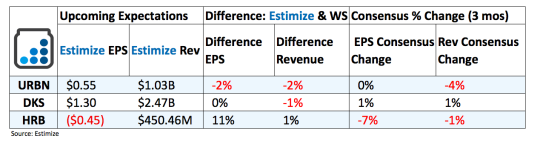

Urban Outfitters: About a month ago, Urban Outfitters reported preliminary sales results for the fourth quarter and full year fiscal 2017. In the three months ending January 31, net sales increased 2% from a year earlier to $1.03 billion. Comparable retail sales, including booming direct to consumer channels, came in flat largely on lower retailer comparable sales. Wholesale segments decreased 1% during the period but ended the year 1% higher than fiscal 2016. Nonetheless, analyst at Estimize expect profitability to drop by 6% with estimate activity steadily declining over the past 3 months.

Dick’s Sporting Goods DKS: Shares tumbled nearly 12% in the past 3 months despite beating analysts expectations for 2 consecutive quarters and management raising full year fiscal 2016 guidance. The past two reports exceeded both Wall Street and the more bullish estimates at Estimize by a significant margin on efforts to expand online capabilities and drive traffic through strategic marketing initiatives. Dick’s also intends to leverage the intellectual property of Sports Authority it purchased last year to improve sales and open new stores. It recently announced the grand opening of five new stores across the United States, one of which occupies a former Sports Authority location.

H&R Block NYSE:HRB (HRB): HRB delivered negative earnings growth in 4 of the past 5 quarters resulting in weak price movement immediately following each report. Shares have dropped about 26% in the past 12 months in response to the string of weak reports with the upcoming report expected to be more of the same. Analysts at Estimize forecast a 26% decline on the bottom line combined with a 5% drop on the top. HRB faces a slew of litigation fees in connection with its operating activities that could push margins further below consensus estimates. Weak underlying fundamentals and unimpressive initiatives will continue to stress performance