- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Futures

What Are Futures?

Futures contracts are legal agreements between a buyer and seller to exchange a specific, standardized asset at a specific time in the future for a specific price. Futures contracts are classified as derivatives, meaning their value is derived from the underlying asset.

How Futures Contracts Work

Futures contracts are most often created for a standard asset such as a government bond, currency, or commodity. These contracts are bought and sold on exchanges, often by speculators with no intention of taking delivery of, or delivering, the hard asset itself.

Speculators enter and exit positions before the contract expires, on the prospect of profiting from changes in market expectations of the underlying asset. Among other things, price changes are a result of economic conditions, government releases, weather, political risk, or company management. If the contract is held through expiration, the seller must deliver the underlying asset to the buyer at the agreed upon price.

At any given time, more than one contract of the same asset is being traded on an exchange, with the difference being the expiration date. Contracts with the most activity and volume are those with expectations of major events. Very often these active contracts are also the next to expire.

However, some contracts with later expirations can be most active because the next major event is expected beyond the expiration of nearby contracts. The Eurodollar contract is a strong example of this. That’s because Federal Reserve policy changes are often expected to be most significant beyond the expiration of the closest contract.

The underlying symbols of contracts are always the same, e.g., CL is crude oil, GC is gold, and ES is the S&P 500. The month of expiration is specified by the letters, detailed in the table below, e.g., CLU is the crude oil contract that will expire for delivery in September.

F = January

G = February

H = March

J = April

K = May

M = June

N = July

Q = August

U = September

V = October

X = November

Z = Decmebe

Additional Futures Trading Strategies

Strategies for trading futures go beyond simple speculation on one underlying asset at one expiration date. Spread trading is a method of finding a value between the expiration of two or more contracts of one or more underlying assets.

For example, a spread trade can be initiated by selling one contract and buying another with the expectation that the difference between the two will change in favor of the trader. Spread trades are also used to manage the risk of holding a position in an individual contract.

Finding Futures Information on Investing.com

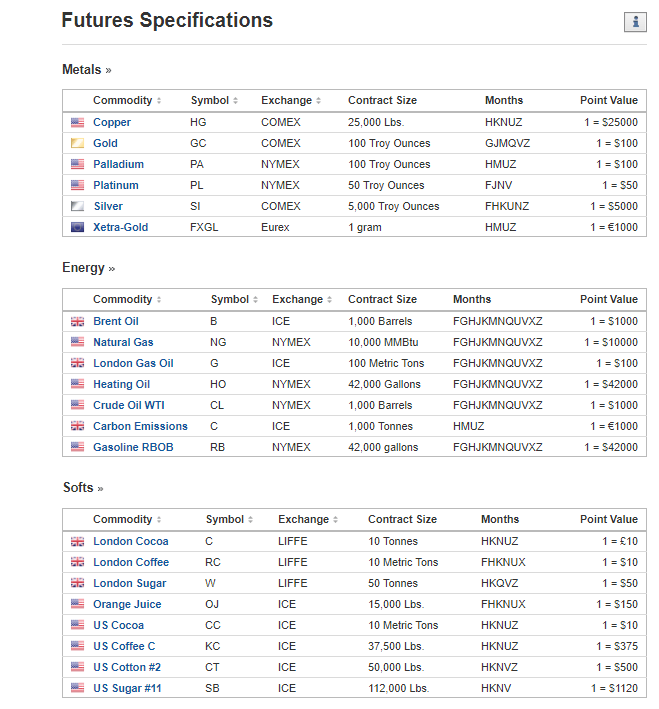

At Investing.com, the Futures Specifications page is a good place to start exploring futures contracts. This page details the characteristics of each major contract, including symbol, exchange, contract size, months of expiration, and value of each point of the contract price.

The Futures Expiration Calendar provides users with dates of expiration and rollover. The Real-Time Commodity Futures Prices page summarizes major futures commodity markets with helpful tabs at the top of the table.

Each tab details a specific market in sortable columns, making it easy to find opportunities based on a number of different criteria. A similar page for financial futures is also available.