- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Weekly Q&A: Investors Ask, Clement Answers #9

This week, Clement discusses the unpredictability of the stock market, the composition of the S&P 500, and what makes for the best short-term high-gain stocks.

Why is the stock market so difficult to predict?

Stock market moves are ultimately an aggregate of all of the decisions of all of its participants. There are millions of us making decisions and investments based on our own analysis. We then place our investments and hope they do well. They do well when the majority of the participants agree with us, which creates demand for the stocks we purchase, and the price increases.

It is very hard to predict the actions of one person, let alone the actions of millions. We all have a different view and judgments of current events. An earnings number, for example, can surpass one person’s expectations, while at the same time disappoint another one. But the price will move according to what the majority of people think and do.

This is where technical analysts claim to be able to predict moves, based on previous patterns of buying and selling. They try to identify prices with many buyers or many sellers, according to what happened last time the stock traded at this price. Does it work? Well, as you said yourself, the stock market is very difficult to predict…

What are the best short term high gain stocks?

This is a question that gets asked a lot. There is no definitive answer, and I’ll explain why:

The market moves in two directions, up or down. Everyone does their own analysis - but there is no one surefire way to find a stock at a breakout point. Fundamental analysis can find fundamentally undervalued stocks that should bounce back, and technical tries to find reversals and breakouts on the chart.

But the only objective way to find big swings is to look at a stock’s volatility. The idea is that a volatile stock can swings strongly one way or another, hence being short term high movement stocks. The high potential gains are of course offset by high potential losses - but there are no risk-free investment, especially if looking for high returns.

In short, look at the most volatile stocks, and there you are at least guaranteed to get some strong action. Whether you catch the moves in the right direction, well, that’s up to you and your method.

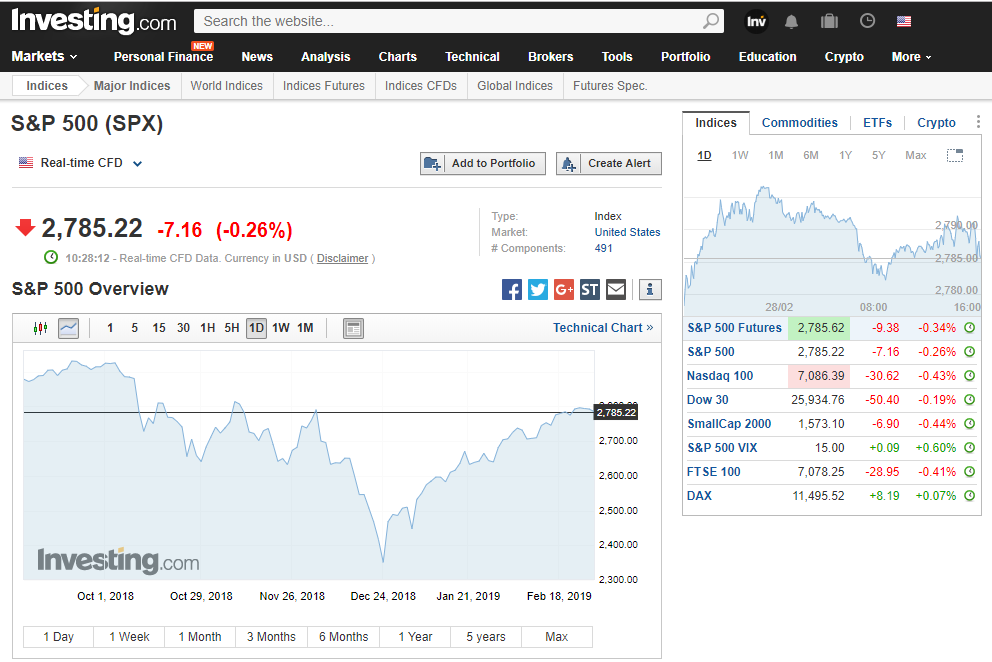

What are some stocks that affect the S&P 500 the most?

The S&P 500 is what we call a weighted index. That means that every component is represented according to its relative size of the total index market cap. If a company’s market cap is 10% of the total index market cap, a move of 1% in that stock will move the index 0.1%, a tenth of a percent, since the company is a tenth the size of the index. The market cap for the S&P 500 is calculated according to the ‘float’, which is the number of shares available for public trading.

So of course, the biggest companies in today S&P 500 are the ones that affect it the most.

Today, Microsoft is the biggest stock, with a weight of 3.7. Apple follows at 3.35, Amazon at 2.86, and Facebook at 1.68. It means that a move in Microsoft counts double what a move from Facebook counts.

There are only 16 stocks weighted at 1 or higher. The lowest weighted stock is at 0.006, making it almost irrelevant compared to Microsoft (Microsoft outweighs it by a multiple of 616).

If you have questions of your own you’d like Clement to answer, please leave them in the comments below or send them directly to Clement via Twitter - @ClemThibault.

You may also like:

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.