- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

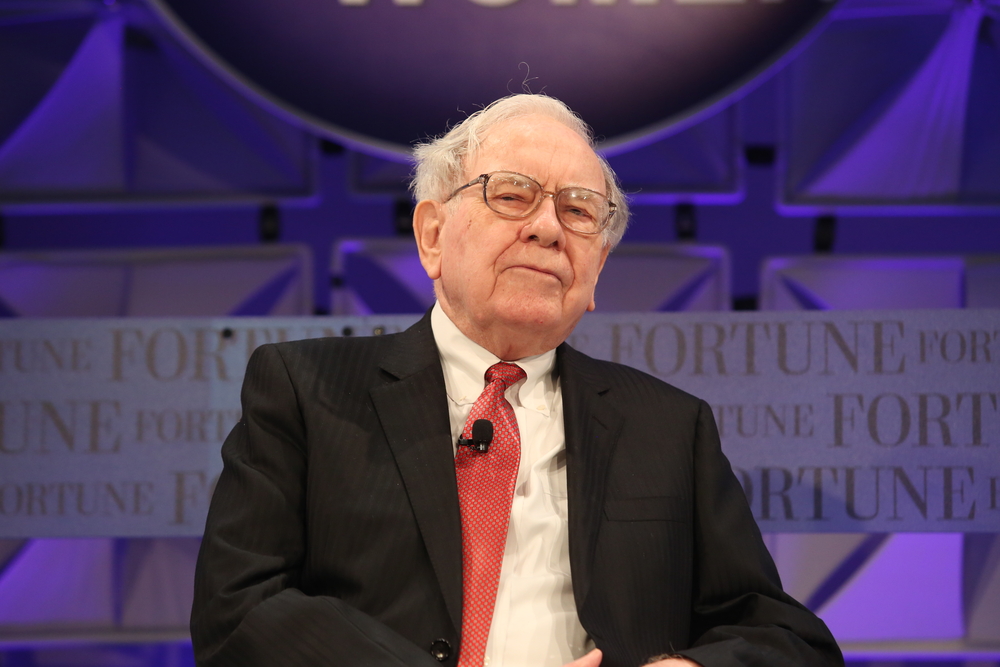

Buffett’s Blunder and Other Great Mistakes

5 stories of Investing gone wrong

Anyone who’s been following finance news recently has seen the story of how Berkshire Hathaway (NYSE:BRKa) lost $4.3 billion thanks to a bad bet on Kraft Heinz (NASDAQ:KHC). This is not the first, or last time this will happen to investors, but remembering the truly big mistakes may help you avoid making similar mistakes in the future. Below you will find the 5 of the greatest investment mistakes, regrets, and bad decisions in recent history.

1. Buffett's (First) Berkshire Billions Blunder

Did you know that Warren Buffett first invested in Berkshire Hathaway all the way back in 1962? Back then it was just a failing textile company, Buffett bought a whole lot of shares, planning to profit when other textile mills close down. Seeing green, the company tried to squeeze more cash from Buffett, which angered the man. As a reprisal, Buffett bought the controlling share of the company and fired the CEO, then tried to make the business become profitable again for 20 years. When asked about it, Buffett said he estimates he lost some $200 billion on the business. WOW…

2. Not Taking a Bite of the Apple

Alongside the names Steve Jobs and Steve Wozniak, Apple (NASDAQ:AAPL) had a 3rd founder - Ronald Wayne. Mr. Wayne had a pivotal role in the company during its first years, but after 11 days he decided that the company doesn’t have a future, he sold the 2 his share of the company for $800 (yes, that’s a mere eight hundred dollars). If he’d have kept his share, it would now be worth over $32.5 billion today. Sometimes you just have to HODL...

3. How 20th Century Fox Outfoxed Themselves

Back in 1977, a young and not very-well-known director called George Lucas released what was to be the first Star Wars movie. Back then, the executives at Twenty-First Century Fox (NASDAQ:FOX) had very little faith in the project, so much so, that they gave up the licensing rights for the brand to Lucas. In 2012, Lucas sold his company - Lucasfilm to the Walt Disney Company (NYSE:DIS) for just over $4 billion, and in 2018 the entire Star Wars franchise’ worth stood at a whopping $65 billion.

4. How $70,000 Turned to $1.1 Billion (Loss)

Back in 1983, Toshihide Iguchi was working as a portfolio manager in the New York branch of Japan’s Daiwa Bank (OTC:DSEEY). Iguchi traded Federal Reserve Notes (FRN) but incurred losses worth $70,000. In an effort to conceal his losses and save his reputation, Iguchi kept his mistakes a secret for several years, as the losses kept growing. In 1992, Iguchi blamed what was now a $350 million loss on 2 junior traders, prompting a federal investigation that found nothing. By 1995, Iguchi’s losses amounted to over $1 billion. Feeling the burden on his conscience, Iguchi sent a confession letter to the bank president and eventually was arrested. Talk about not knowing when to cut your losses…

5. Not Getting Excite(ed) Enough for Google

Most of you won’t remember this, but back in 1999, the search-engine war was still raging. The giants of that time included Yahoo!, Excite, and Altavista, with Google (NASDAQ:GOOG) barely being 3 years old and still not having a serious market share. Google’s then-owner Larry page went to Excite and offered to sell them Google’s technology for $750,000. Excite refused. Nowadays, Excite doesn’t exist anymore, while Google (now a part of Alphabet Inc (NASDAQ:GOOGL)), is worth $777 billion. Talk about a lost investment...

So, what was YOUR worst investing decision? Tell us in the comments.

You may also like:

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.