- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will ECB Draghi Provide Today’s FX Clue?

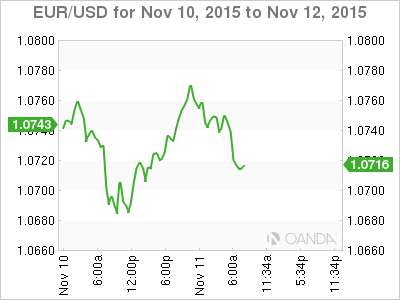

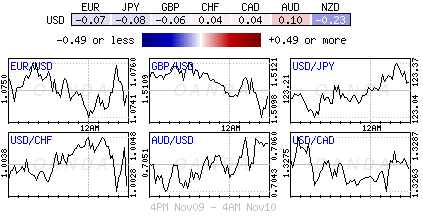

Position adjustments by investors in thin trading conditions have managed to punish the dollar on this Veteran’s Day. The mighty buck has given back some of this week’s gained ground across the board. The EUR printed an intraday six-month low outright yesterday (€1.0682) as the market prepares itself for looser monetary policy from the Eurozone and for higher rates from the Fed next month. For now, market moves remain relatively contained, but noticeably with a lot less participation. Amid so many investors betting that the dollar will grind higher over the coming weeks, the natural market risk is that some of the weaker long dollar positions will be at risk to sharp market reversals should the U.S economy stall.

Will he disappoint? Focus on Draghi for deposit clues: The market is expecting ECB’s Draghi to hint at further monetary easing at next months ECB meeting (December 3) during a speech later this morning at the Bank of England (BoE) open forum (08:15 EST). The market has increased their bets that the ECB will cut its “deposit” rate further next month in a ploy to discourage investors from holding euros. Draghi may not specifically push back against a rate cut, but a cut to the “depo” rate would have more of a negative impact on the single currency than other easing measures available. Market needs to focus on the type of instrument being mentioned, if any.

China economic reporting remains somewhat consistent: Data from the world’s second largest economy continues to provide a challenge for global investors. Industrial output growth hit a new seven-month low overnight (+5.6%), while fixed asset investment hit new multi-year lows (+10.2%). However, not all China data is bad news. Retail sales came in at a nine-month high (+11%), further proof that Chinese authorities are making progress in transitioning their own economy towards consumption. Dealers are currently expecting the People’s Bank of China (PBoC) to cut their RRR by another -50bps again before the end of the year. The soft CPI data earlier this week has also increased the probability of another interest rate cut. Do not be surprised to see Chinese authorities holding off from making a move until there is further clarity from the Fed. The logic of further easing is probably keeping some pressure on USD/Asia pairs due to the risk on suggestion of further economic stimulus by China.

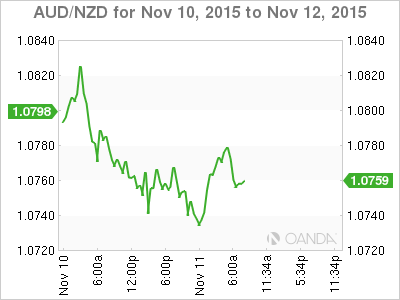

Risks highlighted down under: In the Reserve Bank of New Zealand (RBNZ) semi-annual financial stability report, the bank saw a rise in the risks to their financial system, particularly in the property space where policy makers see the potential for a “damaging” correction. The bank also noted there was an increased risk in the dairy sector given the rising indebtedness of farms, but added that “credit losses on dairy exposure were manageable” thanks to low-rate loans, granted to farmers by Fonterra. Naturally, the market was looking for hints about a change in monetary policy. Governor Wheeler commented on the report, but deflected any comments on monetary policy to the next decision on December 9. The central bank did not adjust interest rates in October, leaving the benchmark rate at +2.75% (N$0.6549).

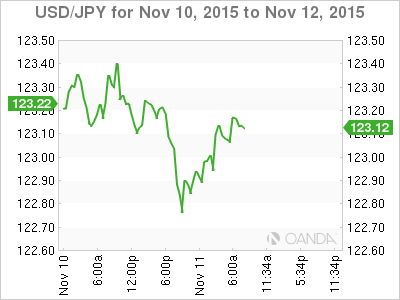

BoJ’s Kuroda steadfast on current policy stance: The Bank of Japan’s (BoJ) Governor Kuroda is not giving anything away. Comments overnight indicate that he is “not” any closer to favoring additional easing. The Governor is committed to achieving their +2% inflation target as early as possible – the delay is mainly due to lower energy prices. Other more dovish BoJ members did note that the central bank should be able to tell by March 2016 if CPI can reach their desired +2%. The dovish members will be in a position to call for further easing if the “virtuous cycle is threatened.” The BoJ doves do recognize that consumption and investment are still weak, and that the BoJ is monitoring external risks (potential shock from a U.S rate hike and slowdown in China). The yen’s high overnight (¥122.76) coincided with the non-committal stance from the BoJ’s Governor.

U.S Debt showing ‘fair value': After last week’s stellar U.S jobs report, fixed income dealers have been doing their bit and slowly backing up the U.S curve and directly supporting the USD. Ahead of yesterday’s 10-year Treasury auction, 10’s managed to trade atop of their four-month high (+2.35%). Results from yesterday’s auction drew solid demand, an indication that investors see “value” after the recent back up in yields. Dealers took supply down at +2.304% vs. +2.308% expected. Indirect bidding was a strong +60.5% vs. the previous fours sale average of +59%. Direct bidding hit a six-month high of +14%.

Related Articles

US Dollar Index is experiencing a very strong decline, a move we have been warning about for weeks. Since the start of the year, we have discussed potential dollar weakness, which...

An aggressive fiscal spending proposal by Germany has attracted bullish animal spirits into EUR/USD. A significant rally in the longer-end German Bund yields is likely to alter...

USD/JPY trades heavy despite widening yield differentials Non-farm payrolls loom large as traders focus on the unemployment rate. Mixed signals in data could see choppy trade,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.