- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why You Should Invest In 1st Source Corporation (SRCE) Now

Improving operating backdrop, rising rate environment and strengthening domestic economy are anticipated to continue supporting banking stocks. Keeping this in mind, we have selected 1st Source Corporation (NASDAQ:SRCE) for your consideration.

With record earnings and revenues, along with loans and deposit balances in the first nine months of 2017, 1st Source Corporation appears a solid bet now. The company’s rising net interest margin and fee income are anticipated to yield positive results for the stock.

Further, the recent interest rate hikes are likely to bring further stability to top-line generation, in turn, creating buying opportunity for long-term horses. Though escalating costs might lead to operational inefficiency, sharper focus on organic growth will likely make the growth path smoother for the company.

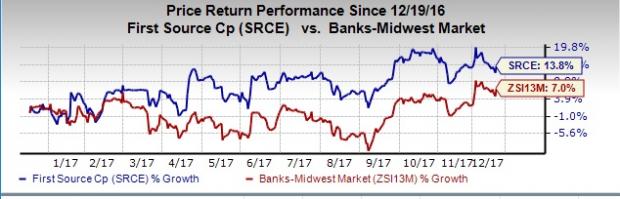

Shares of this Zacks Rank #2 (Buy) stock have gained around 13.8% in a year’s time, outperforming 7% growth recorded by the industry.

Notably, 1st Source Corporation has a number of other aspects that make it an attractive investment option.

Why is 1st Source Corporation (SRCE) a Must Buy

Strong Organic Growth: 1st Source Corporation’s revenues witnessed 2.7% compounded annual growth rate (CAGR) over the last five years, ending 2016. The company’s projected sales growth (F1/F0) of 9.28%, as against the 3.13% industry average, highlights continued upward momentum in revenues.

Earnings per Share Strength: 1st Source Corporation witnessed earnings growth of 5.01% in the last three-five years. This earnings momentum is likely to continue in the near term as reflected by the company’s projected earnings per share (EPS) growth rate (F1/F0) of 16.44%.

Also, the company’s long-term (three-five years) estimated EPS growth rate of 10% promises rewards for investors over the long run. Good news is that the company recorded an average positive earnings surprise of 3.42% over the trailing four quarters.

Strong Leverage: 1st Source Corporation’s debt/equity ratio is valued at 0.18 compared to the industry average of 0.45, indicating relatively lower debt burden. It highlights the financial stability of the company despite an unstable economic environment.

Stock Looks Undervalued: The stock currently has a Value Score of B. The Value Score condenses all valuation metrics into one actionable score that helps investors steer clear of “value traps” and identify stocks that are truly trading at a discount. Our research shows that stocks with a Style Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best upside potential.

Other Stocks to Consider

Federated Investors, Inc. (NYSE:FII) has been witnessing upward estimate revisions for the past 60 days. In six months’ time, the company’s share price has been up more than 27%. It carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Enterprise Financial Services Corporation (NASDAQ:EFSC) has been witnessing upward estimate revisions for the last two months. Additionally, the stock moved up more than 7% over the past six months. It currently carries a Zacks Rank of 2.

Artisan Partners Asset Management Inc. (NYSE:APAM) has been witnessing upward estimate revisions for the past month. Also, the company’s shares have risen nearly 32.3% in six months’ time. It also holds a Zacks Rank of 2, at present.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

1st Source Corporation (SRCE): Free Stock Analysis Report

Enterprise Financial Services Corporation (EFSC): Free Stock Analysis Report

Federated Investors, Inc. (FII): Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM): Free Stock Analysis Report

Original post

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.