- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

What's In Store For AMC Entertainment (AMC) In Q4 Earnings?

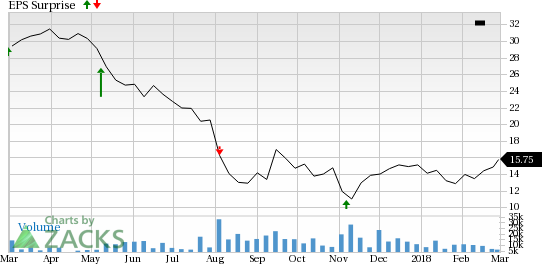

AMC Entertainment Holdings (NYSE:AMC) is slated to report fourth-quarter 2017 results on Mar 1, before the opening bell.

The Zacks Consensus Estimate for revenues is pegged at $1.4 billion, reflecting year-over-year growth of 51.3%. The consensus estimate for earnings is pegged at 27 cents per share, indicating year-over-year decline of 27%.

The company has a positive earnings surprise history. Earnings outpaced the Zacks Consensus Estimate in three of the previous four quarters, with an average beat of 120.2%.

Let’s see how things are shaping up for this announcement.

Factors Likely to Influence Q4 Earnings

AMC Entertainment is one of the largest theatrical exhibition companies in the United States, Europe and globally with approximately 1,000 theaters and 11,000 screens. The company successfully operates theaters in 15 European countries and is the market leader in 22 of the 25 largest metropolitan areas in the United States, including the top three markets (New York, Los Angeles and Chicago). The company is also an industry leader in innovation and operational excellence.

Further, AMC Entertainment has been actively involved in the renovation and refurbishing of multiplexes through enhancements like reclining seats, improved food and beverages, dine-in theaters as well as advanced sound and digital equipment.

Completion of the $130-million sale-leaseback transaction of 7 U.S. theatres should help the company in enhancing overall liquidity position, funding the buyback of AMC shares, paying its debt and fueling growth through deployment of strategic initiatives.

AMC Entertainment’s initiative to identify approximately $400-million non-strategic assets and monetize them strategically and systematically looks impressive. The company sold 12 million shares of National CineMedia’s (NASDAQ:NCMI) common stock to Standard General, L.P. for approximately $73.1 million. AMC Entertainment also sold 2.8 million shares of National CineMedia’s common stock to an undisclosed American buyer for approximately $18.2 million.

We also appreciate the company’s efforts to offer a quarterly cash dividend of 20 cents on shares of Class A and Class B common stock for the quarter ended Sep 30, 2017. The dividend was paid in cash on Dec 18, 2017, to shareholders of record as of Dec 4, 2017. It marks the company’s fifteenth consecutive dividend payout since its initial public offering.

Backed by these tailwinds, AMC Entertainment performed pretty well in the past six months. Shares of AMC Entertainment have soared 20.9%, outperforming the industry’s growth of 7.8%

However, the latest strategy adopted by Hollywood studios (film makers) is a major setback to the movie theater (exhibitor) industry. It involves making the latest releases available for home viewing at a premium rate within two weeks of debut. Moreover, being part of the entertainment industry exposes the company to macroeconomic fluctuations. AMC Entertainment competes with major theatrical exhibitors like Cinemark Holdings Live Nation Entertainment. and Regal Entertainment.The company also faces threats from alternative movie streaming services such as Netflix (NASDAQ:NFLX) , Time Warner’s HBO Now and Hulu. Despite the recent shift in audience preference toward streaming services, film studios seek better bargains with large-screen theater companies. This might hamper the company’s profitability.

Earnings Whispers

Our proven model does not conclusively show that AMC Entertainment is likely to beat the Zacks Consensus Estimate this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, that is not the case here as elaborated below.

Zacks ESP: AMC Entertainment has an Earnings ESP of -6.25%. This is because the Most Accurate estimate is pegged at 25 cents per share while the Zacks Consensus Estimate stands at 27 cents. You can uncover the best stocks to buy or sell before they’re reported with the Earnings ESP Filter.

Zacks Rank: AMC Entertainment has a Zacks Rank #3, which increases the predictive power of ESP. However, the company’s negative ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stock to Consider

AMC Networks (NASDAQ:AMCX) from the Zacks Consumer Discretionary sector has the right combination of elements to post an earnings beat in its fourth-quarter 2017 results, scheduled to be released on Mar 1. The company has an Earnings ESP of +4.80% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s earnings surpassed the Zacks Consensus Estimate in each of the previous four quarters with an average beat of 21.9%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Netflix, Inc. (NFLX): Free Stock Analysis Report

National CineMedia, Inc. (NCMI): Free Stock Analysis Report

AMC Networks Inc. (AMCX): Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.