- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Weekly Review Strategy: Week 29

Open/pending positions of last week

This pair will be analyzed briefly, for more information read the article Weekly Review Strategy Week 24 where the pair was tipped for going short. A position has been opened for this pair. The NZD is the weakest currency with a currency score of 1 and the USD is at the moment the strongest currency with a score of 8. The pair broke through the most recent lows around 0,6785 and had a pullback to that level which is now a resistance level. This offered an opportunity and a position has been opened. If you are interested in the trades click here.

From a longer term perspective the pair succeeded on May 29 to close and break through the lows of February and March around 0,7170. Since then it remains an interesting pair for taking short positions.

- On the weekly (decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in negative area and the histogram is showing increase of momentum.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 28

Rank: 2

Rating: - - -

Total outlook: Down

This pair will be analyzed briefly, for more information read the article Weekly Review Strategy Week 28 where the pair was tipped for going short. A position has been opened for this pair. The AUD is the weakest currency with a currency score of 1 and the CHF is at the moment one of the strongest currencies with a score of 7. The pair succeeded to break through the recent lows around 0,7090 and this offered an opportunity. A position has been opened on July 7 at 0,7044. The pair may continue the downtrend towards the low of January 15 at 0,6832.

- On the weekly (decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in negative area and the histogram is showing increase of momentum.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 29

Rank: 3

Rating: - - -

Total outlook: Down

Possible positions for coming week

This pair will be analyzed in detail. The pair is clearly in an uptrend and it is gaining momentum. From a longer term perspective it broke through a previous significant top of February 24 at 1,9556 and it closed last week at 1,9637. It is a pair to monitor in the coming week. When trading with the CAD I also check the Weekly Crude Oil chart and this one is again picking up the downtrend after the pullback that started in February and March.

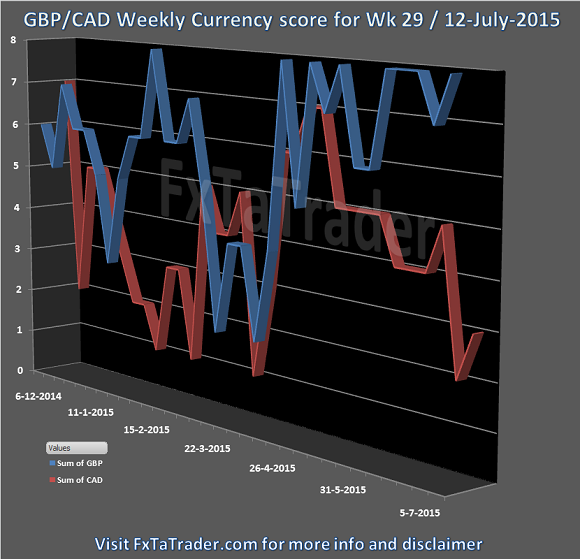

- As can be seen in the Currency Score chart in my previous article of this weekend the GBP has a score of 8 and the CAD a score of 3.

- In the current Ranking and Rating list of this weekend the pair has a rank of 6. This list is used as additional information besides the Currency score and the Technical Analysis charts.

- Besides the general information mentioned the outlook in the TA charts also makes this an attractive opportunity.

Ranking and rating list Week 29

Rank: 6

Rating: + +

Weekly Currency score: Up

Based on the currency score the pair looked interesting since the beginning of June. The GBP is a strong currency from a longer term perspective. The CAD is an average currency from a longer term perspective and it became weaker in the last few weeks. With currently a Score difference of 5 and the GBP being better classified it is an interesting pair for taking positions in the coming week.

Monthly chart: Up

- On the monthly (context) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive area and gaining momentum.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context how that pair is developing for the long term the indicators are looking fine because they are showing strength in the current uptrend.

Weekly chart: Up

- On the weekly (decision) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive area and gaining momentum.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

Daily chart: Up

- On the daily (timing) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive area but the histogram is consolidating.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

Total outlook: Up

GBP/CAD Weekly chart

If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week and don't forget to check my weekly forex "Ranking and Rating list" and the "Currency Score".

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments.

Related Articles

The USD/JPY is rising due to increased US bond yields and inflation data. Higher-than-expected CPI has delayed Fed rate cut expectations. Upcoming data, like PPI, may push...

The New Zealand dollar is in negative territory on Wednesday. NZD/USD is trading at 0.5636 in the European session, down 0.31% on the day. US CPI Expected to Tick Lower to...

USD/JPY starts a new bullish cycle ahead of US CPI data Key resistance near 154.30. Will the bulls retain their power? USD/JPY drifted up to 153.72 after confirming a bullish...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.