- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Westlake Chemical Prices Senior Notes Offering Worth $500M

Westlake Chemical Corporation (NYSE:WLK) has priced its earlier announced underwritten public offering of $500 million total principal amount of senior unsecured notes due 2047.

The notes, which will carry an interest rate of 4.375% per annum, will mature on Nov 15, 2047. Subject to customary closing conditions, the sale of notes is scheduled to close on Nov 28, 2017.

The company plans to utilize the net proceeds from the proposed public offering of the notes along with cash on hand, borrowings under its revolving credit facility, 2017 Revenue Refunding Bonds and the planned remarketing of up to $250 million total principal amount of Community Development Authority Revenue Refunding Bonds and Louisiana Local Government Environmental Facilities, to redeem $1.138 billion total principal amount of Westlake Chemical’s and its certain fully-owned subsidiaries’ 4.875% senior notes due 2023 and 4.625% senior notes due 2021, on or after the call dates of May 15, 2018 and Feb 15, 2018, respectively.

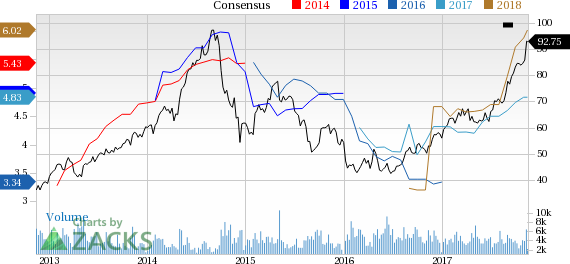

Westlake Chemical’s shares have moved up 32.2% in the past three months outperforming the industry’s 26.9% growth.

Westlake Chemical recorded a net income of $210.8 million or $1.61 per share for third-quarter 2017, up roughly 220.9% from $65.7 million or 51 cents a year ago. Barring one-time items, earnings for the reported quarter were $1.65 per share, which topped the Zacks Consensus Estimate of $1.39.

According to Westlake Chemical, third-quarter 2017 results benefited from demand for all major products in both Vinyls and Olefins segments along with higher prices in the Vinyls segment. Moving forward, the company believes that the Axiall buyout and continued investments to improve the reliability and operational efficiency of its assets will enable it to fully leverage the improving Vinyls market.

Zacks Rank & Other Stocks to Consider

Westlake Chemical currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are ArcelorMittal (NYSE:MT) , BHP Billiton (LON:BLT) PLC (NYSE:BBL) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks Rank #1 stocks here.

ArcelorMittal has an expected long-term earnings growth rate of 11.3%. Its shares have rallied 26.3% year to date.

BHP Billiton has an expected long-term earnings growth rate of 5.3%. Its shares have moved up 16.5% year to date.

Kronos Worldwide has an expected long-term earnings growth rate of 5%. Its shares have surged a whopping 123.5% year to date.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

BHP Billiton PLC (BBL): Free Stock Analysis Report

ArcelorMittal (MT): Free Stock Analysis Report

Original post

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.