- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Lowe's (LOW) Register Earnings & Comps Growth In Q3?

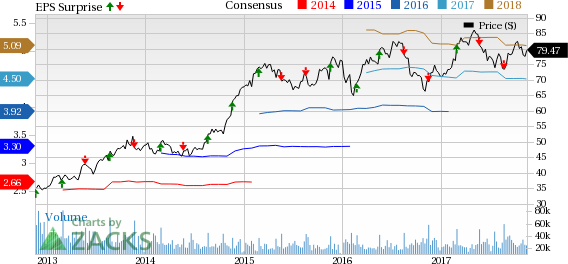

Lowe's Companies, Inc. (NYSE:LOW) is set to release third-quarter fiscal 2017 results on Nov 21. In the trailing four quarters, this home improvement retailer underperformed the Zacks Consensus Estimate by an average of 1.6%. In the second and first quarter, it missed the consensus estimate by 3.1% and 3.7%, respectively.

Which Way are Estimates Treading?

Let’s look at earnings estimate revisions in order to get a clear picture of what analysts are thinking about the company prior to the release. The current Zacks Consensus Estimate for the quarter under review has been stable in the last 30 days and is pegged at $1.02. This reflects a sharp improvement of roughly 16% from 88 cents in the year-ago quarter. Analysts polled by Zacks expect revenues of $16,568 million, up 5.3% year over year.

From aforementioned estimates, it is quite evident that Lowe’s is likely to continue with its top- and bottom-lines growth streak in the third quarter as well. Earnings per share have increased 14.6% and 18.4%, while net sales rose 6.8% and 10.7% in the second and first quarters of fiscal 2017, respectively.

Factors at Play

An improving job scenario, housing market recovery, merchandising initiatives and post hurricane construction activities along with efforts to enhance omni-channel capabilities bode well for Lowe’s. It also remains well-positioned to reap the benefits of strategic acquisitions done earlier such as that of RONA. In an effort to strengthen relationship with pro customers, the company has concluded the acquisition of Maintenance Supply Headquarters, the distributor of maintenance, repair and operations products.

The reflection of these endeavors is evident from 4.5% rise in second-quarter comparable sales (comps), up from 1.9% recorded in the first quarter. This improvement can be attributable to 0.9% growth in transaction and a 3.6% increase in average ticket. Comps for the U.S. business rose 4.6%, following an increase of 2% in the first quarter. The company registered 43% comp growth on lowes.com in the second quarter.

Undoubtedly, the above discussion makes us optimistic about Lowe’s performance in the soon-to-be reported quarter. However, threats emerging from cannibalization and stiff competition cannot be ignored. Also, we observed that the company’s margin have been under pressure for quite some time now. In the fourth, third, second and first quarters of fiscal 2016, Lowe’s gross margin had contracted 25, 40, 10 and 43 basis points (bps), respectively. In the first and second quarters of fiscal 2017, the same declined a respective 64 and 23 bps to 34.4% and 34.2%.

What the Zacks Model Unveils?

Our proven model shows that Lowe's is likely to beat estimates this quarter. This is because a stock needs to have both — a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Lowe's has an Earnings ESP of +0.49% and carries a Zacks Rank #3. This makes us reasonably confident that the bottom line is likely to outperform estimates.

Other Stocks With Favorable Combination

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

American Eagle Outfitters, Inc. (NYSE:AEO) has an Earnings ESP of +1.04% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Kroger Co. (NYSE:KR) has an Earnings ESP of +2.06% and a Zacks Rank #3.

Signet Jewelers Limited (NYSE:SIG) has an Earnings ESP of +27.52% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Signet Jewelers Limited (SIG): Free Stock Analysis Report

Kroger Company (The) (KR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Wall Street Indexes remain under pressure today but have held above the lows we saw on Tuesday as the Trump administration tariffs came into force. The announcement of tariffs on...

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.