- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

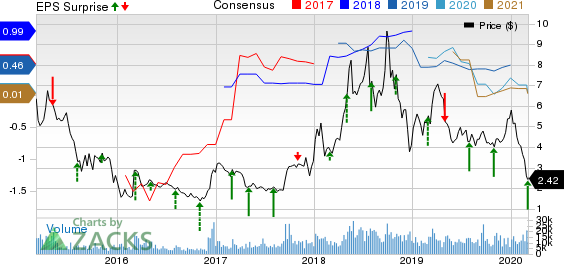

W&T Offshore (WTI) Q4 Earnings Beat Estimates, Reserves Grow

W&T Offshore, Inc. (NYSE:WTI) reported fourth-quarter 2019 adjusted earnings (excluding one-time items) of 17 cents per share, beating the Zacks Consensus Estimate of a cent but declining from the year-ago 24 cents.

Meanwhile, quarterly revenues increased to $152 million from $143 million a year ago. Moreover, the top line beat the Zacks Consensus Estimate of $151 million.

The better-than-expected results were supported by higher oil equivalent production volumes and lower lease operating expenses, partially offset by a decline in average realized prices of commodities. Along with the quarterly results announcement, the offshore producer announced plans of buying the remaining 25% working interest in the Magnolia field by early 2020.

Overall Production Rises

Total oil equivalent production averaged 52,773 barrels of oil equivalent per day (Boe/d), up 51% from 35,000 Boe/d in the year-ago quarter. Oil production was recorded at 1.8 million barrels (MMBbls), up 6.1% year over year. Natural gas liquids output totaled 415 MBbls, higher than 322 MBbls a year ago. Natural gas production of 15,966 million cubic feet (MMcf) in the reported quarter was considerably higher than 7,343 MMcf in the year-earlier period. Of the total production in the quarter, 45.2% comprised liquids.

The rise in production was supported by the company’s Mobile Bay area assets acquisition from Exxon Mobil Corporation (NYSE:XOM).

Realized Prices Decline

The average realized price for oil during the fourth quarter was $56.84 a barrel, lower than the year-ago level of $62.94. The average realized price of NGL dropped to $16.64 from $26.84 per barrel in the prior year. The average realized price of natural gas during the December quarter was $2.58 per thousand cubic feet, down from $3.83 per thousand cubic feet in the comparable period last year. Average realized price for oil equivalent output declined to $30.75 per barrel from $44.15 a year ago.

Operating Expenses

Lease operating expenses contracted to $10.98 per Boe in the fourth quarter from $13.48 a year ago.

Capital Spending & Balance Sheet

W&T Offshore spent $32.2 million capital through the December quarter on oil and gas resources.

As of Dec 31, 2019, the company had approximately $32.4 million in cash and cash equivalents. It also had $139.2 million remaining under its revolving bank credit facility. The company had $719.5 million in long-term debt.

Proved Reserves Grow

As of Dec 31, 2019, the company reported proved reserves at 157.4 MMBoE, up 87% from 2019-end reserves of 84 MMBoE.

Guidance

W&T Offshore expects production for first-quarter 2020 within 49,600-54,800 Boe/d. For the full year, its production view is pegged at 47,100-52,100 Boe/d, compared with last year’s 40,600 Boe/d.

Full-year 2020 capital expenditures, excluding acquisitions, are projected in the range of $50-$100 million, lower than last year’s $125.7 million.

Zacks Rank & Stocks to Consider

W&T Offshore currently carries a Zacks Rank #3 (Hold). Meanwhile, a few-better ranked players in the energy sector are Precision Drilling Corporation (NYSE:PDS) , Antero Resources Corporation (NYSE:AR) and Hess Corporation (NYSE:HES) . While Hess carries a Zacks Rank #2 (Buy), Precision Drilling and Antero sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Precision Drilling beat the Zacks Consensus Estimate for earnings in the last four reported quarters.

Antero is likely to see earnings growth of more than 270% in 2020.

Hess’ bottom line for 2020 is expected to climb 93.7% year over year.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Hess Corporation (HES): Free Stock Analysis Report

W&T Offshore, Inc. (WTI): Free Stock Analysis Report

Precision Drilling Corporation (PDS): Free Stock Analysis Report

Antero Resources Corporation (AR): Free Stock Analysis Report

Original post

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.