- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

What's In Store For Johnson Controls (JCI) In Q4 Earnings?

Johnson Controls International plc (NYSE:JCI) is set to report fourth-quarter and full-year 2017 results on Nov 9, before market open.

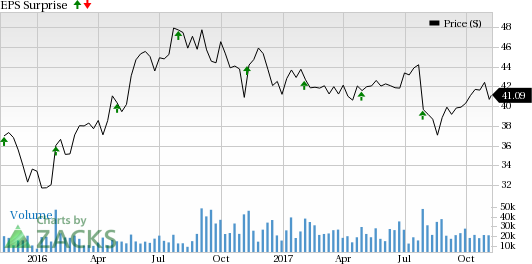

Last quarter, the company reported in-line results. In fact, the company beat earnings estimates in two of the trailing four quarters, with an average positive surprise of 5.14%.

The long-term earnings per share growth (three-five years) for the company is currently pegged at 13.3%.

Johnson Controls’ shares have lost 0.2% year to date, underperforming the 5.4% rise of the industry it belongs to.

Let’s see how things have shaped up for the forthcoming announcement.

Factors Influencing This Quarter

In fiscal 2017, Johnson Controls expects to post strong earnings on integration and productivity savings and cost benefits from mergers. Johnson Controls trimmed the upper end of its adjusted earnings per share range to $2.60-$2.62 for fiscal 2017 from the prior band of $2.60-$2.68. This new guidance represents a year-over-year increase of 13-16%.

The company has raised the revenue guidance for fiscal 2017 to $30.1-$30.2 billion, up from the prior guidance of $30.0-$30.2 billion. The company also guided fourth-quarter fiscal 2017 earnings per share range of 86 cents-88 cents, reflecting an increase of 13-16% year over year.

Deconsolidation of the automotive interiors business and negative foreign currency translation is affecting Johnson Controls’ results. This too is likely to negatively impact the company’s fourth-quarter results.

Earnings Whispers

Our proven model does not conclusively show an earnings beat for Johnson Controls this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here as you will see below.

Zacks ESP: Johnson Controls has an Earnings ESP is -0.44% because the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 86 cents and 87 cents, respectively.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Johnson Controls carries a Zacks Rank #3, which increases the predictive power of ESP. However, the stock’s negative ESP doesn’t make us confident of a positive earnings surprise.

We caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks that Warrant a Look

A few companies with the right combination of elements to come up with an earnings beat this quarter are:

Meritor, Inc. (NYSE:MTOR) has an Earnings ESP of +4.26% and a Zacks Rank of 1. The company is expected to release fourth-quarter 2017 results on Nov 15. You can see the complete list of today’s Zacks #1 Rank stocks here.

Calumet Specialty Products Partners, L.P. (NASDAQ:CLMT) has an Earnings ESP of +80.95% and a Zacks Rank of 3. The company is expected to release upcoming results on Nov 10.

Adaptimmune Therapeutics PLC (NASDAQ:ADAP) has an Earnings ESP of +1.50% and a Zacks Rank of 2. The company is expected to release upcoming results on Dec 3.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Johnson Controls International PLC (JCI): Free Stock Analysis Report

Meritor, Inc. (MTOR): Free Stock Analysis Report

Adaptimmune Therapeutics PLC (ADAP): Free Stock Analysis Report

Calumet Specialty Products Partners, L.P. (CLMT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.