- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Gold Fall Below The 1980 Peak Of $850?

When seeing what Market Makers and Hedge Fund Managers can do with stocks as they have with Apple (AAPL), Netflix (NFLX) and Herbalife (HLF), could we also see the Professionals push gold lower to break the 1980 high of $850 and hear the financial media declare the gold bug dead? How would the pro gold crowd react to such a move? Is this scenario out of the realm of possibility?

Breaking Through Psychological Price Points

While the $1,000 mark for gold is a psychological breaking point, an even more significant breaking point for gold would be the 1980 high which if broken, would ignite a financial media firestorm of “I told you so” from many journalists and analysts. Of course these are the same analysts, like Nouriel Roubini who said when gold first was approaching $1,000 in 2009 that it was “utter nonsense” to think gold would go to $2,000. He went on to say; “Maybe it will reach $1,100 or so but $1,500 or $2,000 is nonsense.”

Gold didn’t get to $2,000 but gold did get to an intraday high of $1,921 so following Roubini’s advice an investor would have missed out on over 100% in potential profit in gold if they were smart enough to sell at the 2011 high. The same is true of Dave Ramsey who in Dec. 2009, about the same time as Roubini’s utter nonsense, called gold a “bad investment.”

How great it would be for stock market gurus to see gold slammed down below the peak price of 34 years ago and gloat that 20 more years of lower gold prices are ahead? I hear the experts claim only stocks are the place to be in 2014. But these are the same stock lovers that didn’t see the financial crisis of 2008 coming where stocks lost over 30% and gold finished the calendar year positive.

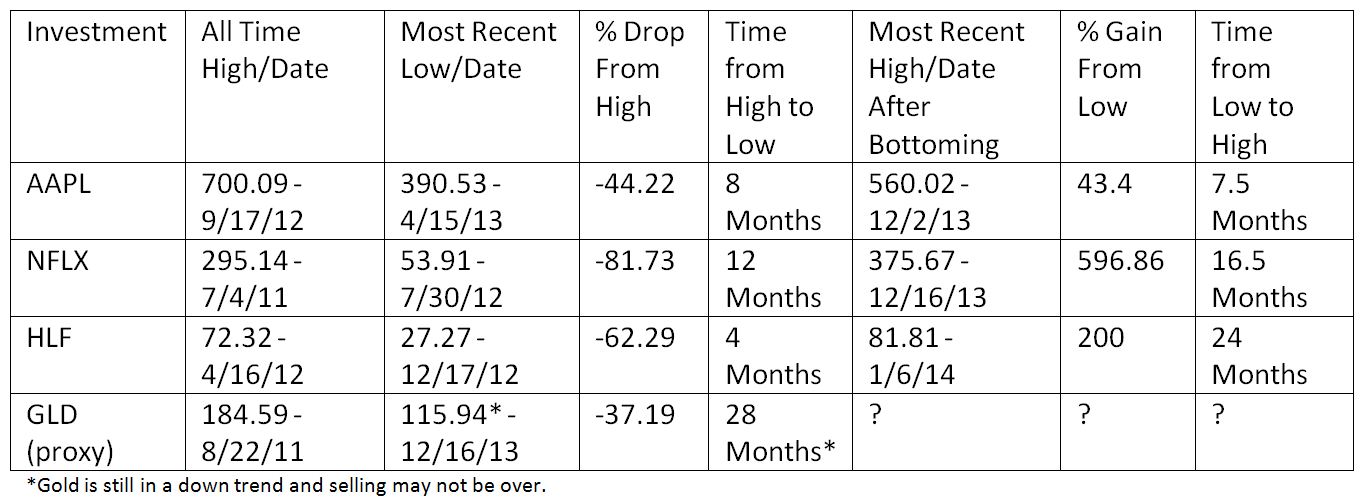

Let’s compare then what’s going on with gold the last five years to some of the most popular talked about stocks; Apple (AAPL), Netflix (NFLX) and Herbalife (HLF) and what the Professionals have done to them also. Let’s see where these Professionals might take gold, represented by SPDR Gold Shares (GLD), irrespective of the conversation related to inflation, deflation, QE and sentiment.

Pushing Prices to Extremes

For anyone who has traded stocks before, they are aware that when they make a trade, for whatever the reason, the trade can immediately go against them. This is especially true when trading low volume stocks. The small investor is always up against big money and although they may have conducted the right research, read the technical’s correctly or followed their wave patterns to the letter, Market Makers can simply do what they want with a stock.

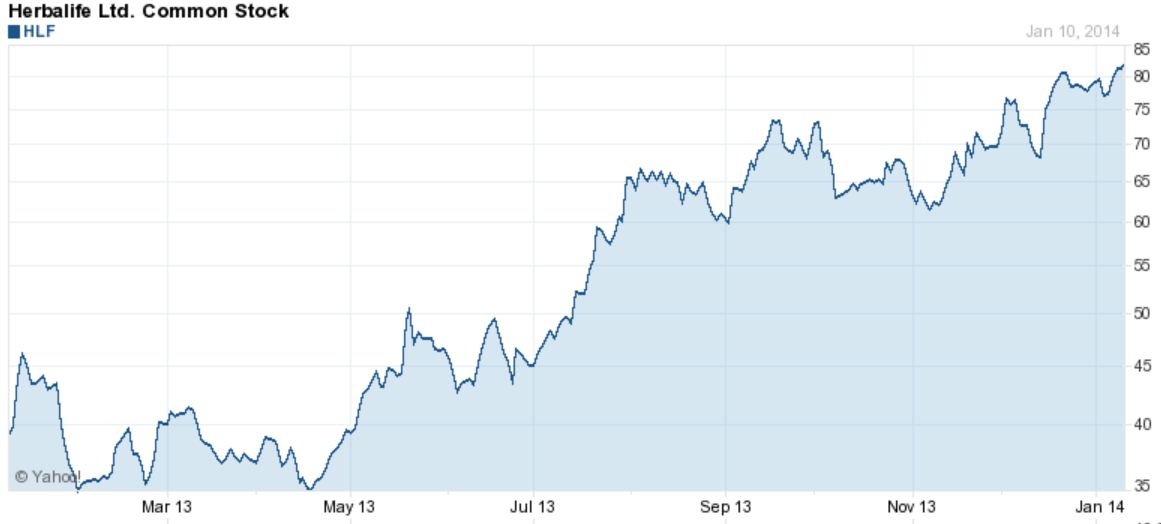

Looking at the following charts of (AAPL), (NFLX) (HLF) and (GLD), we can see the extremes that Professional Traders, Market Makers and Hedge Funds have pushed these price levels to extremes both up and down.

To summarize these charts and the data they represent, the following table shows the extremes from all time highs to most recent lows and the rebound from those lows to their most recent highs. It also includes the time-frame from these highs to lows and from the lows back to the highs. This confirms that no matter if its stocks or gold, the Professionals will push the investment to extreme highs, then to lows, and then back to high’s again.

This volatility in pushing price to extremes shouldn’t come as a surprise to anyone. That’s what Market Makers do! It would come as no surprise to me that they take the price of gold down below $1,000 in 2014. From there a 15% further drop to $850 would not be out of the question either. If we do get these extreme moves down in gold, then we can assume that the bounce off the bottom will also come and gold will more than likely break to higher highs and at some point all-time highs again.

Today we have Hedge Funds with millions and even billions of dollars that move stocks one way or the other. Of the over 8,000 hedge funds, many are on the same side of the trade pushing stocks in their favor. Look at the top Hedge Funds holdings for the investments listed in the chart above by clicking on each symbol; (AAPL), (NFLX), (HLF) and (GLD). There is no doubt in my mind these Hedge Fund managers talk to each other about strategy the same way I talk to my Mom and Dad about investment strategy except without the $700 dinners.

In the 70′s we had just two people, the Hunt Brothers in 1980, corner a market and drive prices to extremes by accumulating the physical metal. Today, Market Makers can move a metals market to extremes with or without owning the physical metal. One can trade the paper proxy representing metal without actually taking delivery of the metal. Anyone who knows how this works, also knows the leverage of paper is a large multiple to the actual metal. This allows the ones doing the leveraging to push around the metals market similarly to how the Hunt Brothers did and push prices to extremes.

In December of 2012 I wrote my only article related to manipulation; Thoughts On Gold Price Manipulation where I said the following;

If you don’t believe that banks are heavily involved in the gold and precious metals game, then take a look at the following chart. They are increasing their involvement. Could it be that this market is easier to manipulate profits?

I don’t need to use such a word as “manipulation” in describing how Market Makers work. They can and will push prices higher or lower in their quest to make profit. If you are on the wrong side of the investment, you complain. If you are on the right side, you’re happy as long as you lock in the profit. If you are a gold buy and hold investor then a further drop to possibly below $1,000 or $850 isn’t going to get you to sell. If you are long gold with leverage then there could be some risk you are facing should Market Makers push the price lower.

So far my call for a higher price in gold and silver for January has come to fruition. This can continue for awhile. See what I wrote in December: Gold and Dollar Down but Both Will Rise Next Year.

If you are bullish on gold because your calculator (if it’s a modern one) shows the trillions of debt and the interest to be paid on it in the future is a ticking time bomb that the Fed and Congress can’t comprehend, and you feel gold represents real wealth rather than the illusion of wealth paper assets represent, then dollar cost averaging into a position still makes sense.

If you’re not bullish on gold and are trying to time the bottom to cover your short, then just like with (AAPL), (NFLX) and (HLF) above, a bottom will come and the reversal in the gold price can move higher rather quickly. Gold bugs know that Federal Reserve Notes have only been around for 43 years without a relationship to gold and in those short 43 years, our monetary system is now burdened with the $17 trillion elephant in the living room that no one dare mention in the media.

Related Articles

Crude Oil WTI Futures oil prices made a run for the 10-day moving average but failed to complete the breakout, keeping us locked in a trading range. Oil prices were hesitant to...

American stock investors have suddenly started buying gold again. After largely ignoring most of gold’s monster upleg, they just started flocking back fueling big builds in...

Analyzing the movements of the natural gas futures since I wrote my last analysis, I anticipate that the natural gas futures will likely start next week with a gap-down opening if...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.