- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

After Friday's NFP Carnage, Majors Open With Slight Gaps Down

We’re Back On!:

Just some light Monday morning reading to ease you back into your trading week.

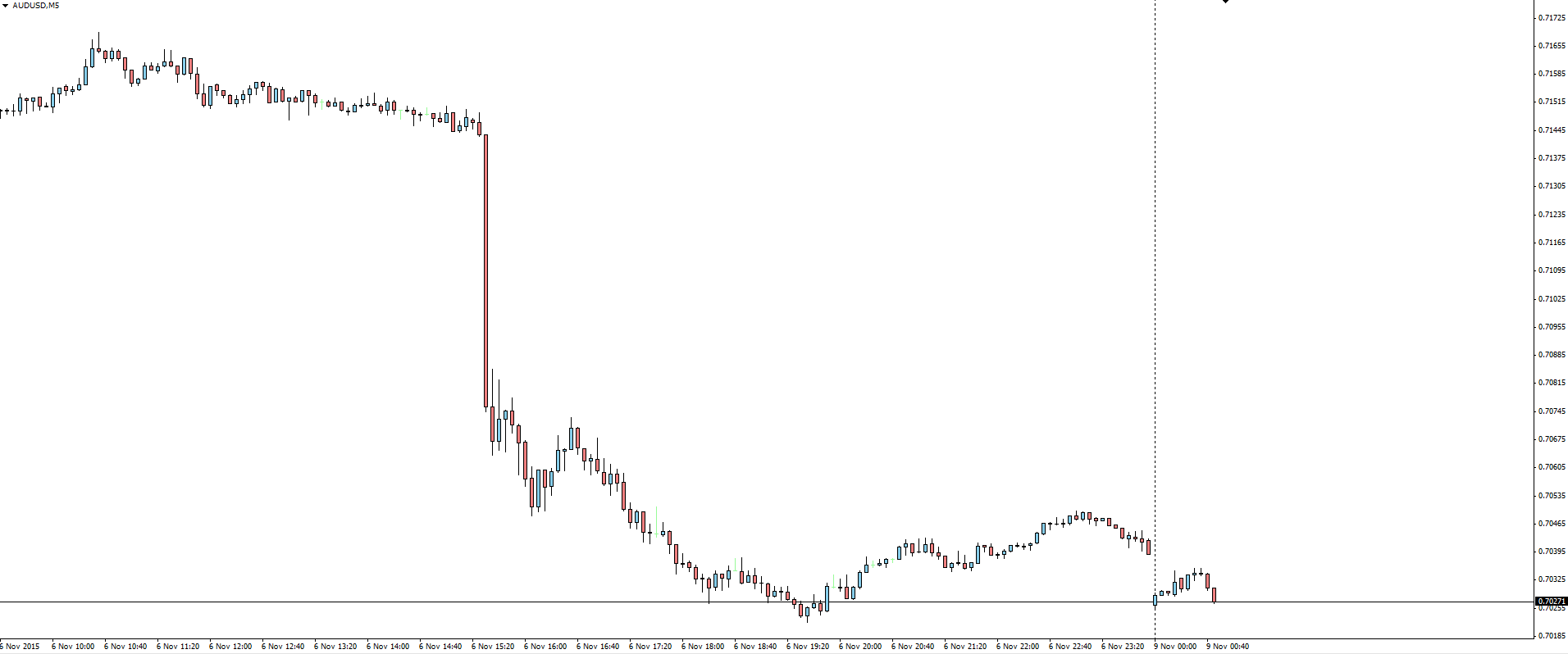

After Friday night’s NFP carnage, the majors have this morning opened with slight gaps down that they are quickly racing to fill. The following AUD/USD 5 minute chart shows the carnage and the open quite well:

AUD/USD Daily:

The October US Non-Farm Payrolls report on Friday night came in at 271K compared to the 181K expected and a revised 137K previously. This 271K jobs gained was the strongest hiring pace this calendar year, adding fuel to the fire that lift-off in December is all but a formality.

These stellar numbers were backed up by comments from San Francisco Fed President John Williams who was speaking on Saturday at an education event in Tempe, Arizona. Williams spoke about why The Fed inserted a reference to its next meeting in its last release and tried to smooth market sentiment again.

“To my mind, the decision was a close call, in part reflecting the crosscurrents we’re navigating.”

“On one hand, the U.S. economy continues to grow and is closing in on full employment. On the other, in large part due to developments abroad, inflation has remained lower than we’d like.”

We’re back on!

On the Calendar Friday:

A quiet start to the week in terms of tier 1 data releases but we did get a juicy set of trade numbers out of China over the weekend which we can take a look at.

CNY Trade Balance (393B v 367B expected)

With Chinese imports again being smashed and a record trade surplus of $61.6 billion, the Chinese government has again had more pressure put on it to keep easing. The major contributing factor was again weaker than expected demand for commodities.

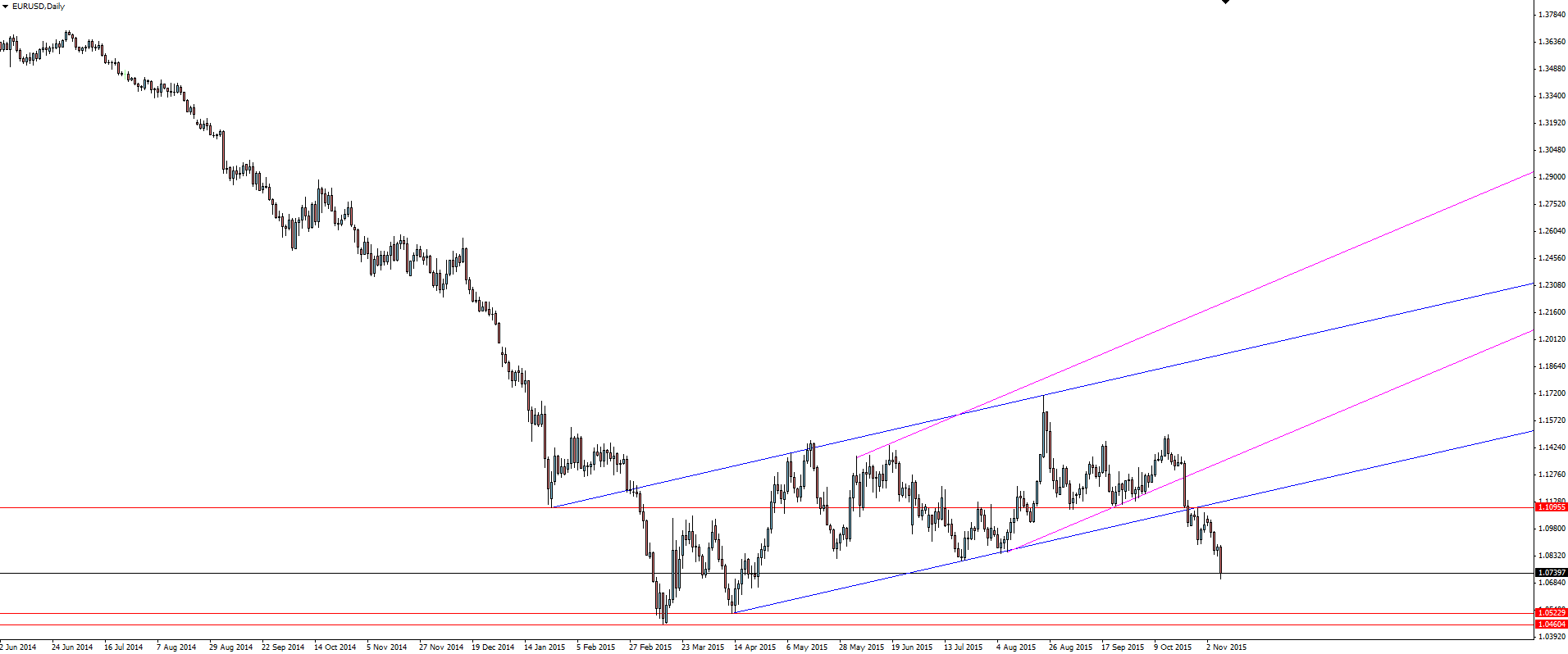

Chart of the Day:

A post-NFP look at one of the more important majors in today’s chart of the day.

EUR/USD Daily:

After the NFP induced drop, price looks to have held that clean re-test of broken channel support. Is price going to reach the next level of support and look to make a new push toward parity?

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.