- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Westlake Chemical (WLK) Q3 Earnings Top, Revenues Trail

Westlake Chemical Corporation (NYSE:WLK) recorded a net income of $210.8 million or $1.61 per share for third-quarter 2017, up roughly 220.9% from $65.7 million or 51 cents a year ago. Net earnings improved mainly due to earnings contribution of Axiall, lower transaction and integration-related costs related to buyout and higher sales price of major products.

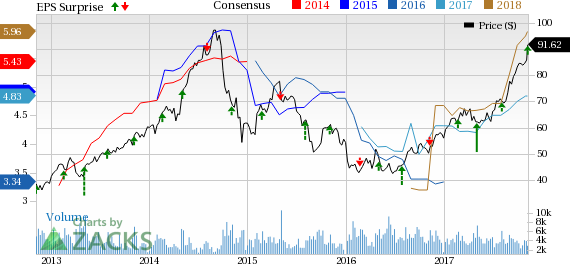

Barring one-time items, earnings for the reported quarter were $1.65 per share, which topped the Zacks Consensus Estimate of $1.39.

Westlake Chemical reported net sales of $2,108.9 million, up around 65% year over year. Sales in the quarter benefited from contribution of Axiall acquisition and increased selling prices for major products. Revenues, however, missed the Zacks Consensus Estimate of $2,123 million.

Segment Highlights

Sales from the Olefins segment improved roughly 0.1% year over year to $502.2 million in the reported quarter. Operating income of the segment increased 39.6% year over year to $165.4 million supported by higher sales prices and higher operating rates, which were partly offset by higher energy and feedstock costs.

The Vinyls segment logged sales of $1,606.6 million, up roughly 105.5% year over year. Operating income of the segment was $216.5 million, roughly a ten-fold year-over-year increase from $22.2 million, aided by Axiall buyout and higher selling prices for major products, which were partly offset by higher energy prices.

Financial Position

Westlake Chemical ended the quarter with cash and cash equivalents of roughly $678.2 million, up 78.2% year over year.

Long-term debt was $3,349.4 million at the end of reported quarter, down 9% year over year from $3,680.6 million.

Cash flow from operations was around $962.7 million for the first nine months of 2017, up 76.9% year over year.

Outlook

According to Westlake Chemical, third-quarter 2017 results benefited from demand for all major products in both Vinyls and Olefins segments along with higher prices in the Vinyls segment. Moving forward, the company believes that the Axiall buyout and continued investments to improve the reliability and operational efficiency of its assets will enable it to fully leverage the improving Vinyls market.

Price Performance

Shares of Westlake Chemical have moved up 31.7% in last three months outperforming the 23% growth recorded by its industry.

Zacks Rank & Other Stocks to Consider

Westlake Chemical currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Sociedad Quimica y Minera S.A. (NYSE:SQM) , Southern Copper Corporation (NYSE:SCCO) and POSCO (NYSE:PKX) . All three stocks flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks Rank #1 stocks here.

Sociedad Quimica has an expected long-term earnings growth rate of 32.5%.

Southern Copper has an expected long-term earnings growth rate of 35.1%.

POSCO has an expected long-term earnings growth rate of 5%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM): Free Stock Analysis Report

Southern Copper Corporation (SCCO): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.