- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Xylem (XYL) Declines 18% YTD: What's Hurting The Stock?

Shares of Xylem Inc. (NYSE:XYL) have declined 17.7% since the beginning of 2020. We believe that the price decline not only reflects investors’ reactions to the company’s dismal projections but also points toward the nervousness caused by the coronavirus outbreak.

The Rye Brook, NY-based company belongs to the Zacks Manufacturing – General Industrial industry, which, in turn, comes under the ambit of the Zacks Industrial Products sector. The industry is currently at the bottom 31% (with the rank of 175) of more than 250 Zacks industries.

Year to date, the company’s shares have dipped 17.7% compared with the industry’s decline of 33.6% and the sector’s fall of 30.9%. Notably, the S&P 500 has declined 23% during the same period.

The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Factors Affecting the Stock

Xylem reported in-line earnings results for fourth-quarter 2019, while lagged estimates by 0.7%. On a year-over-year basis, sales declined 1.1% year over year, with weakness in industrial and commercial end markets. Organic sales were flat in the quarter.

In addition to the lackluster performance, weak projections provided by Xylem must have added to the bearish sentiments for the stock. The company believes that organic sales will decline in low-single digits in the first half of 2020 due to strong year-over-year comparisons, soft orders and uncertainties related to the coronavirus outbreak in China. Organic sales are expected to be down 3-5% in the first quarter.

For the industrial market, Xylem believes that organic sales will be flat year over year in 2020 on geopolitical issues and economic uncertainty in the Middle East, soft short-cycle markets in North America in the first half, and soft mining/oil and gas markets. Also, flattish business in Europe might affect the company. For the commercial market, operating conditions are expected to be soft in the first half of the year.

Xylem expects 8-9% adjusted operating margin for first-quarter 2020. This compares unfavorably with 10.8% reported in the prior-year quarter. Also, it predicts earnings to be 40% of annual projection in the first half. Notably, it was 43% of annual earnings in the year-ago period.

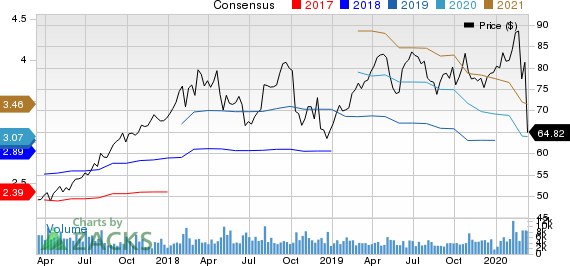

Currently, the Zacks Consensus Estimate for Xylem’s earnings is pegged at $3.07 for 2020 and $3.46 for 2021, marking declines of 8.1% and 7% from the respective 60-day-ago figures. Notably, there were eight downward revisions in estimates for 2020 and six for 2021. No upward revision in estimates has been recorded for both years in the past 60 days.

Xylem Inc. Price and Consensus

Barnes Group, Inc. (B): Free Stock Analysis Report

Nordson Corporation (NDSN): Free Stock Analysis Report

Tennant Company (TNC): Free Stock Analysis Report

Xylem Inc. (XYL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.