- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

WTI Crude Oil Speculator Bullish Bets Fall For 1st Time In 5 Weeks

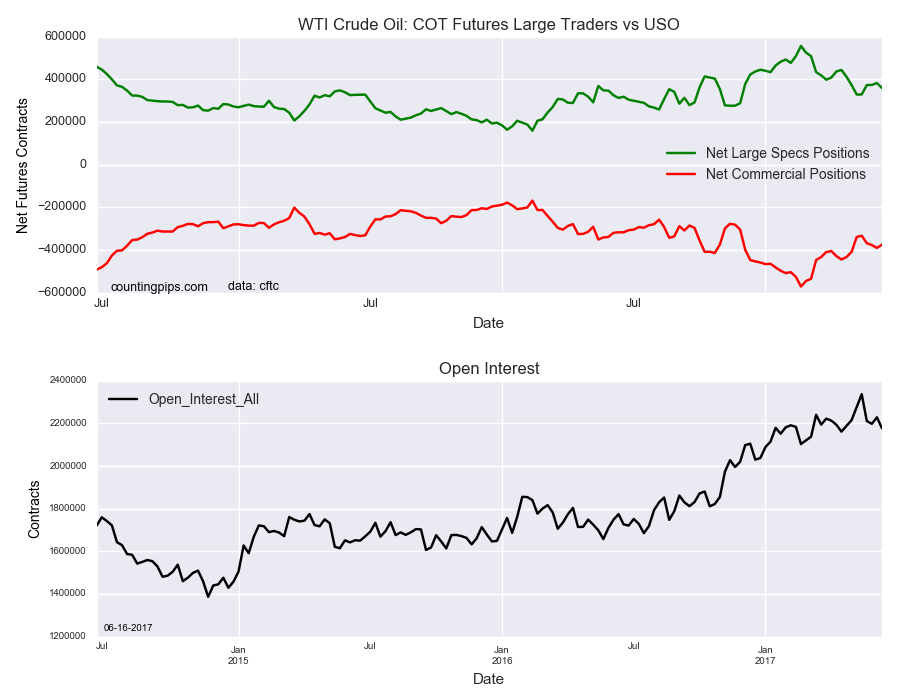

WTI Crude Oil Non-Commercial Speculator Positions:

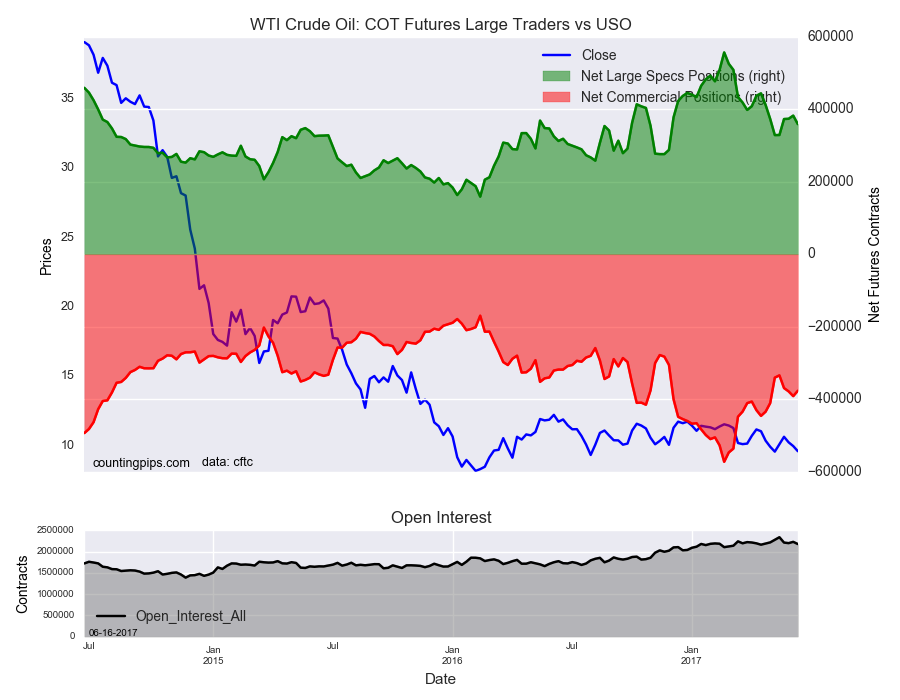

Large speculators sharply cut back on their bullish net positions in the WTI Crude Oil futures markets this week following gains in the previous four weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 358,999 contracts in the data reported through Tuesday June 13th. This was a weekly reduction of -23,470 contracts from the previous week which had a total of 382,469 net contracts.

Speculative positions had risen by over +53,000 total net contracts in the previous four weeks before this week’s pull back. The weekly decline has pushed the spec level to the lowest position since May 16th.

WTI Crude Oil Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -376,005 contracts on the week. This was a weekly boost of 14,814 contracts from the total net of -390,819 contracts reported the previous week.

USO (NYSE:USO):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the USO Crude Oil ETF, which tracks the price of WTI crude oil, closed at approximately $9.60 which was a decline of $-0.37 from the previous close of $9.97, according to unofficial market data.

Related Articles

American stock investors have suddenly started buying gold again. After largely ignoring most of gold’s monster upleg, they just started flocking back fueling big builds in...

Analyzing the movements of the natural gas futures since I wrote my last analysis, I anticipate that the natural gas futures will likely start next week with a gap-down opening if...

President Trump has had success bringing down oil prices by sheer force of will and keeping traders off balance. Perhaps the biggest success has a lot to do with not only...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.