Stocks are hitting the skids as April 2nd, or Liberation Day, quickly approaches. Investors are rightfully scared that tariffs announced on Liberation Day will be crippling to the economy and harm corporate earnings. Based on recent comments from Donald Trump, that is a logical concern. However, what if Trump is playing with emotions to make Liberation Day look like a success? If that were the case, he might promise the worst regarding tariffs and underdeliver. In other words, the tariffs announced on Liberation Day may not be as high or far-reaching as expected. If that were the case, the markets would likely stage a relief rally. Accordingly, Trump can take a victory lap, claiming that tariffs are beneficial, as evidenced by the market’s actions.

Will that happen? We don’t know. However, while it’s easy to be bearish given the uncertainty, there are other scenarios. As investors, we must consider all possible outcomes, from the most obvious to the least suspected. The scenario above may be a big bear trap for those fearing the worst. Keep the old Wall Street adage, “buy the rumor, sell the fact” in mind these next few days. However, this time, it might be sell the rumor, buy the fact!

Market Trading Update

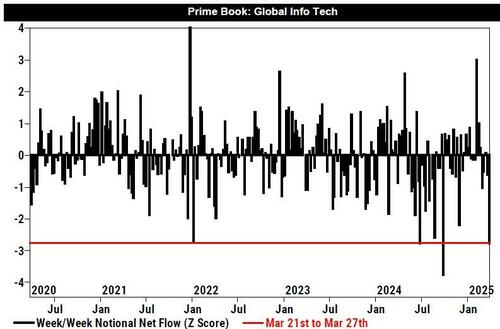

Yesterday, we addressed the recent failure of the market at the 200-DMA which certainly raises near-term alarm bells. However, with the market very oversold, more extreme levels of negative sentiment, and heavy hedge fund selling in Technology stocks, as shown below, the market is set up for a sellable rally with which to reduce risk.

As noted above, the market remains constrained by Trump’s tariffs, and hopefully, Wednesday will provide some reasonable clarity with which markets can begin to adjust valuation estimates.

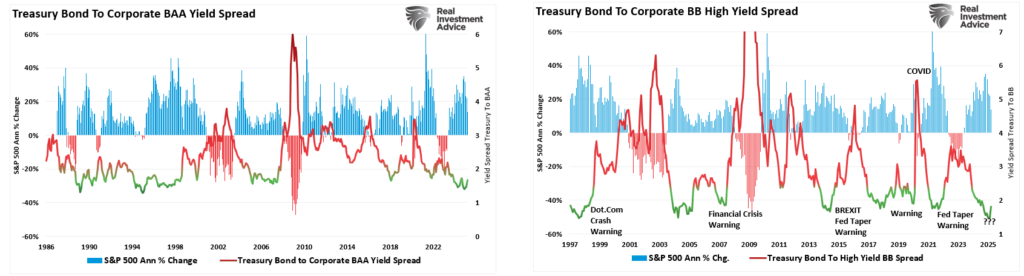

Most importantly, credit spreads remain well contained, which suggests that the current selloff is more of just a “correction event” rather than the beginning of a larger event-driven decline. If those spreads widen to more critical levels, it will likely be associated with a more significant risk-off event, driven most likely by some exogenous event.

Technically, the markets remain very weak, breadth is poor, and price momentum is lacking. Such an environment is not conducive to aggressive allocations to equities. Until we get past April 2nd, I would expect markets to remain volatile and difficult to navigate. However, this is also the type of environment that leads to the most investor mistakes.

We suggest remaining cautious and patient until we pass “Liberation Day.” Once that occurs, we should have a much better assessment of overall market risk, which will help us better assess our risk/reward profiles in portfolios.

Overdone Expectations

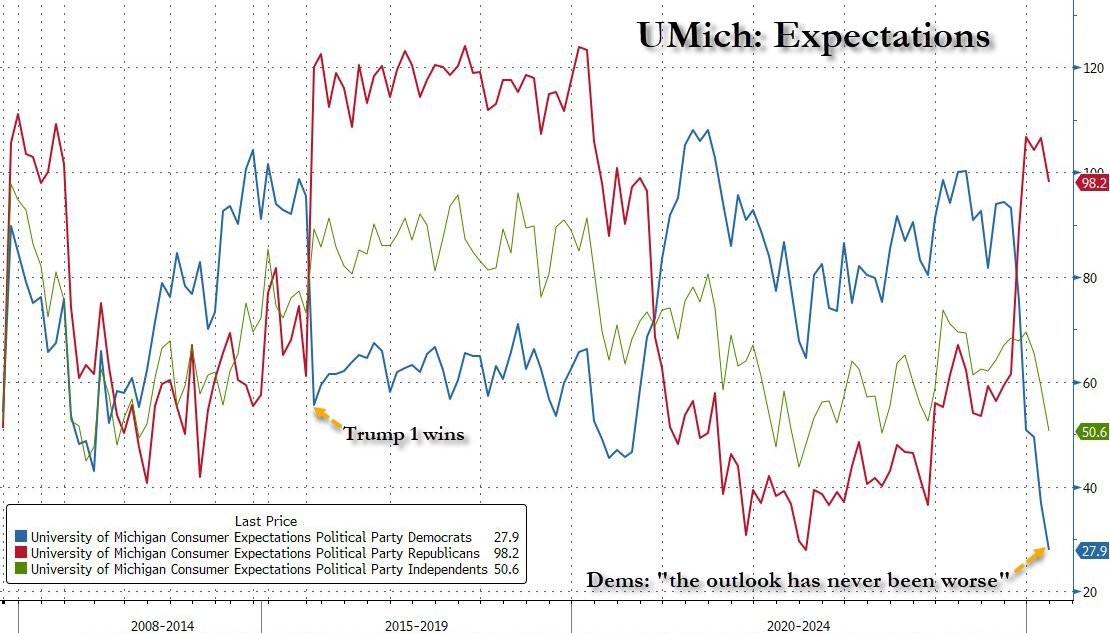

The graph below showing the University of Michigan consumer expectations, separated by political affiliation, is stunning for two reasons. First, and as we have noted in the past, is the extreme divergence of expectations based on the president’s political party. As the graph shows, expectations change on a dime as each new president takes office. However, more interesting to us is the degree to which sentiment for Democrats has eroded. Democrats think today’s economic outlook is worse than during the peak of Covid and the financial crisis of 2008. Sentiment is tricky to convert into an economic forecast. Sometimes, sentiment is bad, but consumers continue to spend. Other times, sentiment dictates consumption habits. Therefore, economic data like retail sales and earnings announcements for retailers will help us see if the negative expectations are bleeding into actual consumption.

Foreign Stocks Are On A Relative Rollercoaster

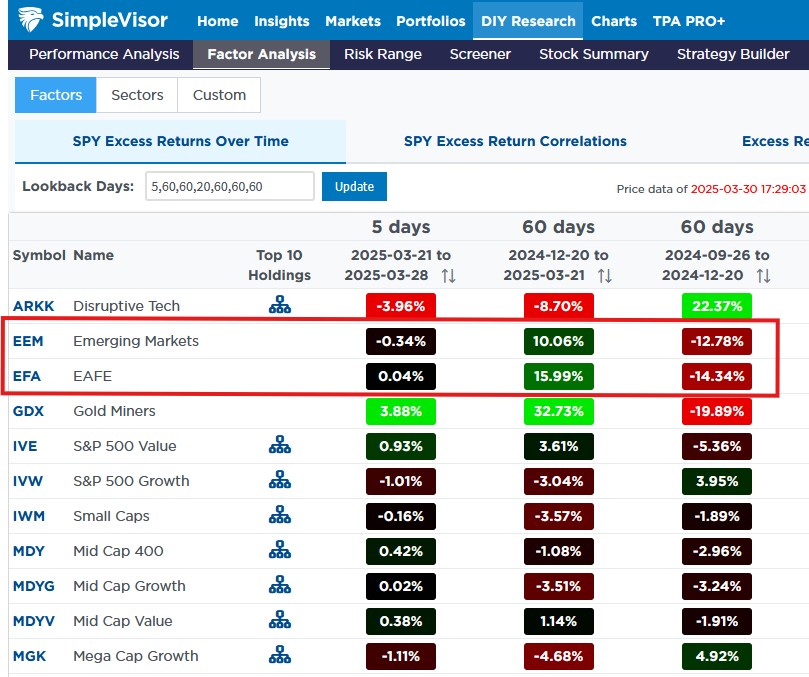

Despite the tariffs and threats of more, foreign stocks have been doing well on an absolute and relative basis. The weakening dollar is helping those stocks. Since peaking in early July, the dollar index has fallen by over 5%. The first graph breaks out the relative performance of many stock factors versus the S&P 500. We circle the two ETFs representing developed foreign markets (EFA) and emerging markets (EEM). As shown, they were more or less in line with the S&P 500 last week, grossly outperformed in the 60 days prior, and well underperformed in the 60 days before that. Simply, US investors selling domestic stocks to buy foreign stocks have had good returns over the last 60 days. However, with tariffs overwhelming the headlines, that may not continue to be the case.

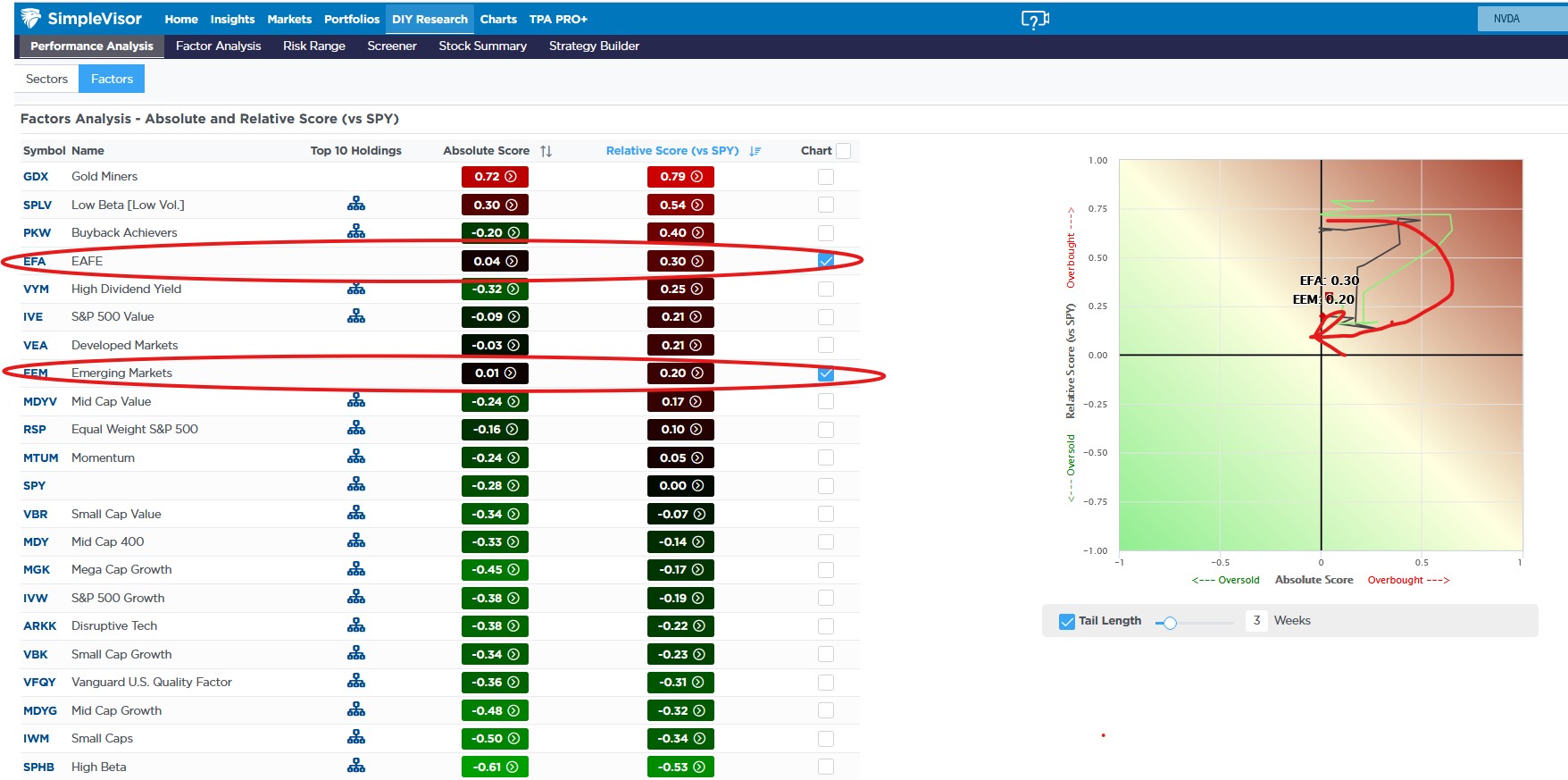

We share the second graphic to help you better assess foreign stocks. This chart shows the progression of their relative and absolute scores over the last three weeks. Both ETFs remain overbought, but their relative scores have declined, and their absolute scores are starting to become negative.

If the dollar continues to fall and the tariff news brightens, we may see both ETFs loop back around toward the upper right. Conversely, they may start to underperform as they have for the last few years.

Tweet of the Day