- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

What's In Store For Epizyme (EPZM) This Earnings Season?

Epizyme, Inc. (NASDAQ:EPZM) is expected to report fourth-quarter 2017 results on Mar 8, after the closing bell.

Last quarter, the company delivered a positive earnings surprise of 3.08%. In fact, its track record has been solid, with Epizyme surpassing expectations in each of the trailing four quarters, recording an average positive surprise of 8.68%.

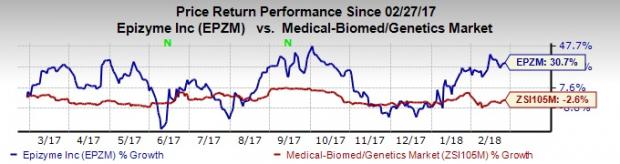

Notably, Epizyme’s shares have returned 30.7% over a year as against the industry’s decline of 2.6%.

Let’s see how things are shaping up for this quarter.

Factors Influencing This Quarter

Epizyme has made significant progress with its lead candidate, tazemetostat (an EZH2 inhibitor), for the treatment of multiple types of hematological malignancies and genetically defined solid tumors.

Epizyme is conducting a broad clinical development program for tazemetostat as both a monotherapy and combination treatment in relapsed/refractory and first-line non-Hodgkin lymphoma (“NHL”). The company expects to submit a new drug application (“NDA”) for the NHL in 2019.

The company is also exploring tazemetostat to increase the clinical activity of immuno-oncology therapies by combining an anti-PD 1 or PDL-1 agent. Under its collaboration with Roche (OTC:RHHBY) , the company is evaluating tazemetostat, in combination with anti-PD-L1 cancer immunotherapy, Tecentriq, for the treatment of patients with relapsed or refractory diffuse large B-cell lymphoma (“DLBCL”)to determine the recommended phase II dose and advance the study.

The company is also evaluating tazemetostat as a treatment for adults with mesothelioma characterized by BAP1 loss-of-function and expects to report data from phase II study for the same in 2018.

Epizyme’s second pipeline candidate, pinometostat is being evaluated in a phase I dose-escalation study on pediatric patients suffering from an acute leukemia with genetic alterations of the MLL gene (MLL-r). Epizyme has an agreement with Celgene (NASDAQ:CELG) for the discovery, development and commercialization of small-molecule HMT inhibitors including pinometostat in ex-United States’ markets.

Epizyme had $307.2 million of cash, cash equivalents and marketable securities as of Sep 30, 2017 and expects that it will be sufficient to fund its planned operations at least till third-quarter 2019.

Earnings Whispers

Our proven model does not conclusively show an earnings beat for Epizyme this quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. Unfortunately that is not the case here, as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is -0.40%. The Zacks Consensus estimate for the quarter’s earnings is pegged at a loss of 56 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Epizyme has a Zacks Rank #3. This when combined with negative ESP makes surprise prediction difficult.

Conversely, we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Epizyme, Inc. Price and EPS Surprise

Stocks to Consider

Here are some health care stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Gemphire Therapeutics (NASDAQ:GEMP) is expected to release fourth-quarter 2017 results on Mar 21. The company has an Earnings ESP of +8.01% and a Zacks Rank #2. You can seethe complete list of today’s Zacks #1 Rank stocks here.

Atara Biotherapeutics (NASDAQ:ATRA) is expected to release fourth-quarter 2017 results on Mar 8. The company has an Earnings ESP of +7.42% and a Zacks Rank #3.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Epizyme, Inc. (EPZM): Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA): Free Stock Analysis Report

Gemphire Therapeutics Inc. (GEMP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.