- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why American Eagle (AEO) Fell After Solid Q4 Earnings, Sales

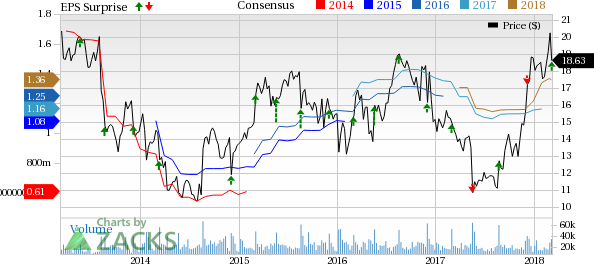

American Eagle Outfitters, Inc. (NYSE:AEO) declined nearly 9.4% on Mar 8, despite reporting accelerated sales, continued sequential margin improvement and EPS growth in fourth-quarter fiscal 2017. While the company’s earnings matched the Zacks Consensus Estimate, sales topped estimates. This marked the third sales beat in the last four quarters.

Moreover, American Eagle’s shares ascended 51.9% in the last six months, outperforming the industry’s 23.3% growth.

Q4 Highlights

Quarterly adjusted earnings of 44 cents per share rose 13% from 39 cents recorded in the prior-year quarter and were in line with the Zacks Consensus Estimate. On a GAAP basis, earnings surged 73.3% year over year to 52 cents per share.

Total net revenues increased around 12% year over year to $1,228.7 million and surpassed the Zacks Consensus Estimate of $1,197.7 million. Moreover, this marked record sales for the company, with fourth quarter recording the best of 2017.

Consolidated comps increased 8% compared with a slight increase witnessed last year. This marked the company’s strongest comps since the third quarter of fiscal 2015. Moreover, fiscal 2017 marked the third straight year of comps growth.

Further, the company’s digital business continued to exhibit solid growth, improving more than 20% in the quarter. In fact, this was the company’s 12th straight quarter of double-digit e-commerce growth. Moreover, trends in brick-and-mortar stores improved as both American Eagle (AE) and Aerie stores reported positive in-store comps, increasing low single-digits.

Evidently, traffic and transactions improved and store traffic surpassed mall traffic for both brands. Average unit retail price increased low-single digit on account of a favorable mix, while average dollar sales improved marginally.

Brand-wise, comps rose 34% at Aerie stores, while it improved 5% at AE brand outlets. Notably, this marked aerie brand’s 15th straight quarter of positive comps.

Quarter in Detail

Gross profit increased 9.4% to $425.1 million in the reported quarter, with the gross margin contraction of 80 basis points (bps) to 34.6%. The decline can primarily be attributed to greater promotions and increased shipping costs and compensation, partly negated by lower rent. However, the company witnessed sequential improvements from the 270 bps, 240 bps and 120 bps gross margin declines in the first, second and third quarters of fiscal 2017, respectively. Clearly, this reflected a solid reduction in gross margin erosion from 270 bps in the first quarter to 80 bps in the fourth quarter.

SG&A expenses increased nearly 9% to $263.8 million, while as a percentage of sales it leveraged 60 bps to 21.5%. The rise in SG&A expenses, in dollar terms, was driven by higher store salaries, due to a strong holiday season and the extra week alongside increased incentive compensation.

Furthermore, the company’s adjusted operating income was $118 million, up 10% from $107 million recorded in the prior-year quarter. Adjusted operating margin also shriveled 20 bps to 9.6%.

Financial Position

American Eagle ended fiscal 2017 with cash and cash equivalents of $413.6 million compared with $378.6 million in fiscal 2016. Further, total shareholders’ equity as of Feb 3 was $1,246.8 million.

Moreover, the company spent $169 million as capital expenditures in fiscal 2017. For fiscal 2018, management anticipates capital expenditures in the range of $180-$190 million, of which roughly 50% will be spent on store openings and refurbishment. The balance will be invested in omni-channel and digital projects as well as general corporate maintenance.

As of Feb 3, American Eagle’s merchandise inventory at cost was roughly $398 million, up 11% from the comparable year-ago period. The increase is attributed to the investments in bottoms, women’s tops and Aerie apparel to support strong sales trends.

During 2017, the company returned nearly $176 million to shareholders by paying dividends of $89 million and buying back 6 million shares for $88 million.

Backed by its strong cash position, positive free cash flow and gains from the tax reform, the company raised its quarterly dividend by 10% to 13.75 cents per share. The increased dividend is payable on Apr 27 to shareholders with record as of Apr 13.

Store Update

During fiscal 2017, American Eagle inaugurated 15 new AE Brand stores, 15 stand-alone Aerie locations and 28 Aerie side-by-side stores. Moreover, the company closed 25 AE brand stores and eight stand-alone Aerie stores.

As of Feb 3, the company operated a total of 1,047 stores, including 933 AE (having 116 Aerie side-by-side locations) and 109 stand-alone Aerie stores. Additionally, the company operated 214 international licensed outlets.

In fiscal 2018, management intends to open 15-20 new AE outlets and 35-40 Aerie stores, including 10-15 standalone stores and balance side-by-side Aerie locations. Further, this Zacks Rank #3 (Hold) company expects to shut down 10-15 AE stores and 5-10 old format Aerie stores.

Looking Ahead

Management remains impressed with its quarterly performance, particularly record sales and sequential improvement in profit margins. The company expects these trends to continue in the first quarter.

American Eagle anticipates comps for first-quarter fiscal 2018 to increase mid-single-digits. This is likely to result in adjusted earnings per share of 20-22 cents compared with 16 cents earned in the prior-year quarter.

Looking for Some Trending Picks? Look at These

Some better-ranked stocks in the same industry are Abercrombie & Fitch Co. (NYSE:ANF) , sporting a Zacks Rank #1 (Strong Buy), Foot Locker Inc. (NYSE:FL) and The Gap Inc. (NYSE:GPS) , both carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Abercrombie & Fitch has gained 24.7% in the last three months. Moreover, it has a long-term earnings growth rate of 14%.

Foot Locker has a long-term EPS growth rate of 5%. Further, the stock improved 16.8% in the last six months.

The Gap stock grew nearly 25.7% in the last six months. Moreover, the company has a long-term EPS growth rate of 8%.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Foot Locker, Inc. (FL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.