- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cheap Oil: Buying Opportunity?

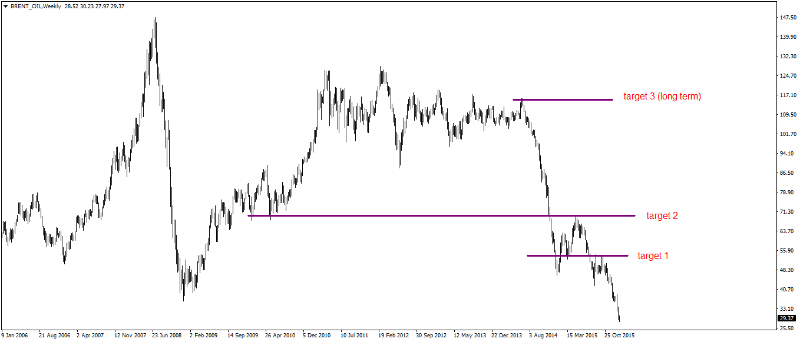

OPEC countries are not decreasing their supply in order to maintain their market share. But the current situation may not be here to stay. Medium-long term buying positions may be taken following a gradual path within the $20-$30 range.

Global crude oil prices have experienced a free fall during the last two years. The decline has recently reached the price of $28/barrel, levels unseen for over a decade. Some analysts already forecast an imminent hard landing at $20 and a subsequent stabilization at very low prices. What will happen afterwards? Shall we expect a prolonged collapse? Will oil price dynamics change?

TODAY – OVERSUPPLY

Oil prices are currently driven downward by an estimated excess in production of about 1 million barrels a day. On the other hand the economic slowdown (particularly in China, the world’s leading oil consumer) puts downside pressure on the global demand, widening the existing output gap. At the moment, OPEC has not taken any initiative to interrupt the decline and the removal of sanctions against Iran has fueled sales, largely as a result of speculation. Saudi Arabia and Iran are among few countries able to produce large quantities of oil at very low cost. Consequently, their companies are able to balance their budgets even at very low prices, at least for some short time. The objective is clear: to eliminate competitors, mainly non-OPEC producers that are struggling and generating losses at the current prices. OPEC has decided so far that the equilibrium price will be reached through a “natural selection”, rather than by intervening by cutting its output. This implies necessarily a drop in prices, down to the level on which the production will experience a natural decline due to extinction of the participants.

TOMORROW – POTENTIAL REVERSAL

The strategy is producing its effects, as many companies (and banks) are seeing their profits evaporating over time. Both OPEC and non-OPEC companies are cutting their estimated output for the near future and many projects are being postponed or cancelled. The Wall Street Journal mentioned recently the decision of multiple US lending banks to delay projects for over 13 million barrels per day, deferred indefinitely. It has to be underlined that in Saudi Arabia’s economy around 73% of total revenues comes from the oil industry. Its incomes from oil has dropped 23% last year, resulting in a widening deficit. Their strategy has a clear goal and must have a limited time horizon to avoid damaging themselves. Given this backdrop, can Saudis (and now Iran, after a long time of inaction) realistically increase production beyond current levels? As soon as, the price war will have produced its concrete effects, most likely we will see a significant reduction in supply due to the lack of market participants. Furthermore, deferring projects and exploration foreclose investments and development of known proven reserves. This means that under different market conditions we may discover us not able to satisfy the market’s demand. After years of inactivity there could be a very huge time lag before resuming investments to get around to drilling and then bringing the oil into the market, available as a supply. In this case, the price would shoot up. On the other hand, global economy appears to be in better condition than the financial markets estimate. Both in the United States and China, the economy is quite solid, driven by the solid labor market and consumption. Eurozone is still struggling to generate growth and inflation, but the ECB is committed to do whatever it takes to reach its goals. As a result, monetary policies are expected to stay accommodative for quite some time, supporting the economic environment.

OPPORTUNITY

As far as today the oil price is around $28-29 a barrel. The current levels are becoming quite interesting. It is crucial to highlight that no investor is able to predict exactly when the price reversal will occur, and from which price level. Some long positioning may be taken gradually, within the range $28-$20, keeping the risk under control. That means being able to withstand an eventual decline to $25 or (less likely) a brief touch to the psychological floor at $20. That would eventually be used as an opportunity for adding gradual positions in our portfolio, rather than selling on panic. The room for an upside move in quite big, but we expect the recovery to be gradual. Between 45 and 65 dollars it is possible to take some profits, even though a completely different market scenario may lead to higher prices in the medium-long term horizon.

Related Articles

Gold prices surged to an all-time high of $2,940 per ounce last Thursday, pushing its market cap above $20 trillion for the first time ever, as trade tensions between the U.S. and...

Gold stabilised around 2,940 USD per troy ounce on Tuesday, remaining close to record highs. The metal continues to benefit from strong demand for safe-haven assets amid growing...

Gold moves with weak momentum Remains near 2,950 RSI and MACD look overbought Gold has been fighting with 2,945-2,956 restrictive region, which encapsulates the 161.8% Fibonacci...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.