- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will Coffee Unit Softness Hurt Smucker's (SJM) Q2 Earnings?

The J. M. Smucker Company (NYSE:SJM) is set to report second-quarter fiscal 2018 results on Nov 16, before the opening bell.

The company’s coffee, consumer foods and pet foods businesses are likely to face challenges owing to unfavorable market conditions. However, the company expects positive yields from the partnership with Dunkin' Brands as well as its cost-reduction efforts.

We note that Smucker has delivered an average positive earnings surprise of 0.9% in the trailing four quarters. Let’s look into some of the aspects that are likely to impact Smucker’s second-quarter results.

What to Expect?

The Zacks Consensus Estimate for earnings per share has inched up by a cent in the past 30 days to $1.89. However estimated earnings depict a 7.8% decline from $2.05 recorded in the year-ago quarter.

Further, analysts polled by Zacks expect net sales of $1,895 million, down 1% from the prior-year sales of $1,914 million.

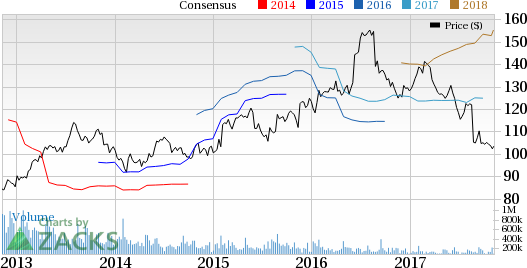

J.M. Smucker Company (The) Price, Consensus and EPS Surprise

Factors at Play

Smucker’s coffee segment has been performing disappointingly, owing to price rise and unfavorable volume/mix. Management expects headwinds in the coffee market to persist in fiscal 2018. As a result, the consensus mark for second-quarter sales of the U.S. Retail Coffee unit is at $532 million, depicting a 3.6% decline from the prior-year quarter.

Further, the company’s U.S. Retail Consumer Foods business segment is expected to face challenges from stiff competition and unfavorable volume/mix. The consensus estimate for sales for this segment is pegged at $547 million, reflecting a 1.8% dip year over year.

We note that sales from Smucker’s U.S Retail Pet Food business were flat in the prior quarter, owing to adverse impacts from rising competition and shift in consumer preference toward protein-rich products. These hurdles are likely to continue in the second quarter. Accordingly, the consensus mark for sales at the pet foods segment is $532 million, which represents a marginal 0.2% rise from the year-ago figure.

Nevertheless, Smucker is hopeful about its strategic partnership with companies such as Dunkin' Brands Group. This is likely to drive the company’s performance in the second quarter. Moreover, the company’s cost-reduction initiatives and innovation-related efforts have been encouraging and are expected to yield favorable results. While these endeavors bode well for the company’s quarterly results, the aforementioned factors pose concerns.

What Does the Zacks Model Unveil?

Our proven model shows that Smucker is likely to beat earnings estimates this quarter. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Smucker has an Earnings ESP of +0.88% and a Zacks Rank #3 that make us reasonably confident of an earnings beat.

Stocks With Favorable Combinations

Here are some companies which, according to our model, have the right combination of elements to deliver earnings beat.

Nomad Foods Limited (NYSE:NOMD) has an Earnings ESP of +8.70% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here

Energizer Holdings Inc (NYSE:ENR) has an Earnings ESP of +0.35% and a Zacks Rank #2.

United Natural Foods, Inc. (NASDAQ:UNFI) has an Earnings ESP of +6.33% and a Zacks Rank #2.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Energizer Holdings, Inc. (ENR): Free Stock Analysis Report

United Natural Foods, Inc. (UNFI): Free Stock Analysis Report

J.M. Smucker Company (The) (SJM): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.