- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Is Whirlpool (WHR) Down 8.7% Since The Last Earnings Report?

It has been about a month since the last earnings report for Whirlpool Corporation (NYSE:WHR) . Shares have lost around 8.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is the stock due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Whirlpool Q3 Earnings & Sales Miss, Cuts View

Whirlpool reported third-quarter 2017 results, wherein both earnings and sales missed the Zacks Consensus Estimate. The quarter marked the company’s fifth consecutive negative earnings surprise and second straight sales miss. Additionally, management cut earnings guidance for 2017 due to higher raw material inflation and unfavorable price/mix.

Q3 Highlights

Whirlpool’s quarterly adjusted earnings per share came in at $3.83 that missed the Zacks Consensus Estimate of $3.90. However, it increased 4.7% year over year.

On a GAAP basis, the company’s earnings grew 20% to $3.72 per share from $3.10 earned in the prior-year quarter. The upside was driven by lower income tax expense versus year-ago period, owing to the timing of tax planning activities in the current year.

Revenues were $5,418 million that rose nearly 4% from the comparable year-ago quarter revenues of $5,248 million. The top line fell short of the Zacks Consensus Estimate of $5,487 million. On a currency-neutral basis, Whirlpool registered sales growth of 2%. Markedly, the top line benefited from strength in North America, Asia and Latin America.

Further, adjusted operating profit in the quarter dropped 9.8% to $376 million from $417 million in the year-ago quarter. Also, the operating margin contracted 100 basis points (bps) to 6.9%. During the quarter, ongoing cost productivity and increased unit volumes were more than offset by the adverse product price/mix and raw material inflation.

Regional Performance

Revenues from North America went up 3.5% year over year to $3 billion while the same grew 4% on a currency-neutral basis. Adjusted operating profit margin contracted 40 bps to 11.7% while in dollar terms operating profit grew 1.2% to $350 million. Notably, operating profit gains reflected from higher unit volumes and cost productivity negated adverse currency impacts and raw material inflation. However, the negative impact of raw material price inflation dented operating margins. Yet, the company retained North-American industry unit shipments guidance of 4-6% growth for 2017.

Revenues from Latin America rose 6.1% year over year to $849 million. Also, the same increased 5% excluding the effects of currency translation. Adjusted operating margin of 6.3% increased 50 bps, on the back of higher volumes and cost productivity gains, more than offset by raw material inflation and adverse product price/mix. The company reiterates its industry unit shipments in Brazil to be flat in 2017.

Meanwhile, revenues from EMEA remained flat year over year at $1.3 billion. On a currency-neutral basis, the same dropped 8%. Whirlpool reported adjusted operating profit of $11 million in the third quarter versus adjusted operating profit of $48 million in the year-ago quarter. Further, its adjusted operating margin came in at 0.8%, which fell 290 bps from the year-ago period. The decline can be attributed to raw material inflation, adverse product price/mix as well as lower volumes that were more than offset by cost productivity benefits and restructuring gains. However, Whirlpool reaffirms its industry unit shipments growth in 2017 in the range of flat to up 2%.

Revenues from Asia grew 5.6% to $357 million in third-quarter 2017 from $338 million in the prior-year quarter. Excluding currency effects, revenues rose 4%. However, adjusted operating margin contracted 430 bps to 0.6%. Cost productivity gains were more than compensated with adverse product price/mix in China and raw material inflation. Nevertheless, management maintains its industry unit shipments guidance in the range of flat to 2% growth for 2017.

Financial Position

Whirlpool had cash and cash equivalents of $1,087 million as of Sep 30, 2017 and long-term debt of $3,669 million.

The company used cash of $33 million in operating activities during the nine months of 2017. In the same period, the company’s capital expenditure was $371 million. As of Sep 30, 2017, Whirlpool had negative free cash flow of $348 million due to the company's focus on working capital optimization.

In the reported quarter, management bought back shares for nearly $200 million and intends to repurchase in the remaining period of 2017. Moreover, Whirlpool bought back shares worth $550 million and paid cash dividend of $235 million in the nine months of 2017.

Other Developments

We note that Whirlpool has been witnessing significantly higher raw material prices, which are expected further increase through 2018. In October, management announced to its trade customers, global cost-based pricing that will include most of the company’s operations in order to mitigate raw material inflation. This is anticipated to be implemented in the fourth quarter and the first quarter of 2018.

Furthermore, Whirlpool took initiatives to cut down its fixed overhead expenses by $150 million. These initiatives are likely to be implemented in early 2018 and add to its ongoing cost productivity program.

Guidance

Whirlpool slashed earnings forecasts for 2017 based on raw material inflation and adverse price/mix. The company now envisions adjusted earnings per share for 2017 in a range of $13.60-$13.90 compared with $14.50-$15.00, guided earlier. On a GAAP basis, Whirlpool anticipates earnings in a range of $11.10-$11.40 per share compared with the previous estimate of $12.40-$12.90 for 2017.

Nonetheless, the company continues to anticipate generating free cash flow of about $900 million for 2017 while it revised operating cash flows guidance to range from $1.55–$1.6 billion. Earlier, the company had anticipated operating cash flows of $1.65-$1.7 billion.

The revised guidance includes restructured cash outlays of approximately $175 million, legacy product warranty and liability costs of $70 million, pension contributions of $45 million and capital expenditures of $650-$700 million.

Also, management stated that it reiterates 2020 goals and remains optimistic about ongoing growth initiatives as well as global cost-based pricing and fixed cost reduction strategies.

How Have Estimates Been Moving Since Then?

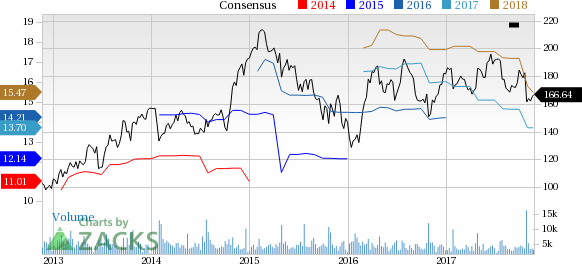

Following the release, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 17.8% due to these changes.

VGM Scores

At this time, Whirlpool's stock has an average Growth Score of C, though it is lagging a lot on the momentum front with an F. However, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. It's no surprise that the stock has a Zacks Rank #4 (Sell). We expect below average returns from the stock in the next few months.

Whirlpool Corporation (WHR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.