- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Yandex Unveils Project Helping Hand To Combat Coronavirus

Yandex N.V. (NASDAQ:YNDX) is leaving no stone unturned to combat the coronavirus pandemic as evident from its growing investments. The company’s roll out of the project, Helping Hand, is a testament to the same.

Notably, the project focuses on transportation, medicinal deliveries, and food and other essential commodity supplies. It will also deliver COVID-19 testing kits. The company’s initial investment in this project stands at RUB 250 million.

The company is also arranging a special fleet with the aid its Yandex.Taxi service in order to transport doctors

Yandex strives to curb the spread of COVID-19 with the latest initiative. The company has taken stern steps to ensure safety of doctors and drivers by disinfecting the vehicles on a daily basis.

Moreover, drivers will be taken for regular medical testing.

We believe all these endeavors are likely to help the stock in winning investors’ confidence amid this challenging scenario.

Strong Investments to Manage COVID-19

The company is constantly infusing resources in order to help the government, doctors, public health organizations and the quarantines in order to manage the coronavirus-induced crisis.

The total investment of the company in this regard has exceeded RUB 1.5 billion to date.

We note that the initial investment in underlined project is dedicated to drivers who will be driving the Helping Hand fleet.

Apart from the latest move, Yandex has infused RUB 600 million in procurement and distribution of antiseptic supplies, vehicle disinfection and drivers support. Further, it has spent RUB 250 million for taking care of social and medical service workers’ transportation costs.

Additionally, the company has initiated an online distance learning project for school children for which it has invested more than RUB 200 million.

Further, the company is planning to invest further RUB 500 million in Yandex.Taxi over the next month. Apart from these, Yandex has taken public information initiatives related to COVID-19 by creating a separate section on its web page.

All the above mentioned investments and initiatives remain noteworthy.

However, mounting investment expenses pose a serious threat to the company’s profitability in the near term.

Yandex Joins the Pack

Yandex joins the community effort along with other companies such as Alphabet (NASDAQ:GOOGL) , Alibaba (NYSE:BABA) and Microsoft (NASDAQ:MSFT) , which are also taking strong measures to help government and people efficiently manage this pandemic situation.

Notably, Alphabet’s Google recently launched a website in the United States, which offers information related to coronavirus symptoms, treatment and preventive remedies from the World Health Organization.

The company’s health-care division called Verily has recently launched COVID-19 screening and testing website under Project Baseline.

Microsoft has unveiled a COVID-19 tracker tool that offers up-to-date infection statistics of each affected country on the tracker. Moreover, the tool provides access to various coronavirus related articles and other information.

Meanwhile, Alibaba presented its cloud-based coronavirus diagnostic tool to the European health systems. We note that the tool is a Machine Learning based software that helps in chest scans.

Alibaba strives to manage this pandemic situation with this diagnostic tool by accelerating the testing process.

We note that competition is intensifying among the tech companies in managing and preventing the society from the virus on the heels of their robust technologies.

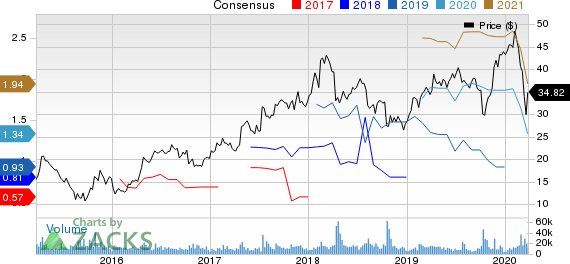

Currently, Yandex carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Yandex N.V. (YNDX): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.