- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Workday's (WDAY) Q3 Earnings Beat Estimates,'18 Guidance Up

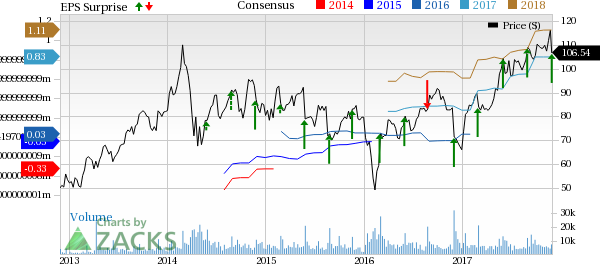

Workday Inc. (NASDAQ:WDAY) reported third-quarter fiscal 2018 non-GAAP earnings of 24 cents per share, which beat the Zacks Consensus Estimate of 15 cents. The figure was also better than 5 cents reported in the year-ago quarter.

The strong growth was primarily attributed to 34.3% jump in revenues, which totaled $555.4 million. The figure surpassed the guidance of $538-$540 million and beat the Zacks Consensus Estimate for revenues of $540 million. The robust top-line performance was driven by solid growth in subscription and professional revenues.

Subscription revenues (82.7% of total revenues) soared 37.2% year over year to $463.6 million, driven by expanding customer base. The figure surpassed the guidance of $450-$452 million. Annual customer satisfaction rating was 98%, which was better than management’s target of 95%.

Professional services revenues (17.3% of total revenues) grew 21.4% from the year-ago quarter to $91.8 million and were better than the guidance of $88 million.

Revenues outside the United States surged 48% to $116 million, representing a record 21% of total revenues in the quarter.

Shares fell 5.2% during after hour trading. Workday’s shares have gained 62.3% year to date, substantially outperforming the industry’s 18.1% rally.

Customer Addition Continues

During the quarter, companies like Lowe’s Corporation, M&T Bank Corporation (NYSE:MTB), Lloyds (LON:LLOY) Bank plc, Software AG and Oshkosh Corporation selected Workday’s HCM solution. Moreover, Dell USA, Coca-Cola Company (NYSE:KO) and Cerner Corporation (NASDAQ:CERN) went live.

Workday added 37 financial management customers, up more than 60% from the year-ago quarter. The clientele now includes Sanford Health, University of Louisiana and Melco Resort Services.

Further, the company won 34 planning customers. Total planning customers on Workday’s platform totals more than 200.

Product Launches

Workday announced the availability of Workday Prism Analytics and Workday Benchmarking, the first offering delivered on Workday Data-as-a-Service, during the quarter.

Management stated that Hitachi, Shelter Insurance and United Technologies Corporation (NYSE:UTX) have already selected Workday Prism Analytics solution.

The company believes that these solutions will expand Workday’s total addressable market (TAM) with each having more than $1 billion opportunity in revenues.

Accolades Reflect Solid Portfolio

Workday was placed in the Leaders quadrant of “Magic Quadrant for Cloud Human Capital Management Suites for Midmarket and Large Enterprises” by Gartner.

Forrester Research also placed Workday as a leader in “The Forrester Wave: SaaS Human Resource Management Systems, Q3 2017.”

Operating Results

Gross margin expanded 160 basis points (bps) from the year-ago quarter to 74.1%, primarily due to favorable mix toward higher-margin subscription revenues.

Product development expenses jumped 32.3% to $176.7 million. Sales and marketing expenses increased 18.8% to $150 million. General and administrative expenses climbed 7.8% to $34.5 million.

The company reported non-GAAP operating profit of $50.1 million compared with $8 million in the year-ago quarter.

Balance Sheet

Cash, cash equivalents and marketable securities were $3.2 billion as of Oct 31, 2017.

Operating cash flows were $144.0 million and free cash flows were $107.7 million.

Unearned revenues were more than $1.2 billion, up 21.5% from the year-ago quarter. Current unearned revenues (that will be recognized over the next 12 months) were more than $1.1 billion, representing annual growth of 27%.

Non-current unearned revenues declined 18% year over year as fewer customers opted for paying more than one year of subscription fees upfront.

Subscription revenue backlog, which represents all future revenues from existing customer subscription contracts, both on and off-balance sheet was $4.5 billion, up 3% sequentially and 37% year over year.

Management observed slight decline in duration of contracts signed in the quarter compared with previous quarters. In the reported quarter, almost 91% of subscription revenues came from the backlog.

Guidance

For fourth-quarter fiscal 2018, Workday expects revenues in the range of $538-$540 million. Subscription revenues are anticipated in the range of $482-$484 million (up 31-32%), while professional services revenue expectation is $89 million.

Management expects annual contract value (ACV) in financials to surge more than 50% in the current quarter.

Workday anticipates non-GAAP operating margin of 7-8%.

Buoyed by the encouraging results, Workday raised its guidance for fiscal 2018. Revenues are projected in the range of $2.132-$2.134 billion, up from the previous range of $2.093-$2.1 billion. The revised guidance reflects growth of 35-36%.

The company now expects non-GAAP operating margin to be almost 9.5%, up from the previous guidance of 8%.

Additionally, Workday now projects subscription revenues between $1.78 billion and $1.782 billion compared with the prior guidance of $1.750 billion and $1.757 billion. Professional services revenues are anticipated to be about $352 million, up from $343 million in fiscal 2018.

The company reiterated its operating cash flow guidance of $420 million for fiscal 2018.

Management also provided a glimpse of fiscal 2019 expectations. Subscription revenues are projected at roughly $2.25 billion. For first quarter of 2019, subscription revenues are expected to increase 5%.

Workday projects operating margin of 10% for fiscal 2019.

Zacks Rank & Key Picks

Workday has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Oracle Corporation (NYSE:ORCL) , Cadence Design Systems (NASDAQ:CDNS) and Callidus Software (NASDAQ:CALD) . All the three stocks carry a Zacks Rank #2 (Buy). For top-ranked stocks you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Workday, Inc. (WDAY): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Callidus Software, Inc. (CALD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.