- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why It's Wise To Hold Hancock Holding (HBHC) Stock For Now

We issued an updated research report on Hancock Holding Company (NASDAQ:HBHC) on Nov 21. The company has been undertaking strategic initiatives, witnessing an increase in its loan and deposit balances, and enhancing shareholder value through regular dividend payments. The likelihood of lesser regulations and an improving rate environment are also among the factors that will continue to support profitability.

However, rising operating expenses remains a concern for the company. Also, Hancock Holding’s exposure to risky loan portfolios makes us apprehensive.

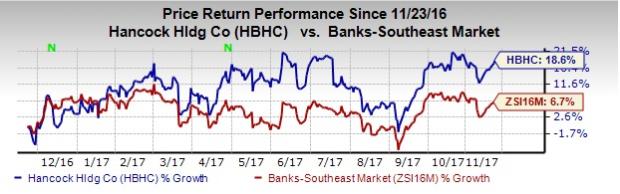

Shares of Hancock Holdings have gained 18.6% over the past 12 months, outperforming 6.7% growth recorded by the industry.

Further, the company’s earnings estimates have inched up for the current year, over the last 30 days. It currently carries a Zacks Rank #3 (Hold).

Hancock Holding remains focused on its organic growth strategy. Revenues have seen a CAGR of 2.3% over the past three years (2014-2016), with the trend continuing in 2017. We remain optimistic about future revenue growth, given the implementation of initiatives to enhance its core revenues. Also, branch acquisitions in early 2017 should support growth. Going ahead, strategic investments in growth markets are not only expected to be accretive, but should also bolster the bank’s presence in such areas.

Further, total loans (net of unearned income) increased at a five-year (2012-2016) CAGR of 9.7%, with the trend continuing in 2017. Additionally, the company has been witnessing a consistent rise in non-interest-bearing deposits. Such deposits lower the funding cost for the company, and the capital generated from these deposits can be meaningfully employed with economic recovery.

On the flip side, mounting operating expenses remain a major concern for Hancock Holding. The company’s total non-interest expenses (excluding non-operating expenses) have increased at a three-year (2014-2016) CAGR of 2.2%. The trend is lasting in 2017. The primary reasons for persistently higher costs are increase in personnel costs, and deposit insurance and regulatory fees. Also, as the company has been expanding inorganically and hiring additional workforce, costs are expected to remain on a higher level going forward.

Moreover, the company has significant exposure to residential mortgage, construction and land development as well as commercial real estate loans. The company’s exposure to these loan portfolios constitute over 34% of total loans. Any deterioration in real estate prices will pose a risk to the company. As such exposure calls for higher provisions, it may strain the company’s near-term profitability.

Some better-ranked stocks in the same space are First Bancorp (NASDAQ:FBNC) , Republic Bancorp (NASDAQ:RBCAA) and Summit Financial Group (NASDAQ:SMMF) , each carrying a Zacks #1 Rank (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

For First Bancorp, over the last 30 days, the Zacks Consensus Estimate has been revised 8.6% upward for 2017. Its share price has increased 48.2% in a year.

Republic Bancorp has witnessed an upward earnings estimate revision of 4.7% for 2017, over the last 30 days. Over the past 12 months, its share price has gone up 8.8%.

Summit Financial has witnessed an upward earnings estimate revision of 3.7% for 2017, over the last 30 days. Its share price has risen 7% over the past 12 months.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Hancock Holding Company (HBHC): Free Stock Analysis Report

First Bancorp (FBNC): Free Stock Analysis Report

Republic Bancorp, Inc. (RBCAA): Free Stock Analysis Report

Summit Financial Group, Inc. (SMMF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.