- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Is Walt Disney (DIS) Down 1.1% Since Its Last Earnings Report?

A month has gone by since the last earnings report for Walt Disney Company (The) (NYSE:DIS) . Shares have lost about 1.1% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is DIS due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Disney Q1 Earnings Beat, Parks & Resorts Leads the Way

The Walt Disney Company reported positive earnings surprise in first-quarter fiscal 2018. The company however, missed the Zacks Consensus Estimate in the preceding quarter. However, the big take away from the quarter under review was a robust top-line performance. Revenues surpassed the consensus mark for the first time in six quarters.

The company’s adjusted earnings in the reported quarter came in at $1.89 per share, beating the Zacks Consensus Estimate of $1.62 and increased 21.9% year over year. Moreover, revenues came in at $15,351 million, up 4% year over year and also topped the Zacks Consensus Estimate of $15,244 million. The company’s solid performances were driven by double-digit growth in Parks and Resorts segment.

The company’s total operating income came in at $3,986 million during the quarter, up 1% year over year. This upside was on a sharp increase in operating income at Parks and Resorts, which offset the decline at Media Networks, Studio Entertainment and Consumer Products & Interactive Media.

Segment Details

The Media Networks segment’s revenues came in at $6,243 million, almost flat year over year. Cable Networks inched up 1% to $4,493 million whereas Broadcasting revenues declined 3% to $1,750 million.

The segment’s operating income came in at $1,193 million, down 12% year over year. Cable Networks saw a 1% dip in operating income to $858 million while the Broadcasting segment reported a 25% slump in operating income to $285 million. Drop in operating income at Cable Networks was primarily due to loss at BAMTech as well as a decline at ESPN, which overshadowed growth at Disney Channels and Freeform.

At ESPN, increase in affiliate revenues and lower programming cost were offset by dismal advertising revenues. Decrease in advertising revenues were chiefly on decline in average viewership and lower rates. Meanwhile, rise in affiliate revenues was driven by an increase in contractual rate, which mitigated the fall in subscribers. Decline in Broadcasting revenues was due to reduction in advertising revenues and program sales income plus an increase in production cost write-downs.

Parks and Resorts segment once again turned out to be the savior for Disney. The segmental revenues came in at $5,154 million, up 13% from the year-ago period. The segment’s operating income climbed 21% to $1,347 million, backed by growth at the company’s domestic parks and resorts, cruise line and vacation club businesses. Moreover, a sturdy performance of Disneyland Paris contributed to the operating income growth. Increase in operating income at domestic parks was driven by higher guest spending and attendance, overshadowing higher costs. Rise in guest spending was due to higher average ticket prices, merchandise spending, food and beverage expense and a surge in room rates. Meanwhile, growth at Disneyland Paris was owing to rising attendance as well as higher average ticket prices.

The Studio segment generated revenues of $2,504 million, down 1% year over year. Moreover, operating income slipped 2% to $829 million due to dismal performance of home entertainment and TV/SVOD distribution, which overshadowed strong results from theatrical distribution. Increase in theatrical distribution was on the back of blockbuster performances of Star Wars: The Last Jedi and Thor: Ragnarok.

We believe that the year ahead will be fruitful for Disney. The studio is all set to continue with its success story beyond Star Wars, Zootopia and Beauty and the Beast as it boasts an impressive line-up of big budget movies. In 2018, the company is expected to release Black Panther, A Wrinkle in Time, Avengers: Infinity War, The Incredibles 2 and Ant-Man and the Wasp. Moreover, analysts believe that the deal with Rian Johnson, director of The Last Jedi, to produce a brand new Star Wars trilogy may rekindle investors’ hopes.

Further, Disney is acquiring majority of Twenty-First Century Fox, Inc.’s assets including its Film and Television studios accompanied by cable and international TV businesses in a transaction worth $52.4 billion. The accord would give the company a hold on Twenty-First Century Fox's film production business like Twentieth Century Fox, Fox Searchlight Pictures, Fox 2000 and its storied television units, Twentieth Century Fox Television, FX Productions and Fox21.

Consumer Products & Interactive Media division saw a 2% decrease in revenues to $1,450 million. Moreover, the unit’s operating income dropped 4% to $617 million due to decline at merchandise licensing business.

Other Financial Details

Disney generated free cash flow of $1,256 million during the reported quarter compared with $405 million in the year-ago period. The company ended the quarter with cash and cash equivalents of $4,677 million, borrowings of $20,082 million and shareholder’s equity of $43,289 million excluding non-controlling interest of $3,794 million.

During the quarter under concern, the company bought back nearly 12.8 million shares for $1.3 billion.

How Have Estimates Been Moving Since Then?

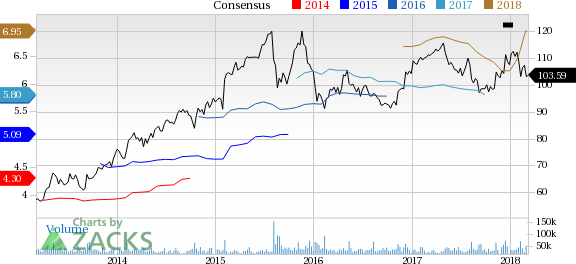

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision higher for the current quarter compared to two lower.

Walt Disney Company (The) Price and Consensus

VGM Scores

At this time, DIS has a subpar Growth Score of D, a grade with the same score on the momentum front. Following the exact same course, the stock was also allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate investors will probably be better served looking elsewhere.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions looks promising. Notably, DIS has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.