- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Reasons Why Avon Products (AVP) Is Off Investors' Radar

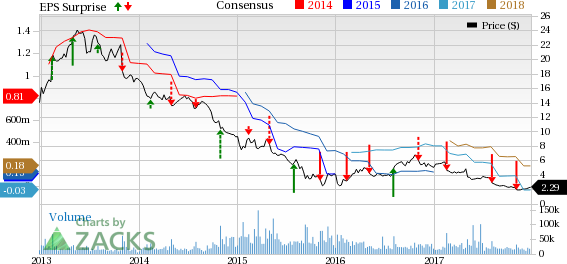

Avon Products Inc. (NYSE:AVP) has lately fallen out of investors’ favor due to dismal earnings surprise trend. This can primarily be attributed to declining Active Representatives in the past few quarters. The company’s bleak prospects are evident from the dismal stock performance and recent fall in estimates. Further, the company now has a Zacks Rank #5 (Strong Sell).

Stock Continues to Decline

Shares of Avon declined 4.2% in the last three months, against the industry’s growth of 16.3%. Additionally, the stock has witnessed solid downside of 54.6% year to date. Moreover, the company’s dismal performance in the most recent quarter led the shares to fall 3.4% since Nov 2.

Avon reported adjusted earnings per share of 3 cents lagging the Zacks Consensus Estimate for the fifth straight quarter. Results were hurt by decline in both Active Representatives and Ending Representatives across in various segments. Moreover, operating margins were hampered by higher bad debt expenses, increased Representative, sales leader and field expenses, all mainly in Brazil.

Estimates Trend Down on Bleak View

Following the dismal quarter, the company provided a bleak view for 2017, which led to a downtrend in estimates.

The Zacks Consensus Estimate trended downward in the last 60 days. Notably, the estimate of 6 cents per share for the fourth quarter moved down by 7 cents per share. Additionally, the Zacks Consensus Estimate for 2017 declined from earnings of 10 cents per share to a loss of 2 cents per share. Moreover, the Zacks estimate for 2018 declined by 9 cents to 18 cents per share.

While management expects modest growth in fourth-quarter 2017 due to favorable trends in various markets, it expects results to fall short of expectations in 2017. The company now anticipates both constant-dollar revenues and adjusted operating margin in the band of flat to slightly up compared with the prior-year period.

Competition to Take a Toll on Results

Avon faces intense competition from cosmetics products retailer like Coty Inc. (NYSE:COTY) in domestic and international markets. Changing market trends and evolving consumer preferences might also weigh upon the performance and hurt its overall profitability.

Forget Avon, Check These Stocks That Witnessed Positive Estimate Revisions

The fourth quarter and fiscal 2018 consensus mark for Hibbett Sports Inc. (NASDAQ:HIBB) has moved up by 2 cents each to 27 cents per share and $1.44 per share in the last 30 days. This sporting goods retailer sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ross Stores’ (NASDAQ:ROST) earnings estimates for fiscal 2017 have increased by 6 cents to $3.28 per share in the last 60 days, while estimate for fiscal 2018 rose 4 cents to $3.28 per share. The discount store retailer currently carries a Zacks Rank #2 (Buy).

Zacks Editor-in-Chief Goes ""All In"" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Avon Products, Inc. (AVP): Free Stock Analysis Report

Coty Inc. (COTY): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.