- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

What Ails GoPro As The Stock Continues To Go Downhill?

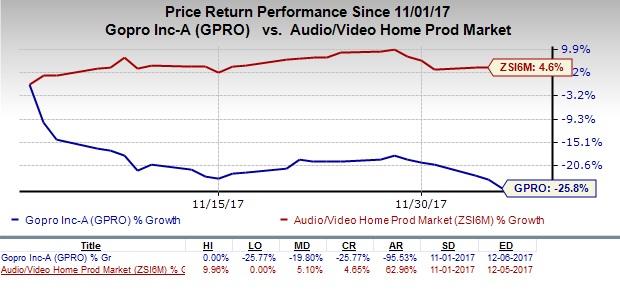

Shares of GoPro, Inc. (NASDAQ:GPRO) have plunged 25.8% since Nov 1, when the company announced its fourth-quarter outlook concurrent with the quarterly earnings release. In contrast, the industry has risen 4.6% since then. The action-camera maker reported decent third-quarter 2017 numbers, but disappointed investors with soft growth projections for the holiday season.

Q3 Failed to Impress

In its third-quarter results, GoPro reported earnings of 15 cents, substantially ahead of the Zacks Consensus Estimate of break-even level. Also, the company surprised investors with the sales figures as its quarterly revenues soared 37.1% from the prior-year quarter’s tally. The top line trumped the Zacks Consensus Estimate and marked the company’s second consecutive quarter of revenue growth.

Top-line growth was driven by robust sales of the latest Hero5 cameras and launch of the premium-priced HERO6 Black with global on-shelf availability. The HERO5 camera is proving to be particularly popular in China and Europe. Also, the company has been recently logging strong accessory revenues that should continue to drive the metric higher in the near term.

GoPro has also significantly curbed operating expenses, limiting the possibility of making illogical decisions like selling the Karma drone at low margins and pushing inventory into the retail channel. Operating expenses in the third quarter were down a whopping 42.4% year over year, having contributed significantly to the earnings beat. In fact, the company expects operating expenses to fall below $500 million, which will boost profits and expand margins.

However, all investors could focus on was GoPro’s outlook for the fourth quarter.

Gray Skies Ahead?

GoPro expects its holiday quarter sales to be subdued, which is curious, given a complete range of product offering and better supply-chain management. Compared to last year’s holiday quarter, this year GoPro ought to benefit from a full holiday season of Karma, two new cameras (GoPro 6 and Fusion 360) and a complete range of complementary accessories. Further, GoPro seems to have solved its supply chain issues which have plagued the company’s performance in the past.

Despite all these supposed growth catalysts, GoPro estimates its fourth-quarter revenues to come in at about $470 million (+/- 10 million). This figure represents a 13% contraction from last year's tally and a massive 26% decline from 2014’s fourth quarter. And GoPro suffered from major supply-chain issues last year which meaningfully impacted the holiday season, which should also be taken into account in year-over-year comparisons.

Projected full-year 2017 results don't look good either, and actually reflect negligible growth when normalized for supply-chain issues and messed-up product launches which supposedly hurt growth. Additionally, a free cash flow shortfall, and continued margin compression are other red flags that cast doubts over GoPro’s growth story.

Evidently, weakness in the holiday season of 2017 would likely spill over to the first half of next year as well. And we have yet to talk about the intense competition and soft demand that GoPro faces.

As GoPro grappled with production delays and bungled-up product roll outs, it lost significant ground to competitors like Sony Corp. (NYSE:SNE) , Garmin Ltd. (NASDAQ:GRMN) and Nikon Corp. (OTC:NINOY) . Amid an onslaught of tough competition and reviewers increasingly recommending cheaper alternatives, we believe GoPro's market share faces a very real threat.

Right now, it is prudent to wait for the numbers of GoPro’s holiday season and its revenue outlook for the first quarter of 2018.

GoPro currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Nikon Corp. (NINOY): Free Stock Analysis Report

Sony Corp Ord (SNE): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

GoPro, Inc. (GPRO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.