- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Weekly Review Strategy Week 13: EUR Remains Weak

In this article I will provide my view on the EUR/NZD, AUD/NZD, AUD/USD, EUR/USD. These are the pairs that I am currently interested in or was interested in last week for trading with the FxTaTrader weekly strategy. I will pick one to analyse in more detail from the pairs that have not been discussed yet recently.

Open/pending positions of last week

EUR/NZD

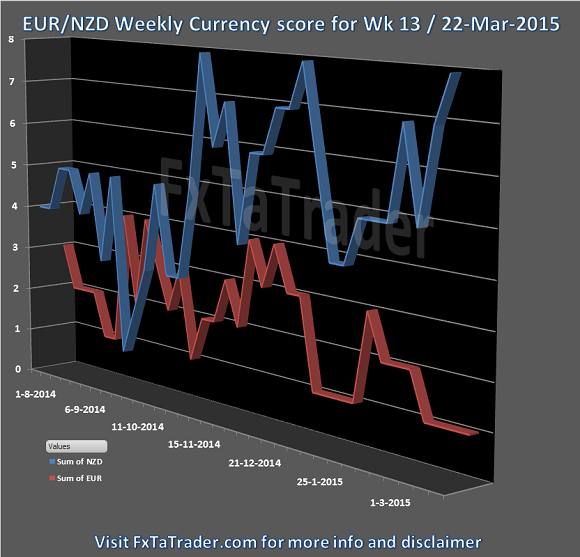

This pair will be analyzed in detail. The NZD is a stronger currency from a longer term perspective with a score of 8. The EUR remains weak with a score of 1. The pair broke on March 3 through a previous bottom looking for new lows. The downtrend is still active and any pullback is an opportunity to step in. Last week (pending) orders were placed and profit was made of 1/4 Weekly ATR, 95 pips. The pair remains interesting for coming week.

- As can be seen in the Currency Score chart in my previous article of this weekend the NZD is having a score of 8 and the EUR a score of 1.

- In the current Ranking and Rating list of this weekend the pair has a rank of 1. This list is used as additional information besides the Currency score and the Technical Analysis charts.

- Besides the general information mentioned the outlook in the TA charts also makes it an attractive opportunity.

Ranking and rating list Week 13

Rank: 1

Rating: - - -

Weekly Currency score: Down

Based on the currency score the pair looked interesting in the last 3 months. The NZD is a stronger currency from a longer term perspective and had in the last weeks a score of 5 to 8. The EUR is a weaker currency from a longer term perspective and had in the last weeks a score between 1 and 3. The currency remains weak and it seems to stay this way in the coming period. With currently a Currency Score difference of 7 and the NZD being better classified it is an interesting pair for taking positions in the coming week.

Monthly chart: Down

- On the monthly(context) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context how that pair is developing for the long term the indicators are looking fine because they are showing strength in the current downtrend.

Weekly chart: Down

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining a lot of strength.

- The Parabolic SAR is short showing the preferred pattern of lower stop loss on opening of new long and short positions.

Daily chart: Down

- On the daily(timing) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Total outlook: Down

AUD/USD Weekly chart

Possible positions for coming week

AUD/NZD

This pair will be analyzed briefly, for more information read the article Weekly Review Strategy Wk10 where the pair was tipped for going short. The pair started to look more interesting on Friday. It broke through a previous low and the MACD started to gain strength in the Daily Chart. All the other indicators that I work with are looking great in the Weekly and Daily chart. It is an interesting pair for coming week.

The NZD is a stronger currency from a longer term perspective and currently has a score of 8, a pullback took place in February and the currency recovered well in the last weeks. The AUD is a weaker currency from a longer term perspective and currently has a score of 3. It also had a pullback in February and is back again on the lower side of the Currency Score range. The currency remains weak and it seems to stay this way in the coming period. With a Currency score difference of 5 and the NZD better classified it is an interesting pair.

- On the weekly(decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in negative area and the histogram shows momentum building again.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 13

Rank: 6

Rating: - -

Total outlook: Down

EUR/USD

This pair will be analyzed briefly, for more information read the article Weekly Review Strategy Wk11 where the pair was tipped for going short. The USD is a stronger currency from a longer term perspective with a score of 7. The EUR remains weak with a score of 1. The downtrend is still strong but there is a pullback in the last few days offering an opportunity. The entry has to be timed well however because in the last days there is a lot of price movement. It seems best to have weakness in the 4 Hour chart of the current short term uptrend.

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining momentum.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 13

Rank: 17

Rating: =

Total outlook: Down

AUD/USD

This pair will be analyzed briefly, the USD is a stronger currency from a longer term perspective with a score of 8. The AUD remains weak with a score of 3. The pair was around a previous bottom made in February but is having currently a pullback. Also here, just like with the EUR/USD, It seems best to have weakness in the 4 Hour chart of the current short term uptrend.

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area but it should gain some more momentum.

- The Parabolic SAR is short showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 13

Rank: 21

Rating: =

If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week and don't forget to check my weekly Forex "Ranking and Rating list" and the "Currency Score".

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only.

Related Articles

The US dollar fell last week due to Trump's inconsistent trade policies and signs of a slowing economy. February's non-farm payroll data disappointed, with unemployment...

Forex Strategy is Bearish: USD/JPY is currently at 146.76 in a 5th fractal wave in a channel. We are looking for a continuation to the ATR target at the 146.10 area, with a...

The Canadian dollar is steady at the start of the week. USD/CAD is trading at 1.4385, up 0.06% on the day. The Canadian dollar declined 0.50% on Friday after Canada’s job report...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.