- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

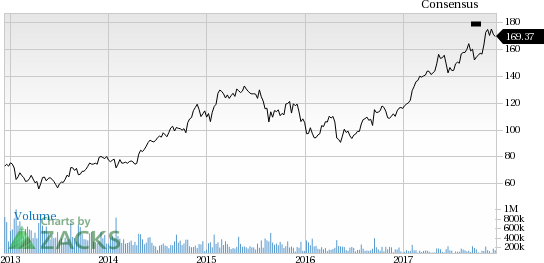

Why Is Energizer (ENR) Up 12.3% Since The Last Earnings Report?

More than a month has gone by since the last earnings report for Energizer Holdings, Inc. (NYSE:ENR) . Shares have added about 12.3% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Recent Earnings

Energizer reported strong fiscal fourth-quarter 2017 results. Adjusted earnings of 54 cents per share and revenues of $465.1 million comfortably beat the Zacks Consensus Estimate of 48 cents and $436.4 million, respectively.

The year-over-year revenue growth was boosted byincreased organic net sales of 7.5% (including of hurricane volumes). Excluding hurricane volumes, organic revenues rose 3% year over year.

Quarterly Details

Batteries revenues grew 9.2% year over year to $409.4 million while revenues from Other segment fell 3% to $55.7 million.

In Americas, the company recorded revenues of $299.6 million, up 7.2% from last year’s quarter. Revenues from Europe, the Middle East and Africa region were $92.4 million, up 12.1%. The Asia Pacific region recorded revenue increase of 3.7% year over year to $73.1 million.

Gross margin decreased 270 basis points (bps) to 46%. Selling, general and administrative expenses as a percentage of net sales were 20.7% compared with 21.5% reported in the year-ago quarter.

As of Sep 30, 2017, Energizer had cash and cash equivalents of $378 million compared with $287.3 million as of Sep 30, 2016. Long-term debt was $978.5 million compared with $981.7 million as of Sep 30, 2016.

For the fiscal ended Sep 30, 2017, cash flow from operations was $197.2 million. Free cash flow amounted to $199.2 million.

As of Sep 30, 2017, the company had repurchased shares worth $58.7 million. Dividend payments in the year were approximately $69.1 million.

Guidance

For fiscal 2018, Energizer now expects earnings per share in the band of $3.00–$3.10.

Organic revenues are expected to be up in low-single digits. Moreover, favourable forex movements will boost sales of the company by 1%–1.5%.

Gross margin is expected to be flat as increased commodity costs and lithium pricing offset benefits of improved pricing.

Capex is expected in the range of $30–$35 million. Free cash flow is expected to to be in the band of $210 to $220 million.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the past month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, the stock has a subpar Growth Score of D, a grade with the same score on the momentum front. However, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value based on our styles scores.

Outlook

The stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Energizer Holdings, Inc. (ENR): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.