- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Scales Tilt in Favor of Active Managers, Opinion From Leading Wealth Managers

Four wealth managers confirm the shift to an active approach for better return

BlackRock (NYSE:BLK), the world's largest asset management firm, which helped popularize passive investment strategies, recently stated that 2024 marks an era of active management. According to its “2024 Global Outlook,” the “autopilot” phase of wealth management has been replaced with a “new regime,” advocating for a shift toward actively managed strategies.

For years, investors have enjoyed the simplicity and effectiveness of static, buy-and-hold allocations, buoyed by an era of ultra-low interest rates. But BlackRock’s analysts argue that this period has ended. A combination of higher interest rates, persistent inflation, and more geopolitical risk tilts the scales in favor of active managers and hedge funds rather than passively managed portfolios, the company warns.

This insight is also voiced by dozens of other leading global wealth and asset managers. “Welcome to a World of New Realities,” says Goldman Sachs Asset Management, highlighting that active investment strategies that focus on diversification and risk management will be important to navigate increased performance dispersion in 2024 and “help deliver alpha.”

This sentiment extends beyond US-headquartered wealth managers. MAPFRE Asset Management, a Spanish independent asset manager, also supports this claim. “In a global financial landscape characterized by volatility in all asset classes and uncertainty, active management in mutual funds has emerged as an essential strategy for weathering the market,” MAPFRE states.

Swiss-based wealth managers, renowned for their expertise and premier status among international clients, also advocate for active management. LINVO AG, a wealth manager for UHNW clients headquartered in Switzerland, echoed the consensus. Alexander Kogan, LINVO’s Managing Director, outlined that “active long-short strategy has consistently been a top choice for investors seeking extra yield in unpredictable and volatile market conditions, such as those we appear to be facing currently.

“In 2022,” Mr. Kogan continued, “our active strategy for a balanced portfolio delivered positive returns while the S&P 500 declined by nearly 20%. [...] Our market-neutral active strategy offers both competitive returns and peace of mind for investors, with a year-to-date performance of 15.18% compared to the S&P 500's 11.52%.”

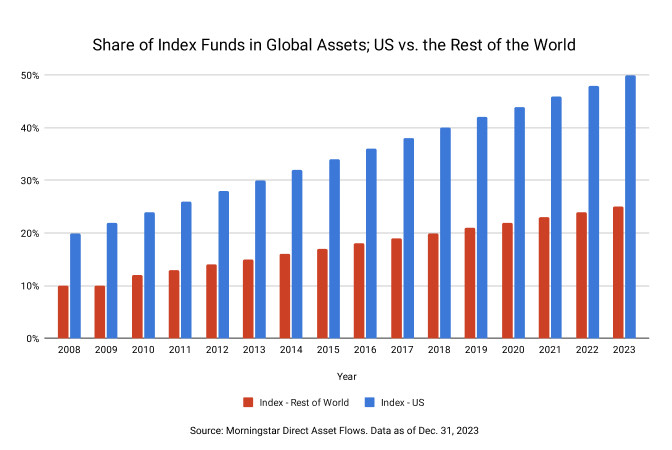

Amid the prevailing uncertainty, the ability of an active approach to outperform a passive approach seems to be bearing out. Why has the passive approach lost ground to the “new regime?” In the past 15 years, passive investing levels have climaxed, as reported by Morningstar, with the share of passive funds more than doubling, reaching 50% for the U.S. and 25% for the rest of the world. Consequently, the number of buy-and-hold investments is poised to soon exceed those backed by thorough analysis.

As a result, stocks of large companies that have reached a certain capitalization level and have automatically entered the passive fund’s portfolio constantly rise, largely due to heightened demand and not fundamental value. Concurrently, as retail investors drive capitalization, passive cap-based funds proportionately augment their allocation. Passive index funds are therefore no longer merit-based, with companies being rewarded simply for being large.

In the end, this forms a feedback loop: companies with significant market capitalization grow with little to no dependence on their intrinsic or book value. Some commentators argue this can even be seen as a bubble that could burst.

It is evident that active management, when done right, is well-positioned in 2024 and beyond to outperform passive management by a significant margin. In the current environment, experienced wealth managers who leverage an active approach might therefore be superior for international clientele.