- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

VMware (VMW) Scraps Q1 & Fiscal 21 View On Coronavirus Woes

VMware (NYSE:VMW) in an 8K filing on Mar 26 announced the withdrawal of its first-quarter and fiscal 2021 guidance provided on Feb 27. The company cited uncertainty about the impact of the coronavirus spread on its business operations behind the withdrawal.

VMware joins a long list of technology companies including bigwigs like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and Twitter who either withdrew their guidance or warn of lagging expectations due to the coronavirus pandemic.

Notably, for the fiscal first quarter, this Zacks Rank #5 (Strong Sell) stock projected total revenues to be $2.73 billion, suggesting 11.4% year-over-year growth. Moreover, non-GAAP earnings were expected to be $1.27 per share.

Further, for fiscal 2021, VMware anticipated total revenues to be $12.050 billion. Additionally, non-GAAP earnings were expected to be $6.55 per share.

Markedly, the Zacks Consensus Estimate for earnings in the fiscal first quarter has declined 3.1% to $1.23 per share in the past week. The consensus mark for fiscal 2021 fell 2.6% to $6.38 per share.

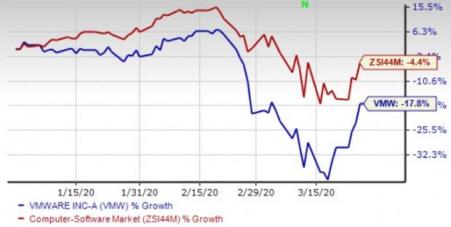

VMware shares have been down 17.8% on a year-to-date basis, underperforming the industry’s 4.4% decline.

Year-to-Date Performance

Will Solid Partner Base & Strong Portfolio Aid VMware?

Apart from instability related to the coronavirus outbreak, VMware’s underperformance can be attributed to an unfavorable revenue mix. Moreover, margins are anticipated to be under pressure due to the ongoing investments in hybrid cloud and SaaS portfolio expansions. Additionally, the Carbon Black and Pivotal acquisitions are expected to dent the operating margin in fiscal 2021.

Nevertheless, VMware’s solid partner base and the expanding portfolio supported by acquisitions are expected to drive the top line in the long haul.

VMware’s partnerships with the likes of International Business Machines (NYSE:IBM) , Amazon’s (NASDAQ:AMZN) cloud computing arm AWS, Microsoft Azure, Google (NASDAQ:GOOGL), Oracle (NYSE:ORCL) and Alibaba (NYSE:BABA) are helping it expand its customer base in the cloud space.

Furthermore, the addition of Carbon Black solutions equips VMware’s existing security portfolio to provide deep protection across infrastructure, applications and endpoints.

Moreover, the Heptio and Pivotal acquisitions combined with the VMware Cloud native offerings make up the Tanzu, a portfolio of products and services designed to transform the way enterprises build, run and manage application software. VMware aims to simplify the use of Kubernetes in a multi-cloud environment by offering this solution.

Nyansa enables VMware to deliver an end-to-end network visibility monitoring and remediation solution within VMware SD-WAN. Addition of Nyansa’s AI & machine learning capabilities to VMware’s existing network and security portfolio will further strengthen the company’s efficiency to enable self-healing networks.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

VMware, Inc. (VMW): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.