- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

What If The Fed Expectations Were Too Hawkish?

Forex News and Events:

The FX traders are in wait-and-see mood before the most important eco-political events back loaded on the second half of the week. The Fed decision (Wed) and the Scottish referendum (Thu) are the key events that should shape the FX prices in the coming days. Given the decent USD-long positioning in the markets, a balanced Fed tone may trigger a relief rally in the high yielding EM. Released in UK this morning, the August inflation report gathered little traction. GBP-traders stay away from spot trading as Scottish uncertainties persist. Finally, the bearish harami formation on the USD/CAD daily chart signals a short-term opportunity for traders playing it technical before the event/news stream begins.

Too hawkish Fed expectations may trigger a relief rally

The FOMC begins its two-day meeting today. Markets are mostly positioned long-USD, in expectations that the Fed should sound more hawkish regarding its forward guidance. The G10 currencies broadly weakened against USD over the past two weeks; the DXY index consolidates strength at the highest levels since July 2013. Given the softness in the recent US data however, the FOMC Chair Yellen will possibly sound more balanced than expected. Hence, we believe that the current positioning leaves room for disappointment and thus increase the risk of a sharp rectification in USD and US yields.

The EM currencies remain under important selling pressures as the risk appetite remains limited due to hawkish Fed expectations. As the FOMC moves closer to the policy normalization, the contraction of the cheap money pool is a concern for the EM world, especially given that the economic vulnerabilities in the leading EMs persist. In China, the August data highlights the significant slowdown in the industrial production (6.9% y/y in Aug vs. 8.8% exp. & 9.0%). The FDI unexpectedly contracted by 14% on year to August pushing USD/CNY higher to 6.1567 onshore. The CNY-bears gather momentum as eyes turn toward the PBOC for additional stimulus.

Elsewhere, BRL (-4.14%), RUB (-3.73%), COP (-3.52%), ZAR (-2.73%) and TRY (-2.50%) have been the top five losers since the significant pick-up in FX volatilities two weeks ago (Sep 1st). The short-end of the sovereign yield curves steepened confirming the EM stress regarding a hawkish Fed outlook. Given the interesting risk premium levels in high yielding EM assets, a balanced tone from the Fed can only trigger a short-term relief rally.

GBP downbeat on Scottish concerns

The Scottish independence risk keeps traders from taking significant positions on one side or the other. The UK inflation report gathered little traction this morning, although the consumer prices hit 5-year lows.

GBP-complex remains focused on news/polls on Scottish referendum; the short-term moves are sharp and unpredictable. We stay in the sidelines before the referendum as a potential Scottish independence will require a significant shift in the long-term GBP forecasts. As the fundamental implications of the Scottish referendum outcome are considerable, we prefer avoiding large/long-term positions before complete clarity regarding the Scottish issue.

USD/CAD: Bearish Harami formation

The formation of bearish harami on USD/CAD daily chart indicates a potential short-term bearish reversal. Failure to break above 1.1098/99 (Sep 12/15 double top) motivated some profit taking in Canada yesterday. Supports can be found at 1.1029 (12/09/2014 low) and 1.0934 (10/09/2014 low). We see resistance building at 1.1100 pre-Fed, while option bids will be activated above.

Today's Key Issues (time in GMT):

2014-09-16T12:30:00 USD Aug PPI Final Demand MoM, exp 0.00%, last 0.10%2014-09-16T12:30:00 USD Aug PPI Ex Food and Energy MoM, exp 0.10%, last 0.20%

2014-09-16T12:30:00 USD Aug PPI Final Demand YoY, exp 1.80%, last 1.70%

2014-09-16T12:30:00 USD Aug PPI Ex Food and Energy YoY, exp 1.80%, last 1.60%

2014-09-16T12:30:00 CAD Jul Manufacturing Sales MoM, exp 1.10%, last 0.60%

2014-09-16T20:00:00 USD Jul Net Long-term TIC Flows, exp $25.0B, last -$18.7B

2014-09-16T20:00:00 USD Jul Total Net TIC Flows, last -$153.5B

The Risk Today:

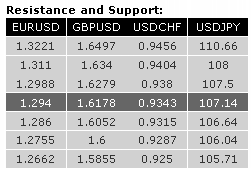

EURUSD EUR/USD is trying to bounce from its oversold decline. However, the hourly resistance at 1.2988 (05/09/2014 high, see also the short-term declining trendline) has held thus far. An initial support lies at 1.2909 (12/09/2014 low). A break of the hourly support at 1.2860 would signal the resumption of the underlying downtrend. Another hourly resistance can be found at 1.3110 (02/09/2014 low). In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. The break of the key support at 1.3105 (06/09/2013 low) opens the way for a decline towards the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low). A key resistance lies at 1.3221 (28/08/2014 high).

GBPUSD GBP/USD is losing its short-term bullish momentum. A break of the hourly support at 1.6186 (11/09/2014 low) would open the way for a test of the recent low at 1.6052. Hourly resistances can now be found at 1.6279 (15/09/2014 high) and 1.6340 (05/09/2014 high). In the longer term, prices have collapsed after having reached 4-year highs. The breach of the key support at 1.6220 confirms persistent selling pressures and opens the way for further decline towards the strong support at 1.5855 (12/11/2013 low). A key resistance now stands at 1.6644.

USDJPY USD/JPY weakened yesterday. However, despite deep short-term overbought conditions, the short-term technical structure is positive as long as the support at 106.64 holds. Another hourly support can be found at 106.04. An hourly resistance now lies at 107.39 (12/09/2014 high). A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. The break to the upside out of the consolidation phase between 100.76 (04/02/2014 low) and 103.02 favours a resumption of the underlying bullish trend. A test of the major resistance at 110.66 (15/08/2008 high) is expected.

USDCHF USD/CHF is consolidating near the resistance at 0.9404 (61.8% retracement). The hourly support at 0.9315 (09/09/2014 low) has held thus far. Furthermore, the short-term technical structure remains positive as long as the hourly support at 0.9287 (05/09/2014 low) holds. From a longer term perspective, the technical structure calls for the end of the large corrective phase that started in July 2012. The break of the strong resistance at 0.9250 (07/11/2013 high) opens the way for a move towards the next strong resistance at 0.9456 (06/09/2013 high). Supports can be found at 0.9176 (03/09/2014 low) and 0.9104 (22/08/2014 low).

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.