- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Shorts Attack NVDA, TSLA And RLGT

It was bound to happen. Stocks that soar high as the sky will end up bringing out the naysayers and of course the shorts. Their reports are filled with promises of a demise. They are filled with charts about how we have seen this before when people overpaid for tulips or some other type of flower. At the end of the day, their reports almost always are focused on one main thing, the valuation of the target.

The valuation argument is one that investors actual already had when they chose to buy the stock, or not buy the stock or short the stock. When an investor chooses to buy the stock they do so with the expectation that the company will be worth in the future. How much more it will be worth and when is up to the individual investor. When the investor chooses to not buy the stock (and not short it) as most investors do, they are making the statement that they don't believe in the prospects for the stock or would rather a better price. Finally, those that short the stock believe that prospects are not to be believed and that investors are paying too much for what is to be expected down the road

Shorts are an important part of the market. They give us a reality check when euphoria takes over and they often do a little more homework than most as they accept unlimited upside risk when taking a short position against a stock.

Follow Brian Bolan on Twitter: @BBolan1

Recent Short Call

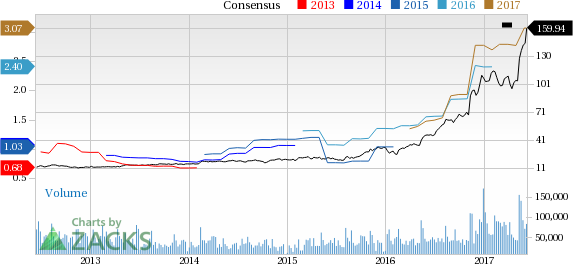

Citron Research came out with a short call on Nvida (NVDA) as they see a 20% downside to the current price. Andrew Left noted that he has been a fan of the company but the last few days have seen the market cap increase by the amount of a competitor (AMD). The short seller says that the company is not a fraud or a scam but the stock simply got ahead of itself.

One of the reasons the stock became overvalued is that Citi put out an "irresponsibly bullish" target price of $180 on the stock. The stock was trading below $150 the day before the target price increase from Citi and it rallied as high as $168.50 today. Left noted that volumes were also extremely high suggesting that day traders and investors were using the stock as a "casino stock" and asked does the stock need to go up every day to be a great company.

While the short-term impact is hurting the stock, the reality is that the stock might have gotten ahead of itself. Does this mean that the shorts and their target of $130 is next for the stock? I sincerely doubt it, but a pause for the cause will be a great thing. The thing that got me was that on a recent TV appearance, Left suggested that the stock price for Intel (NASDAQ:INTC) told him how the business was performing and that is simply not correct. As noted on the segment, the stock price and the performance of the company are not linked at the hip.

Prices tend to move based on supply and demand, but emotions play a role as does overall sentiment in a particular stock. At the end of the day, a professional investor focuses on the earnings and future cash flows of a company more than the movement of the stock on a minute to minute basis. Right now NVDA is a Zacks Rank #3 (Hold) as analysts have not adjusted estimates (up or down) over the last seven days. You can see the movement in earnings estimates on the detailed estimates page at this link (https://www.zacks.com/stock/quote/NVDA/detailed-estimates).

My take is that NVDA has a long road ahead and AI is only just getting started. Investors that have a long term focus should consider adding NVDA to their portfolios. In a recent podcast I discussed the prospects for NVDA here (https://www.zacks.com/stock/news/263279/game-changing-stocks-you-must-own).

Follow Brian Bolan on Twitter: @BBolan1

Tesla (NASDAQ:TSLA) Shares Jolted

You can add independent research firm Hedgeye to the list of market participants that believe that Tesla (TSLA) is a short. It was reported earlier today that the firm known for making snap calls and taking quick gains called the stock their best short idea. Sellers quickly overwhelmed buyers with shares after the call was made public but it appears to have found a bottom.

David Einhorn, a noted short seller, has been short the stock for some time but was feeling the pain again today as the stock reached another new 52 week high of $376.87 before word of the Hedgeye call slammed the stock. Einhorn and Hedgeye are not alone in saying that the shares of the automaker are overvalued. Just as the analyst at Barclays (LON:BARC) who has been unwaveringly wrong on the stock and even noted that the recent earnings from TSLA (which were disappointing by most measures) would still be a catalyst for another leg higher in price.

My view on TSLA, despite it being a Zacks Rank #4 (Sell) is that shares will reach $450 and probably more. Let's go back in time, when the stock was far below the recent highs. April 12 saw the stock trade in a range from $296-$308 -- and it closed that day at $296.84, but that was the day that I published why I believed that it was headed to $450 (https://www.zacks.com/commentary/110024/ride-tesla-to-450-and-beyond) in my article "Ride Tesla to $450 and Beyond."

Following a poor quarter, analysts dialed back some estimates and that caused the Zacks Rank for this stock to slide to a Zacks Rank #4 (Sell). With fresh auto sales numbers coming out around the start of July, I would not want to be short the stock. Keep in mind that the Model 3, which is primary demand driver for the stock is also set to begin production in that month and those two factors alone should send the stock higher.

Follow Brian Bolan on Twitter: @BBolan1

Shorts Of All Sizes

Finally, there was a short piece on a Radiant Logistics (RLGT) the other day penned by a group that also saw huge problems with Burlington Stores and Wix. I am not going to detail this one out much more to say that the prior missives on BURL and WIX were disastrous to investors if you followed their lead, so why is anything going to be different this time around with RLGT? These "short and distort" type publications often scare investors out a perfectly good stock like RLGT. At the same time, they offer wonderful buying opportunities for informed investors who realize the surge that all the transportation and transportation dependent stocks have been seeing of late.

Radiant Logistics is a Zacks Rank #1 (Strong Buy) and a steal at current prices of just over $5. The company sports a growth style score of "B" and is among my favorites.

Wix.com Ltd. (WIX): Free Stock Analysis Report

Tesla Inc. (TSLA): Free Stock Analysis Report

Radiant Logistics, Inc. (RLGT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Advanced Micro Devices, Inc. (NASDAQ:AMD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.