- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Zuora (ZUO) To Report Q4 Earnings: What's In The Cards?

Zuora, Inc (NYSE:ZUO) is scheduled to report fourth-quarter fiscal 2020 results on Mar 12.

For the quarter under review, the company expects revenues in the range of $71-$72.5 million.

The Zacks Consensus Estimate for revenues is currently pegged at $71.8 million, which suggests growth of 12% from the year-ago quarter’s reported figure.

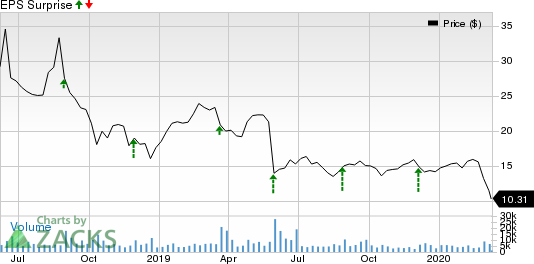

For the quarter under review, the Zacks Consensus Estimate for a loss has been steady at 10 cents per share in the past 30 days. The company reported a loss of 11 cents in the year-ago quarter.

Notably, the company has trailing four-quarter positive earnings surprise of 24.7%, on average.

Let’s see how things have shaped up for this announcement.

Zuora, Inc. Price and EPS Surprise

Factors to Consider

Zuora’s top line is expected to have benefited from the ongoing shift to a subscription-based business model across several business verticals.

Moreover, the company’s innovative portfolio of solutions has well positioned it to serve the majority of non-technical companies that are going through a transition phase due to digital transformation. This is expected to have contributed to the company’s growth during the quarter.

Notably, major automobile companies like Fiat Chrysler and Harley-Davidson as well as utility companies like Saint Gobain (PA:SGOB) have adopted Zuora’s platform for their digital transformation needs in fiscal third quarter.

Further, clients like Briggs & Stratton, Radiuz and Poly were added in fiscal fourth quarter. The addition of aforementioned new customers is likely to have had generated incremental revenues for the company in the quarter under review.

Additionally, integration of the company’s Billing and RevPro platforms has opened up cross-selling opportunities, which is expected to have had a positive impact on Zuora’s subscription revenues in fiscal fourth quarter.

However, the company expects increased expenses due to higher wages and payroll taxes to keep margins under pressure in the to-be-reported quarter. This also includes $600K of additional rent expenses associated with the shift in Zuora’s headquarters.

What Our Model Says

Our proven model doesn’t conclusively predict an earnings beat for Zuora this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zuora has a Zacks Rank #3 and an Earnings ESP of 0.00%.

Stocks to Consider

Here are some companies, which per our model, have the right combination of elements to post an earnings beat this quarter:

Micron Technology, Inc. (NASDAQ:MU) has an Earnings ESP of +5.05% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

lululemon athletica inc. (NASDAQ:LULU) has an Earnings ESP of +0.27% and a Zacks Rank #2.

Darden Restaurants, Inc. (NYSE:DRI) has an Earnings ESP of +1.03% and a Zack Rank #3.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Micron Technology, Inc. (MU): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

lululemon athletica inc. (LULU): Free Stock Analysis Report

Zuora, Inc. (ZUO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.