- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Trading and Investment Tools

Financial Calendars

With our Live Economic Calendar, you can keep track of all the important events that drive the financial markets. You can customize your calendar by filtering according to currency, importance of event, and date range. It is a very useful tool for fundamental traders.

Investment Tools

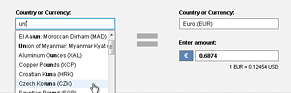

Use our real time currency converter to convert any amount from one currency to another. The converter can be used for every major as well as exotic currency. In addition you can choose specific dates in order to see what market rates were on that day. The converter allows you to toggle between your chosen currencies via the button at the middle of the converter. Once you've chosen the currencies, you'll see an overview of the pair's activity for the previous 7 days as well as the daily and 52-week range. Hover over the range arrow to see the current market price.

Trading Calculators

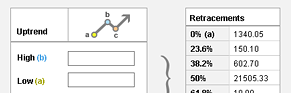

With our Fibonacci calculator you can generate basic Fibonacci retracements and extension values in both up and down trends, by entering the high and low values of your choice. This is a powerful tool for predicting approximate price targets.

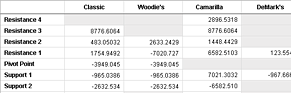

This tool allows you to receive pivot points in four different popular systems, by filling in the previous days’ high, low, and close. It is helpful for determining support, resistance entry and exit points.

Trading Tools

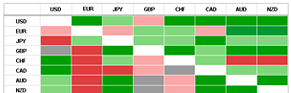

The Currencies Heat Map is a set of tables which display the relative strengths of major currency pairs in comparison with each other, designed to give an overview of the forex market across various time frames.

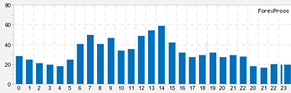

The Forex Volatility tool generates the daily volatility for major, cross, and exotic currency pairs. The calculation is based on daily pip and percentage change, according to the chosen time frame. You can define the time frame by entering the amount of weeks.

Personal Finance Tools

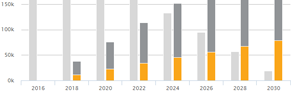

Investing.com’s Mortgage Calculator allows you to outline an appropriate budget for the purchase of a new home. The calculator is designed to help you estimate your monthly mortgage payment, interest payment, tax & insurance, as well as the payments balance over the years, and the total of all your mortgage expenses. You can simply adjust different variables such as the loan amount, interest rate and duration of the loan, in order to see the effect on the monthly payment. You can also provide your monthly income variable in order to develop the most affordable scenario for your personal budget.