Papa John's International, Inc. (NASDAQ:PZZA) stock has been losing sheen of late. Further, the company carries a Zacks Rank #4 (Sell). Let’s explore some of the reasons that may have resulted in the downside.

Shares Down

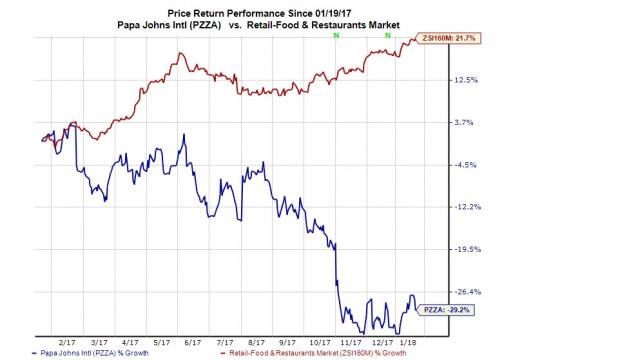

Papa John's shares have lost 29.2% over the last year against the industry’s gain of 21.7%. Downward estimate revisions add to its woes. In the last 60 days, the fourth quarter and 2018 earnings estimates have moved down 6.8% and 6%, respectively. This reflects analysts’ pessimism on the stock, given an uncertain sales environment and rising expenses.

Lowered Guidance for the Full Year

Like other industry players, Papa John's margins are being hurt by rising labor costs and costs related to various comps and sales boosting initiatives. The company has lowered its full year adjusted EPS growth expectation from a range of 8% to 12% to 3% to 7%.

North America system-wide comps growth is estimated to be 1.5%, down from the previous range of 2% to 4% growth. Debt EBITDA ratio is expected in the range of 2.5x to 3.5x, higher than the previously projected range of 1.5x to 2.0x.

Papa John's International, Inc. Gross Profit (TTM)

Reduced Spending Hurts Industry Players

The restaurant space is not much attractive for investors currently. Consumers increased their spending on dining modestly in the past few quarters. This is because disposable income is being marred by wage growth and inflation is also on the rise. Higher health care costs and tightened credit availability have further worsened the situation.

Moreover, increasing demand for high-quality products at lower prices is forcing grocery stores to lower food prices to remain competitive. This is resulting in a bigger gap between food-at-home and food-away-from-home indices.

Thus, same-store sales growth has been dull in a difficult sales environment. Traffic too has been weak. As a result, Papa John's sales have come under pressure. In fact, the third quarter of 2017 marked the seventh-consecutive quarter of negative comp sales for the restaurant industry as a whole, thereby continuing the somber mood.

Key Picks

Some better-ranked stocks in the same space are Darden Restaurants (NYSE:DRI) , Domino's Pizza (NYSE:DPZ) and Dunkin' Brands (NASDAQ:DNKN) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Darden, Domino's and Dunkin' have seen a respective 12, six and four estimates for 2018 move north over the past 60 days versus no southward revisions.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Papa John's International, Inc. (PZZA): Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN): Free Stock Analysis Report

Original post