- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why The Market Dip Feels So Painful

The last week and a half has certainly been a roller coaster ride of emotions in the stock market. After a 3-day sell off that culminated in extreme levels of fear, broad-based equity benchmarks managed to stage a sharp rally that has alleviated (some) feelings of panic.

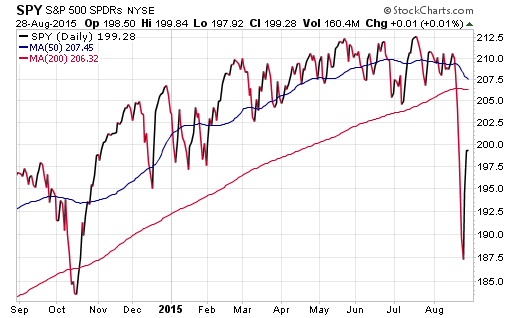

By the numbers, the SPDR S&P 500 ETF (NYSE:SPY) fell 12% from all-time July high to the depths of the August lows. It has subsequently rebounded half of that decline as we head into the first days of September.

While there is still a great deal of work to be done in order to recoup the full extent of those losses, examining how your portfolio performed in the midst of the chaos can be a helpful exercise. Many investors may be surprised at how deeply their accounts fell despite the intention of having a relatively balanced or even conservative asset allocation.

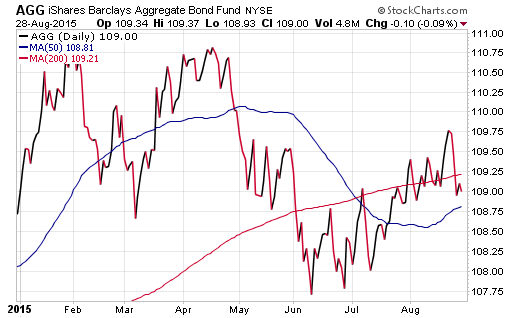

The Shock Absorber Is Missing In Action

One of the most underwhelming asset classes during this sell off in stocks has been the lack of performance in high quality bonds. Since SPY peaked on July 20, the iShares U.S. Aggregate Bond ETF (NYSE:AGG) has gained just 0.39%. This weak follow through was mirrored in the iShares Investment Grade Corporate Bond ETF (NYSE:LQD) and iShares 7-10 Year Treasury Bond ETF (NYSE:IEF), which gained a timid 0.19% and 1.57% respectively.

Typically, during periods of extreme stock market volatility, we see a flight to quality in bonds that helps cushion the draw down in our portfolios. This is one of the primary benefits of multi-asset diversification and helps alleviate overwhelming conviction in a single high risk outcome. Those who have come to rely on the strength of bonds during a sell off have been let down over the last several weeks.

Put simply, if your bonds aren’t marginally offsetting the losses in stocks, you are going to feel the pain of those losses more acutely.

In my opinion, most of this indecision in the bond market is due to three factors:

- We had a strong sell off in Treasury yields (jump in bond prices) during June and July that left fixed-income investors near the high end of relative valuations. This put the bond market in a precarious spot right as the mini stock storm descended.

- Many investors in stocks are wary about transitioning to high quality bonds in front of a near-term interest rate hike by the Federal Reserve. After 6 years of zero interest rate policy, there is no way to know exactly how the fixed-income markets will react to this first adjustment.

- The CBOE 10-Year Treasury Note Yield (TNX) jumped sharply higher as stocks staged a comeback late last week. This may point towards an opportunistic rotation out of bonds and back into stocks for those that were looking for a spot to buy well off the recent highs or feared missing out on a V-shaped recovery.

The Bottom Line

Most aggregate bond funds are sitting near the flat-line for the year and have yet to participate in a meaningful way for 2015. Nevertheless, I’m not looking to reduce my overall exposure for clients at this juncture. In my opinion, this asset class still represents a solid foundation for balanced or conservative investors to bolster their income and lower total portfolio volatility.

I prefer the risk management and security selection that comes with an actively managed ETF such as the SPDR DoubleLine Total Return Tactical ETF (NYSE:TOTL). Now more than ever, it is important to be flexible with respect to credit and interest-rate positioning as the Fed transitions to a new fiscal policy phase.

I pointed out last week that it’s important to make changes on the stock side of the portfolio that are based on rational intermediate or long-term strategy, rather than short-term fear. This may include lightening up overexposure into a rally or taking advantage of new opportunities from your watch list during a correction.

Above all, don’t let these periods of uncertainty get the best of you. Make sure you have a game plan for what you are going to hold or when it makes sense to fold. That way you are prepared for multiple outcomes and able to implement a decisive investment strategy to improve your long-term results.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

Related Articles

Several economic indicators are raising concerns and investor anxiety about a potential recession. When combined with persistent economic and geopolitical concerns, these...

If the Vanguard S&P 500 Index ETF (VFV) doesn’t give you enough large-cap U.S. equity exposure as a Canadian investor, Invesco NASDAQ 100 Index ETF (QQC) is one of the most...

The major market indexes have struggled this year to produce returns. Many actively managed ETFs have fared better than their index counterparts. Here are 3 top actively managed...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.