- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Hold Strategy Is Apt For SunTrust Banks (STI) Stock Now

A favorable operating backdrop with the anticipation of another interest rate hike by the Fed has driven investors’ optimism for banking stocks. So it’s a good idea to bet on some bank stocks that possess strong fundamentals and have solid growth prospects.

SunTrust Banks (NYSE:STI) is one such stock. Easing margin pressure, rise in loan demand and improving asset quality are the major driving factors. Further, initiatives to control costs are encouraging. However, its significant exposure to commercial and residential loan portfolios remains a concern. Also, continued slowdown in mortgage activities is likely to adversely impact non-interest income.

This financial services company reported in-line earnings in third-quarter 2017. The results were primarily driven by an increase in net interest income and a slight fall in operating expenses. Also, a stable loan balance and an increase in deposits supported the results. Then again, a rise in provision for credit losses and lower non-interest income (mainly owing to mortgage banking woes) acted as headwinds.

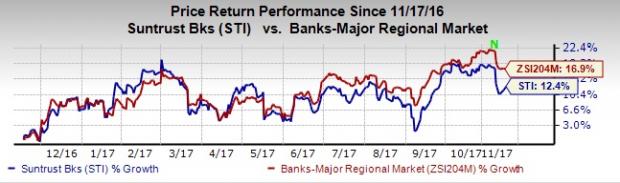

Shares of SunTrust have gained 12.4% over the past 12 months, underperforming 16.9% growth recorded by the industry.

However, the company’s earnings estimates inched up marginally for the current year, over the last 30 days. It currently carries a Zacks Rank #3 (Hold).

SunTrust continues to record a downtrend in expenses. Non-interest expenses declined at a four-year (ended 2016) CAGR of 2.1%, mainly driven by branch consolidation efforts. Also, it remains undeterred in its plans to improve efficiency and targets a tangible efficiency ratio in the range of 61–62% this year and below 60% by 2019-end.

In 2016, the company reported a rise in net interest margin (NIM) after facing a declining trend for years. Also, the company has been increasing its prime lending rate, subsequent to the Fed’s rate hikes. Net interest income (NII) has witnessed a three-year (2014-2016) CAGR of 3.9%. Both NIM and NII maintained an uptrend during the first nine months of 2017. Further, management is undertaking efforts to enhance revenue growth through several initiatives.

On the flipside, the company continues to witness a volatile trend in non-interest income. This is mainly due to lower mortgage production and mortgage servicing-related income. Chances of mortgage-related income improving significantly in the near term are low. Hence, the slowdown in mortgage business is expected to continue hurting the company’s non-interest income in the near term.

Further, we remain concerned about SunTrust’s significant exposure to commercial and residential loan portfolios. The company’s exposure to these loan portfolios constitute over 80% of total loans held for investments. Although the housing sector has shown considerable improvement, any further deterioration in real estate prices will pose a problem for the company.

Some better-ranked stocks in the finance space are Erste Group Bank AG (OTC:EBKDY) , The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) and Stifel Financial Corporation (NYSE:SF) , each carrying a Zacks #2 Rank (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For Erste Group, over the last 60 days, the Zacks Consensus Estimate has been revised 16.6% upward for 2017. Its share price has increased 54.6% in a year.

Bank of N.T. Butterfield & Son has witnessed an upward earnings estimate revision of 2.2% for 2017, over the last 60 days. Over the past 12 months, its share price has gone up 26.7%.

Stifel Financial has witnessed an upward earnings estimate revision of 2.4% for 2017, over the last 60 days. Its share price has risen 4.6% over the past 12 months.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

SunTrust Banks, Inc. (STI): Free Stock Analysis Report

Erste Group Bank AG (EBKDY): Free Stock Analysis Report

Bank of N.T. Butterfield & Son Limited (The) (NTB): Free Stock Analysis Report

Stifel Financial Corporation (SF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.