- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Daily Currency Outlook: GPB/JPY And EUR/JPY : April 21, 2016

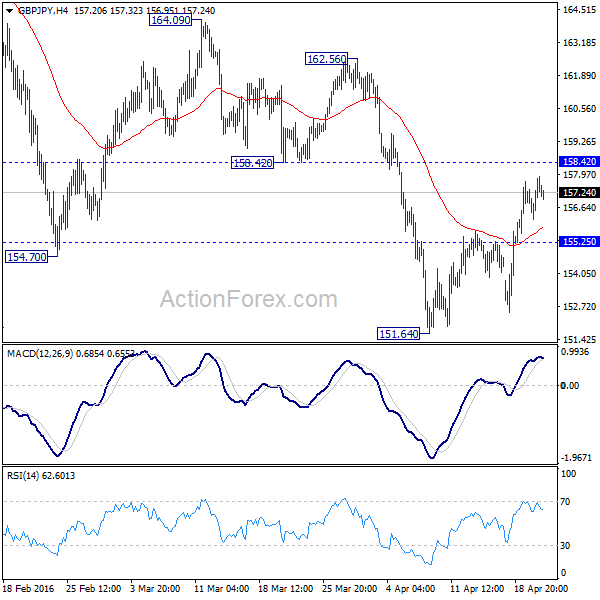

GBP/JPY Daily Outlook

Daily Pivots: (S1) 155.71; (P) 156.71; (R1) 158.20;

The corrective rise from 151.64 is still in progress but we'd expect strong resistance from 158.42 support turned resistance to limit upside and bring down trend resumption. Below 155.25 minor support will turn bias to the downside for 151.64 low first. Break will extend larger fall from 195.86 and target next long term fibonacci level at 147.01.

In the bigger picture, fall from 195.86 medium term is viewed as a corrective move and should target 61.8% retracement of 116.83 to 195.86 at 147.01. We'll start to look for reversal signal below there. On the upside, break of 164.09 resistance is needed to indicate completion of fall from 195.86. Otherwise, outlook will remain bearish in case of rebound.

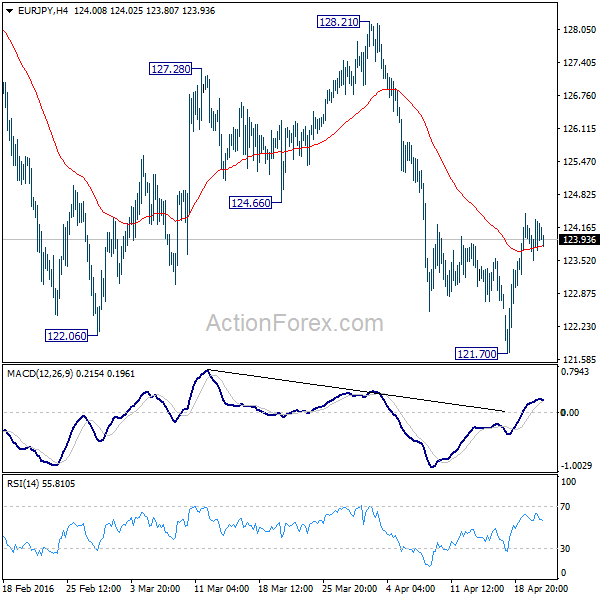

EUR/JPY Daily Outlook

Daily Pivots: (S1) 123.63; (P) 123.98; (R1) 124.43;

A short term bottom was formed at 121.70 and rebound from there is extend to 55 days EMA (now at 125.78). There is no clear sign of trend reversal yet and thus, we'd be cautious on strong resistance above there to limit upside. Meanwhile, break of 121.70 will extend the larger down trend to next projection level at 117.37.

In the bigger picture, medium term correction from 149.76 is still in progress and would extend to 100% projection of 149.76 to 126.09 from 141.04 at 117.37. We'll look for bottoming signal around 61.8% retracement of 94.11 to 149.76 at 115.36. Break of 128.21 resistance is needed to be the first sign of medium term reversal. Otherwise, outlook will stay bearish in case of rebound.

Related Articles

Robust economic data from Japan bolsters declines in USD/JPY. Uncertainty surrounds Donald Trump's tariff policy. 151 test looms after failed attack at 155. Get the AI-powered...

The Australian dollar is drifting on Tuesday after three straight days of gains. In the European session, AUD/USD is trading at 0.63671, up 0.09% on the day. RBA Lowers Rates to...

Should Russia and Ukraine ultimately reach a peace deal, the US dollar is probably due another moderate correction – but for now, markets are lacking tangible bearish USD drivers...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.