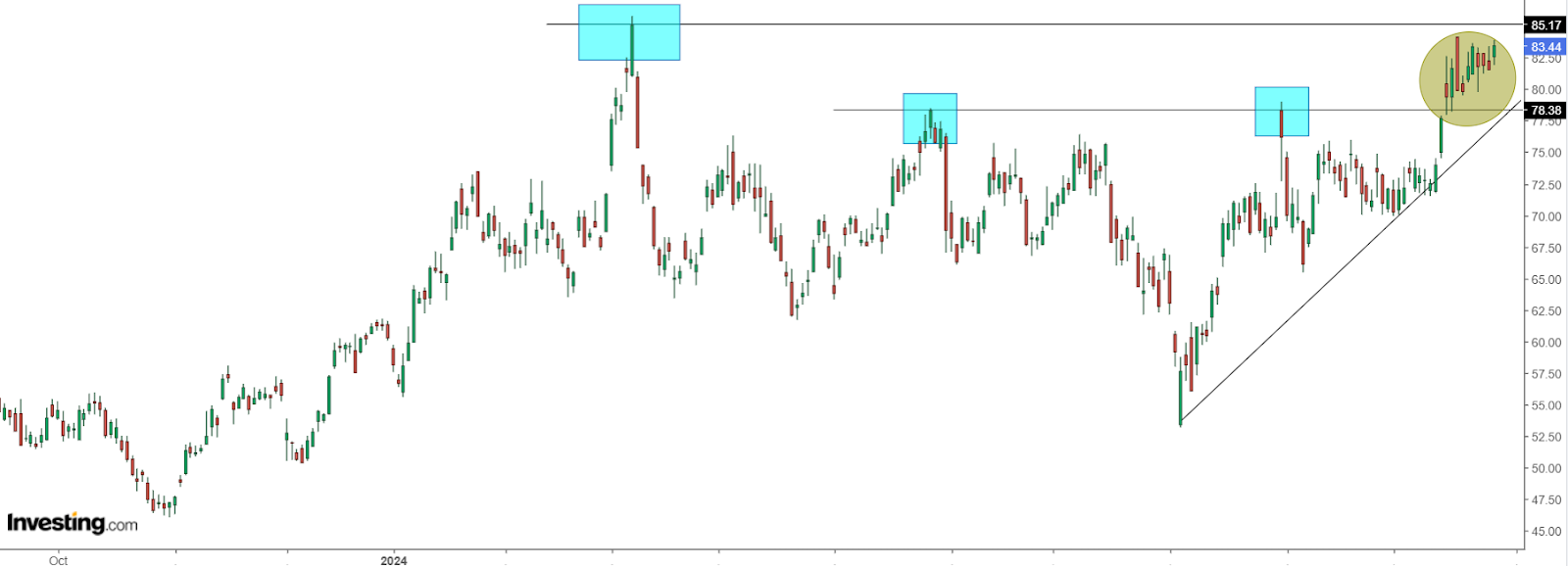

1. Marvell Technology

Marvell Technology (NASDAQ:MRVL), headquartered in Santa Clara, California, develops and produces semiconductors and related technology. Its products find applications in data centers, communications infrastructure, consumer electronics, and automotive sectors.

Source: InvestingPro

The company offers a dividend yield of 0.29%.

Source: InvestingPro

Marvell's recent financial results exceeded market expectations in both revenue and earnings. Over the past 14 quarters, the company outperformed earnings per share (EPS) expectations 11 times. The company maintains a cash balance of just over $800 million, surpassing its debt of $129 million.

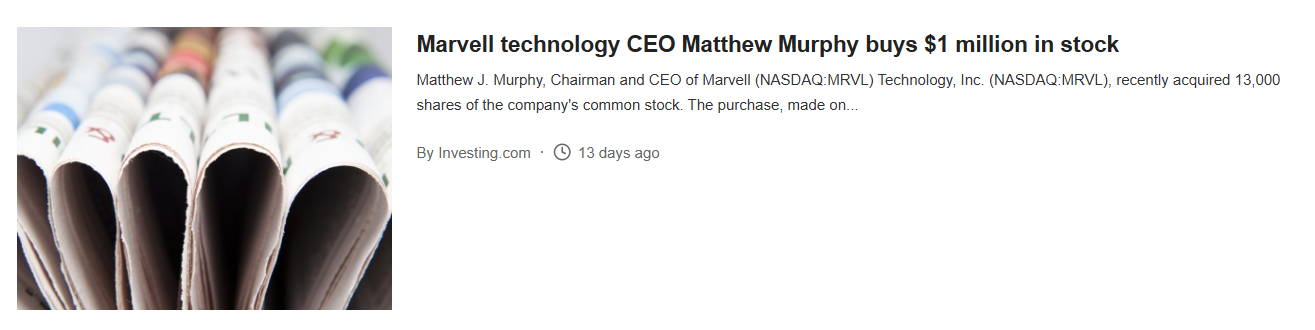

In the middle of this month, Marvell's chairman and CEO purchased 13,000 shares of Marvell stock at an average price of $77.63 per share. Earlier, in June, another insider acquired 1,425 shares at an average price of $70.21 per share.

Source: InvestingPro

Furthermore, partnerships with major cloud providers, like Microsoft (NASDAQ:MSFT), bolster Marvell's market presence.

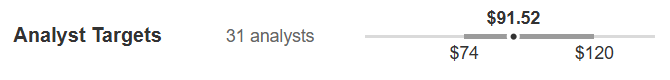

Over the past decade, the company's shares have risen 590%, climbing 240% over the last five years and 78% in the past year. The market's average fundamental price target for Marvell is $91.52.

Source: InvestingPro

2. Lam Research

Lam Research (NASDAQ:LRCX) is a U.S. provider of semiconductor industry-related services, based in Fremont, California.

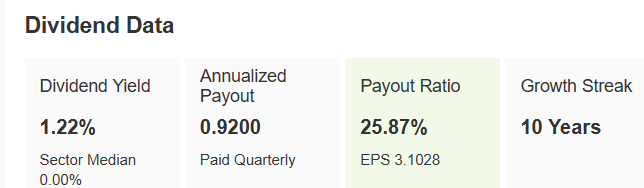

It offers a dividend yield of 1.22%.

Source: InvestingPro

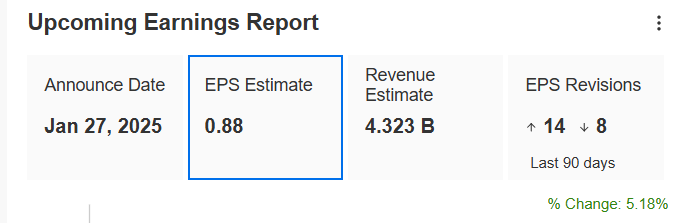

In its fiscal fourth quarter, Lam Research surpassed Wall Street estimates for both revenue and earnings. Over the last decade, the company has grown its revenue and earnings at CAGRs of 12.46% and 19.73%, respectively. It will announce its next financial results on January 27, with EPS expected to rise by 5.18%.

Source: InvestingPro

As a vital player in the semiconductor supply chain, Lam Research is well-positioned to outperform the market as demand for chips in the automotive and industrial technology sectors increases.

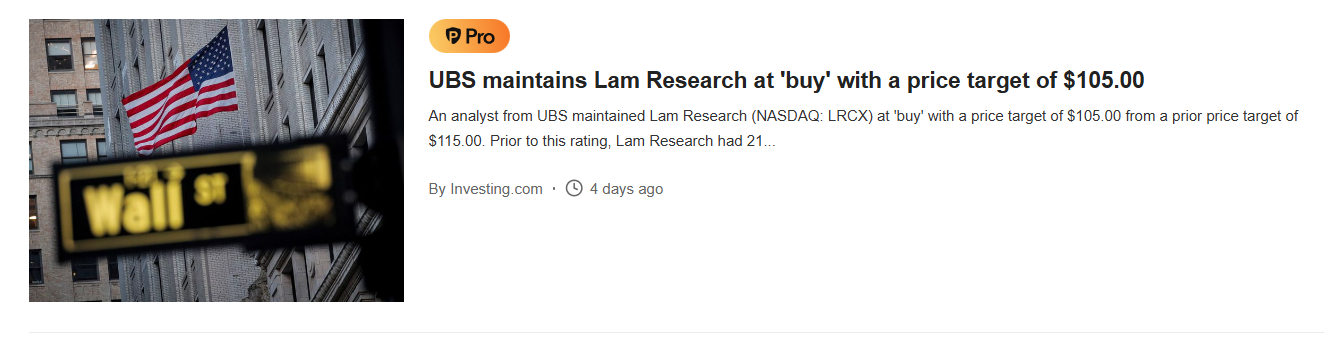

UBS remains bullish on Lam, setting a price target of $105.

Source: InvestingPro

In contrast, the market consensus assigns it an average price target of $93.89.

Source: InvestingPro

3. Qualcomm

Qualcomm (NASDAQ:QCOM), headquartered in San Diego, designs and develops high-performance, low-power chips for industries like wireless telecommunications, PCs, automotive, robotics, and AI.

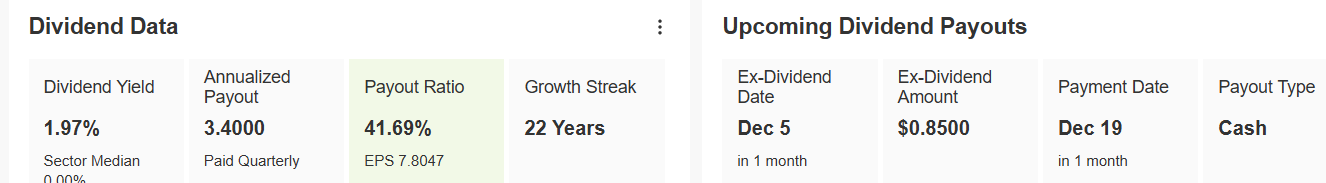

The company boasts a robust history of dividend payments, consistently increasing its quarterly payout over the past 20 years. It plans to pay a dividend of $0.85 per share on December 19, with shares needing to be held before December 5 to be eligible. The dividend yield stands at 1.97%.

Source: InvestingPro

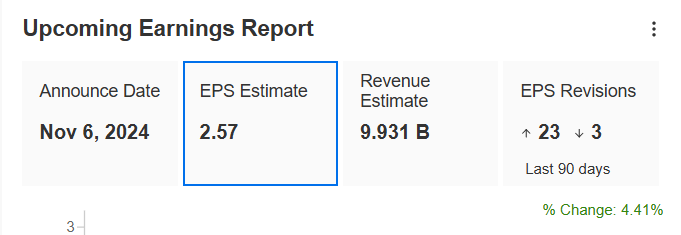

In its latest financial results, Qualcomm reported a profit of $2.13 billion, a 24.6% increase year-over-year, along with a cash reserve of $7.77 billion. The company is expected to report its next results on November 6, anticipating a 4.41% rise in EPS.

Source: InvestingPro

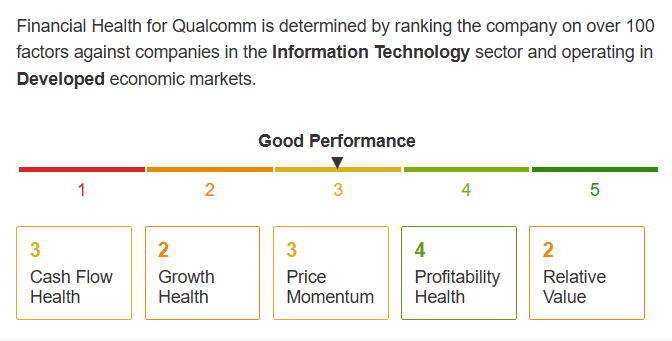

Qualcomm's financial health is favorable, considering more than 100 factors.

Source: InvestingPro

Over the past decade, QCOM's shares have risen by 193%, with a 130% increase over the last five years and 63% in the past year.

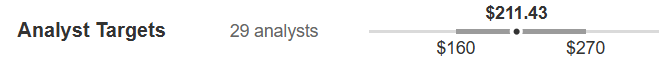

The market's average fundamental price target for Qualcomm is $211.43.

Source: InvestingPro

4. Advanced Micro Devices

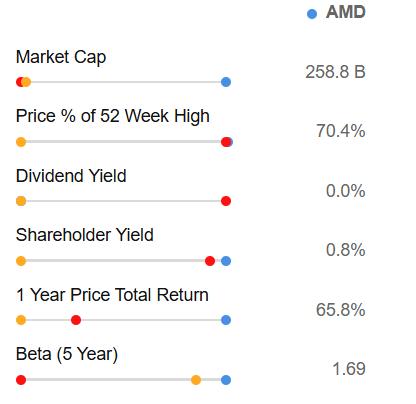

Advanced Micro Devices (NASDAQ:AMD) is a key player in the chip industry. Based in Santa Clara, it specializes in designing and manufacturing semiconductors, particularly microprocessors and graphics processing units (GPUs).

Over the last 15 quarters, AMD has exceeded EPS forecasts 13 times and holds a cash balance of $4.1 billion.

AMD recently launched its new AI chip, the Instinct MI325X, aiming to capture market share in the data center GPU sector dominated by Nvidia (NASDAQ:NVDA).

The acquisition of Silo AI is a strategical move projected to yield long-term benefits, potentially doubling its market share in the next two years, driven by partnerships with industry giants like Google (NASDAQ:GOOGL), Oracle (NYSE:ORCL), Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), and Hugging Face.

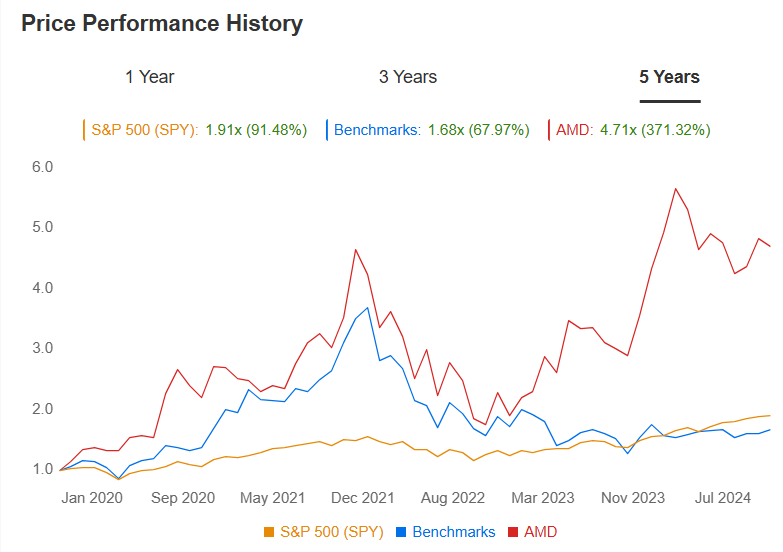

Over the past decade, AMD’s shares have surged 5,600%, increased by 358% in the last five years, and jumped 66% over the past year.

With a Beta of 1.69, AMD's stock moves in tandem with the market with significantly higher volatility.

Source: InvestingPro

Here we can see the comparison between AMD and the S&P 500 in terms of price performance history (5-year).

Source: InvestingPro

The market's average price target for AMD is $188.06.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.