- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Williams-Sonoma (WSM) Q3 Earnings Fall In-Line, West Elm Same-Store Sales Up 11.5%

Williams-Sonoma Inc. (NYSE:WSM) just released its second quarter fiscal 2017 financial results, posting earnings of 84 cents per share and revenues of $1.299 billion. Currently, WSM is a #3 (Hold) on the Zacks Rank, and is down over 8% to $48.50 per share in trading shortly after its earnings report was released.

Williams-Sonoma:

Matched earnings estimates. The retailer reported earnings of 84 cents per share, coming in line with the Zacks Consensus Estimate of 84 cents per share.

Matched revenue estimates. The company saw revenues of $1.299 billion, also meeting our consensus estimate of $1.29 billion and growing 4.3% year-over-year. E-commerce net revenuesincreased 6.4% to $690 million.

Total comparable brand revenue grew 3.3%. By brand, Pottery Barn saw comps dip 0.3%, while Williams Sonoma comps increased 2.3% and West Elm comps surged 11.5%. Additionally, PBteen witnessed an increase of 3% in same store sales, but Pottery Barn Kids declined 0.1%.

Operating margin was 8.5% compared to 8.8% in the year ago quarter.

Looking ahead, WSM expects total net revenues in the range of $1.61 billion to $1.675 billion for Q4. Comparable brand revenue growth is expected in the range of 2% and 6%, while diluted EPS should fall between $1.49 and $1.64 per share.

“During the quarter, strong execution against our product and digital initiatives drove new customer acquisition and top-line expansion in a competitive and dynamic retail environment. Importantly, our demand during the quarter exceeded or was at least equal to net revenues across all of our brands – most notably in Pottery Barn and PBteen – which is a strong indication of the health of our business. Additionally, our investments in digital innovation and cross-brand services, as well as continued optimization of our supply chain, position us to further differentiate our business and to deliver long-term profitable growth.”

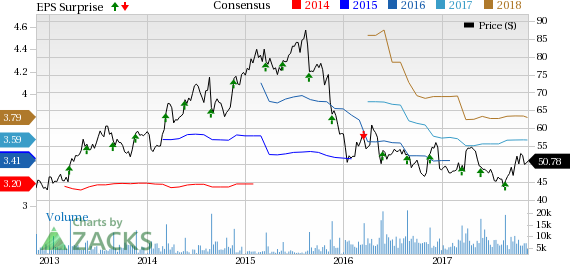

Here’s a graph that looks at Williams-Sonoma’s price, consensus, and EPS surprise:

Williams-Sonoma, Inc. is specialty retailer of products for the home. The retail segment sells its products through its three retail concepts: Williams-Sonoma, Pottery Barn and Hold Everything. The direct-to-customer segment sells similar products through its five direct-mail catalogs, Williams-Sonoma, Pottery Barn, Pottery Barn Kids, Hold Everything and Chambers, and the Internet.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, and for the next month, you can follow all Zacks’ private buys and sells in real time. Our experts cover all kinds of trades: value, momentum, ETFs, stocks under $10, stocks that corporate insiders are buying up, and companies that are about to report positive earnings surprises. You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' private trades >>

Williams-Sonoma, Inc. (WSM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

In a striking reversal of fortunes, equities in developed markets ex-US are now leading the major asset classes in 2025 while US shares are posting a modest loss year to date,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.