- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Yield-Starved Foreign Investors Flood U.S. Munis

Strange are the times when a third of all government debt around the world carries a negative yield, and yet such is the case today.

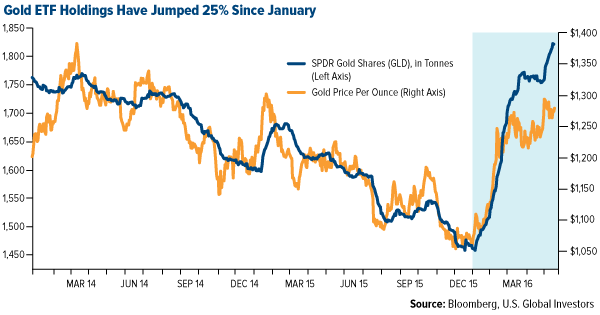

From Japan to eurozone countries, investors are faced with the tough decision of accepting subzero yields, doing nothing—or seeking other so-called “safe haven” options. Many have rediscovered gold, and as I pointed out earlier this week, demand for the yellow metal as an investment just had its best first quarter ever, with near-record inflows into gold ETFs.

But gold hasn’t been the only beneficiary.

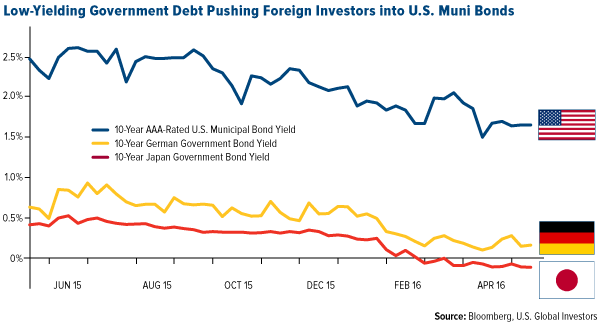

Overseas investors, starved for yield, are also flocking to investment-grade U.S. municipal bonds, which help fund infrastructure projects at the state and local levels. (Seventy-five percent of all infrastructure spending in the U.S., in fact, is financed with municipal bonds.) Munis offer a history of low volatility and near-zero default rates, not to mention diversification and attractive yields in a world of little to no yield. Below, notice that Japan’s 10-year government bond yield continues to edge lower into negative territory.

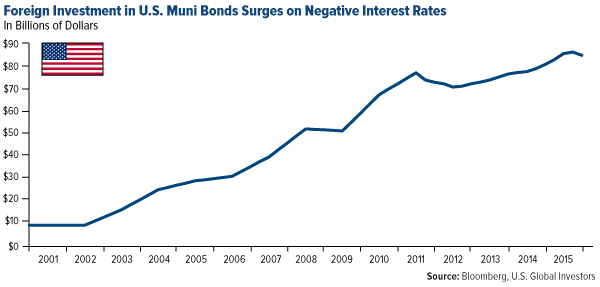

Unlike U.S. citizens, foreign investors are ineligible to take advantage of munis’ income tax-exempt feature. Nevertheless, they’re piling into the $3.7 trillion muni market, validating the “safe haven” status many investors assign to munis. By the end of 2015, foreign investors held more than $85 billion in American municipal debt, up from $72 billion in 2010.

As of the end of April, nearly $10 trillion worth of government bonds across the globe bore a negative yield. As this amount climbs, inflows into high-quality, short-term munis are expected to accelerate.

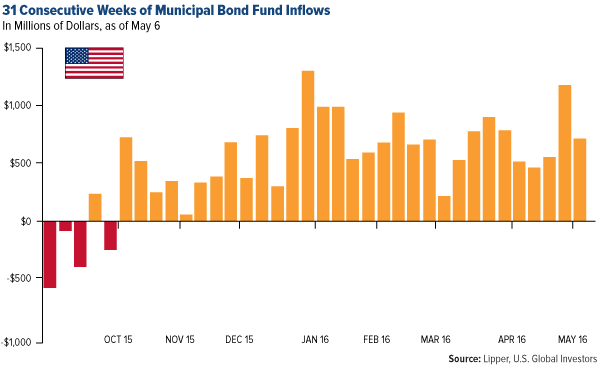

Muni bond funds are already seeing a sustained run of weekly inflows that began in October, with a massive $1.2 billion entering the market in the week ended May 11, following $709.7 million the previous week. This includes both American mutual funds and ETFs, so domestic and foreign investors are reflected here.

One of my favorite investing proverbs is “Follow the money,” and in the case of short-term munis, it’s important to recognize that a global surge in demand is taking place as central banks continue to lower rates and debase their nations’ currencies. Municipal bonds, as well as gold, have traditionally satisfied investors’ need for a store of value when other options seem too volatile or risky.

Today, the unfavorable monetary climate abroad makes American munis all the more attractive.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 03/31/2016.

Related Articles

When it comes to the economy, we’re in a bit of a weird spot: The data tells us that, despite inflation fears, interest rates are likely to fall in the year ahead. Falling rates...

Telegram Group Inc. is a globally recognized messaging service company, offering a cloud-based mobile and desktop messaging application. Known for its strong focus on security,...

Many investors regard passively managed index mutual funds or ETFs as favorable options for stock investing. However, they may also find that actively managed funds offer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.