- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Micron (MU) Posts Loss In Q4, Tops On Revenues; Guides Well

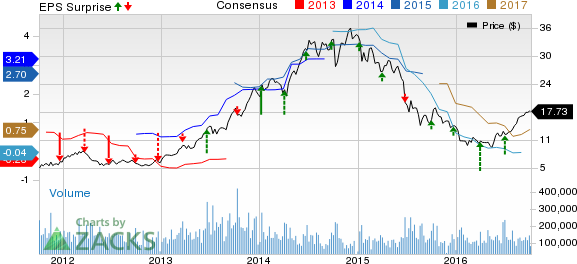

Micron Technology Inc. (NASDAQ:MU) reported better-then-expected fourth-quarter fiscal 2016 results.

Adjusted loss per share (excluding the impact of one-time items) of 5 cents was narrower than the Zacks Consensus Estimate of a loss of 10 cents. However, in the year-ago quarter, the company had reported adjusted earnings of 37 cents per share.

Quarter Details

Though Micron’s revenues in the quarter decreased 10.6% on a year-over-year basis to $3.217 billion, it surpassed the Zacks Consensus Estimate of $3.110 billion. Also, reported revenues increased on a quarter-over-quarter basis (up 11%), primarily due to pricing improvement in the DRAM memory chip market and recovery in the PC market.

DRAM products accounted for 60% of total revenue during the quarter. DRAM revenues increased 20% on a sequential basis. On the other hand, NAND sales volume increased around 12% quarter over quarter.

Coming to the Storage Business Unit (SBU), revenues of $758 million were up 5% sequentially.

Revenues from the Mobile Business Unit (MBU) increased 20% sequentially to $671 million, primarily due to the continuous ramp of eMCP products.

The computing and networking business (CNBU) saw a 14% sequential increase in revenues to $1.25 billion, primarily due to an increase in 20-nanometer shipment growth across all segments coupled with pricing improvement.

Revenues from the embedded business came in at $513 million, up 5% from the last quarter, primarily due to strength in the automotive and consumer segments.

Micron’s gross profit was down 40.3% on a year-over-year basis to $579 million. Gross margin was 18% compared with 26.9% a year ago, primarily due to a lower revenue base.

Selling, general and administrative (SG&A) expenses decreased 7.6% year over year to $157 million. Research and development (R&D) expenses were $411 million, up 8.4% on a year-over-year basis. Operating expenses, as a percentage of revenues, increased 391 basis points on a year-over-year basis to 18.9%.

Micron reported operating loss of $32 million. The company reported operating profit of $427 million in the year-ago quarter.

The company incurred non-GAAP net loss (excluding the impact of one-time items) of $56 million compared with net income of $399 million reported in the year-ago period.

On a GAAP basis, the company suffered net loss of $170 million. In the year-ago quarter, Micron had reported net income of $471 million.

The company exited fiscal fourth quarter with cash and short-term investments of $4.39 billion compared with $4.04 billion in the previous quarter. Receivables were $2.07 billion, flat on a quarter-over-quarter basis. Micron’s long-term debt increased to $9.15 billion from $8.92 billion in the prior quarter.

During the twelve months ended fiscal 2016, the company generated cash of $3.168 billion compared with $5.208 billion generated during the same period last year. Capital expenditure was $1.69 billion in the fourth quarter of fiscal 2016.

Guidance

For the first quarter of fiscal 2016, Micron expects revenues in the range of $3.55 billion to $3.85 billion. The Zacks Consensus Estimate is pegged at $3.363 billion. The company expects earnings per share in the range of 13 cents to 21 cents. The Zacks Consensus Estimate is pegged at earnings of 7 cents.

Management expects gross margin in the range of 23% to 25.5% in fiscal first quarter 2017. Operating expenses are expected in the range of $600 million to $650 million and operating income is likely to be within $245 million to $330 million.

Our Take

Micron reported encouraging fourth-quarter fiscal 2016 results. Though the company posted a loss during the quarter, it compared favourably with the Zacks Consensus Estimate. The top line also surpassed the consensus mark. The first quarter guidance was also encouraging.

Going forward, the acquisitions of Elpida and Rexchip (now known as Micron Memory Japan, Inc. and Micron Memory Taiwan Co., Ltd., respectively) will increase Micron’s traction in the memory market.

Micron is positive about the product launches and growing demand, particularly that of SSD products. The company has been constantly innovating in memory technologies, spanning DRAM, NAND and NOR Flash memory solutions, which are being widely used in the latest mobile computing devices as well as in consumer, networking and embedded products.

However, Western Digital Corporation (NASDAQ:WDC) , a key player in the NAND space, could increase competition in the industry.

Currently, Micron has a Zacks Rank #2 (Buy). Better-ranked stocks in the technology sector include Jabil Circuit Inc. (NYSE:JBL) and Equinix Inc. (NASDAQ:EQIX) , both of which carry a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here

Jabil Circuit and Equinix have a long term-expected EPS growth rate of 12% and 16.94%, respectively.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

WESTERN DIGITAL (WDC): Free Stock Analysis Report

EQUINIX INC (EQIX): Free Stock Analysis Report

MICRON TECH (MU): Free Stock Analysis Report

JABIL CIRCUIT (JBL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett sold large shares of Bank of America and Citigroup, increasing his already large cash pile. Among his additions, Constellation Brands has a strong position in the...

Airbnb's (NASDAQ:ABNB) stock price surged over 14% on February 14, 2025, following the release of the company's impressive Q4 2024 financial results. However, the company's...

It was subtle but significant; the Nasdaq was able to go beyond the breakdown gap and make a push towards all-time highs, closing above 20,000 in the process. Technicals are net...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.