- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will International Expansion Aid JD.com (JD) Q4 Earnings?

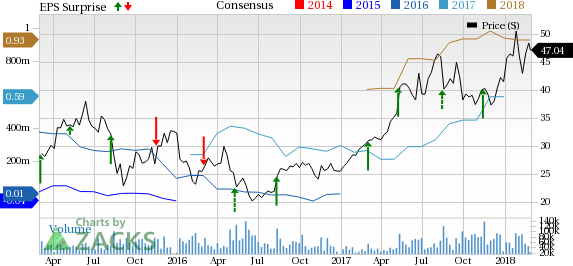

JD.com, Inc. (NASDAQ:JD) will report fourth-quarter 2017 results on Mar 2. In the third quarter, the company delivered a positive earnings surprise of 130%.

The surprise history has been impressive in JD.com’s case. The company surpassed estimates in each of the trailing four quarters, with an average positive surprise of 256.3%.

We observe that the company's shares have gained 53.8% in a year’s time, underperforming its industry’s gain of 66%.

Let's see how things are shaping up for this announcement.

Strong Growth in E-Commerce Business

In the third quarter, net revenues from online direct sales increased 38.5% year over year to RMB76.5 billion (US$11.5 billion). It accounted for 92% of total third-quarter sales. The increase was driven by demand for home appliances, food and beverage, cosmetics, home furnishing and baby products. The company continues to invest in order to expand its fulfillment capability and broaden product offerings to enhance its e-commerce business.

International Expansion to Boost Top Line

JD.com has been focusing on both developing and maturing e-commerce markets outside China. In doing so, the company has been investing in relatively nascent and growing markets. Recently, in January, the company agreed to invest in Vietnamese e-commerce firm Tiki.vn. The investment will expand JD.com’s presence in Southeast Asia and also fend off further competition from Alibaba (NYSE:BABA) Group and Amazon (NASDAQ:AMZN). These investments will expand revenues in the quarter to be reported.

Partnerships to Aid Growth

During the third quarter, JD.com continued to gain popularity with a number of international brands.The Chinese e-commerce company entered into a partnership with Italian brand, Armani, opening official online stores for two additional Armani product lines. It also partnered with other leading international brands such as Spectrum Brands, Reckitt Benckiser and Tiger to launch flagship stores. We expect these moves to contribute to JD.com’s revenue expansion in the to-be-reported quarter.

What Our Model Suggests

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially if these have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

JD.com has a Zacks Rank #3 and an Earnings ESP of -41.86%, a combination that does not suggest that the company is likely to beat estimates this time around.

We see a likely earnings beat for each of the following companies.

Veritiv Corporation (NYSE:VRTV) , with an Earnings ESP of +41.03% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Newfield Exploration Company (NYSE:NFX) , with an Earnings ESP of +5.9% and a Zacks Rank #3.

ICU Medical, Inc. (NASDAQ:ICUI) , with an Earnings ESP of +6.12% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

JD.com, Inc. (JD): Free Stock Analysis Report

ICU Medical, Inc. (ICUI): Free Stock Analysis Report

Newfield Exploration Company (NFX): Free Stock Analysis Report

Veritiv Corporation (VRTV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

When a company is at the top of its industry, it is often afforded benefits that smaller players are not. Industry leaders often have key traits like economies of scale, top...

Often as dividend investors we buy stocks that provide us with income now. We take the current yield and happily collect the monthly or quarterly payout. Sometimes, though, it is...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.