- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Week In FX Americas: Canada Bests US Jobs By A Country Mile

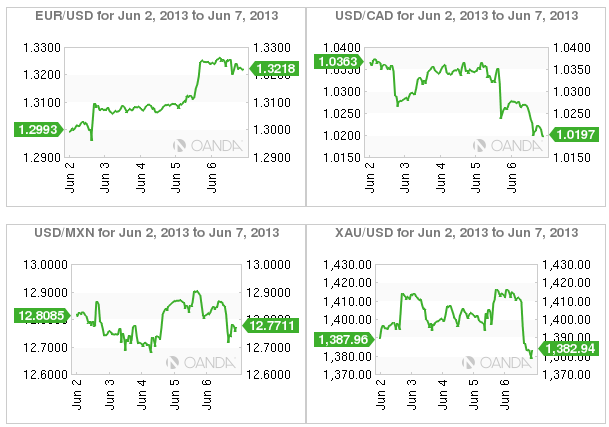

It’s not true – the Toronto Star did not hire an extra +35k employee to follow their beleaguered Mayor. Canada posted an eye-popping, decade best, +95k new jobs in May. To understand somewhat the significance of the print – by superimposing it on its largest trading partners economy, the US, that’s the equivalent of nearly +1-million new jobs being created down south. In contrast, the US managed to edge market expectations by a whisker, printing+175k new jobs in May.

Both countries unemployment rates are heading in opposite direction. Canada has managed to shave 2/10th off theirs, to report a +7.1% unemployment rate, while the US adds a 1/0th to up theirs to +7.6%. However, buyer loonie beware. This Canadian jobs report should be taken with a grain of salt, as one employment report does not completely change a trend.

Least we forget, in March Canada’s commodity, interest rate sensitive sister country down-under, Australia happened to release a similarly strong report (+71.5k), allowing the AUD to scream higher to only quickly reverse both the currency and job gains the next month. Fundamentals aside, a large percentage of speculators are short the CAD at higher levels and this markets swift move, especially the EUR/CAD will keep the commodity favored currency bid in the short term.

Related Articles

EUR/USD remains resilient after dipping below 1.05, hinting at a potential breakout. Weak US data and stagflation fears fuel Fed rate cut bets, pressuring the dollar. A break...

USD/CAD lifted by Trump’s tariff push but faces resistance overhead US data missing forecasts at the fastest pace in five months Fed rate cut bets grow, pushing Treasury yields...

The euro has gained ground on Tuesday. In the North American session, EUR/USD is trading at 1.0515, up 0.45%. On Monday, the euro climbed as high as 1.0527, its highest level this...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.