As we enter the week of September 16th, 2013, everything appears to be hinging on the FOMC announcement Wednesday at 2pm EST. Chairman Bernanke will hold a press conference at 2:30pm EST which will be heavily parsed, to say the least. For a Fed which has had a major communication problem in recent months, the economic forecasts and forward guidance from Bernanke himself will be absolutely crucial.

Back in June I wrote that the Fed would need to “boil the frog slowly” as it began the journey toward ‘normalizing policy’. With the yield on the 10-year note knocking on the 3% door it will be interesting to see what, if anything, Bernanke does to walk back market expectations of Fed tightening.

Another surge higher in yields would almost certainly sink the stock market and the nascent recovery in housing, whereas a stabilization near current yield levels could set the stage for another all-time high in equities over the coming weeks.

Without further ado let’s examine the 3 most important macro-market charts as we enter a crucial week for global financial markets:

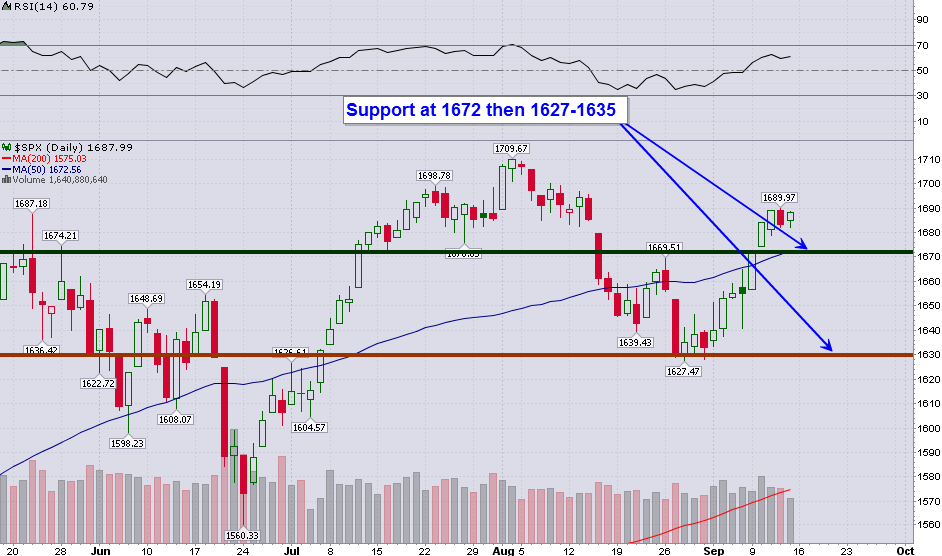

S&P 500

1672 is the first support of significance, which also happens to now coincide with the rising 50-day simple moving average.

10-Year Note Yield

3% is an absolutely massive technical and psychological level for the yield on the 10-year note. Meanwhile, any pullback in yields (rally in bond prices) is likely to find support near the rising 50-day simple moving average (2.70-2.75%).

Gold

Gold printed a potential bullish reversal candlestick on Friday which will need to be ‘confirmed’ higher today – $1350 is now resistance with support below near $1300. If gold is able to recover back above $1350 over the coming days, the door will be opened for a massive potential bottoming formation with a target of $1650+.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Most Important Macro Charts For The Crucial Week Ahead

Published 09/16/2013, 12:30 AM

Updated 07/09/2023, 06:31 AM

3 Most Important Macro Charts For The Crucial Week Ahead

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.