- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Which ETFs Shine The Brightest?

In spite of a stock market sell-off that nearly set the S&P 500 back 10%, some stock ETFs have already recovered. That’s right. A handful of funds barely trembled during last week’s frightful liquidation. Shortly thereafter, this intrepid group ascended to record heights.

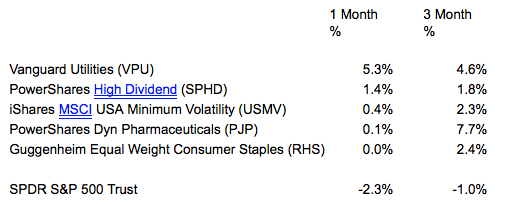

Here are the more notable stock ETFs on the latest 52-Week High list. Do the 1-month and 3-month performance intervals hint at a pattern?

Most investors are familiar with the carnage on a month-over-month basis. And most are relieved that both Janet Yellen, chairwoman of the Federal Reserve, as well as the president of the ST. Louis Fed, James Bullard, backstopped Wall Street investors last week. In light of low inflation and global economic weakness, they strongly hinted that the Federal Open Market Committee (FOMC) would consider maintaining zero interest rate policies for a longer period,

Yet many investors may not have realized the lack of momentum for broader benchmarks over a 3-month span. The Dow 30, the S&P 500 and the Russell 2000 have all turned in losing performances. In contrast, non-cyclical segments that are not particularly tethered to the U.S. economy – consumer staples, utilities, health care – have turned in positive results with less drawdown or volatility.

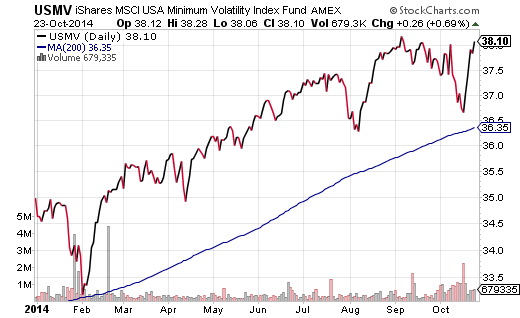

Speaking of volatility, iShares MSCI USA Min Volatility (NYSE:USMV), has been one of my favorite funds throughout 2014. This exchange-traded asset tracks the results of an index composed of U.S. equities that, collectively, possess less volatile characteristics than the broader market. Indeed, this “low-vol” fund has been a stand-out success in the late-stage stock bull. What’s more, it is one of a precious select number of stock ETF assets that did not breach a respective 200-day trendline in October.

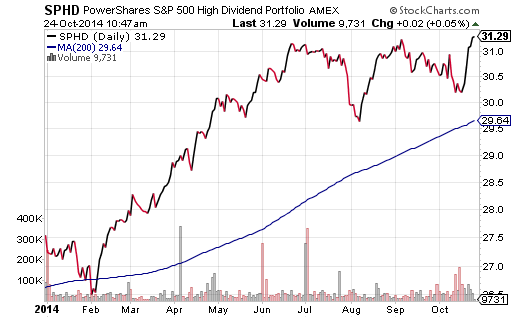

Are there other stock funds that maintained the long-term technical uptrend without a dip? S&P 500 High Dividend Portfolio (NYSE:SPHD) managed this feat, bouncing off a “higher low” before traveling to a brand new perch. And wouldn’t you know it… SPHD pursues investment returns that correspond to the price and yield of a “low volatility” index called the S&P 500 Low Volatility High Dividend Index.

Stay Conservative

Is there a definitive take-away from market instability over the last month as well as market inconsistency over the last three months? Yes. Specifically, conservative stock choices are providing more reasonable rewards for the risk. You might prefer to select a non-cyclical sector with an allocation to utilities, staples or health care. By the same token, you might like a more diversified approach that targets low volatility, dividend-oriented assets.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.